- United States

- /

- Food

- /

- NYSE:TSN

What Does Tyson’s Recent Share Slide Mean After Latest Guidance Cut?

Reviewed by Bailey Pemberton

Wondering what to do with Tyson Foods stock after a rocky ride lately? If you are anything like me, you are keen to cut through the market noise and really understand if the current price is a bargain, or if there is still more volatility ahead. Tyson’s shares recently closed at $52.1, and the chart has not been particularly kind in the short term. Over the past week and month, Tyson is down -3.8% and -5.5% respectively, while year-to-date returns stand at -10.4%. Stretching out even further, the stock has slipped -9.9% in the past year and is nearly flat over five years, up just 3.7%.

Given those numbers, it is clear that the market has shifted its risk perception around Tyson Foods, potentially due to evolving dynamics in the food sector and broader concerns about input costs and consumer demand. At the same time, long-term investors might see opportunity in the uncertainty. After all, market pullbacks can open the door to bargains if the fundamentals are right.

Valuation-wise, Tyson Foods stands out with a value score of 4 out of 6, showing it checks the “undervalued” box on several key metrics. But what does that actually mean for real-world investors, and how do different valuation approaches stack up? Let us dig into how those scores are calculated, which methods matter, and most importantly, why there may be an even smarter way to judge valuation at the end of this analysis.

Approach 1: Tyson Foods Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. In other words, it tries to determine how much all the cash Tyson Foods is expected to generate in the coming years is worth today, after accounting for risk and the time value of money.

For Tyson Foods, the DCF uses a Two-Stage Free Cash Flow to Equity approach. The company’s latest twelve months’ free cash flow stands at $776.9 Million. Over the next ten years, analysts and modelers project this number will grow significantly, with an estimated free cash flow of roughly $1.65 Billion by 2028. For later years, projections are extrapolated. Simply Wall St extends beyond direct analyst estimates by assuming steady growth until 2035, at which point the discounted free cash flow is expected to reach nearly $1.9 Billion.

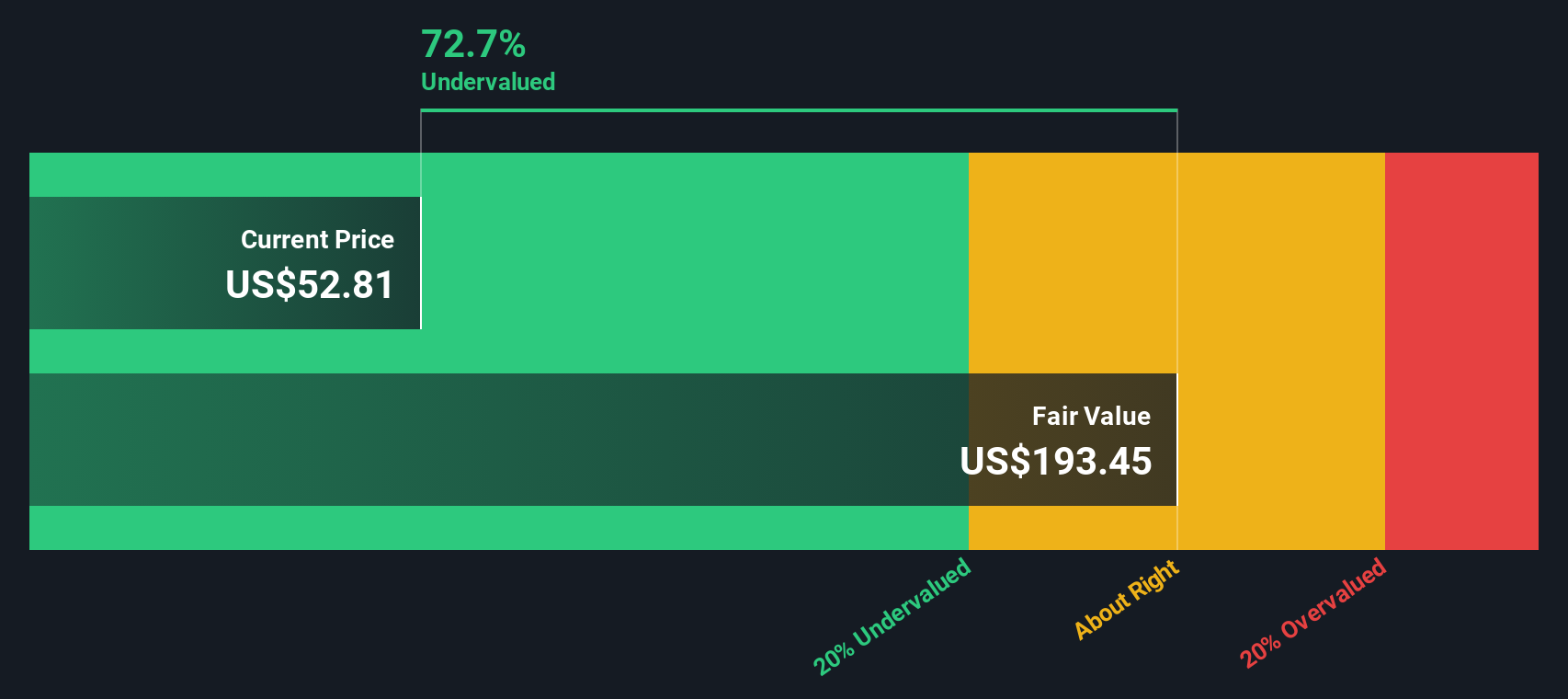

Using this method, Tyson Foods’ estimated intrinsic value is calculated at $193.45 per share. This is substantially higher than its current trading price of $52.10, which implies the stock is trading at a 73.1% discount to its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tyson Foods is undervalued by 73.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Tyson Foods Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is a go-to valuation metric for profitable companies like Tyson Foods, as it measures how much investors are willing to pay today for each dollar of current earnings. A P/E ratio puts the company's share price in the context of its recent profitability, helping investors quickly gauge whether a stock is expensive or inexpensive relative to its earnings power.

However, what counts as a “normal” or “fair” P/E ratio is influenced by both growth expectations and risk. Companies expected to grow earnings quickly or operate with less risk typically command higher P/E ratios, while slower growth or higher risk warrant a lower multiple.

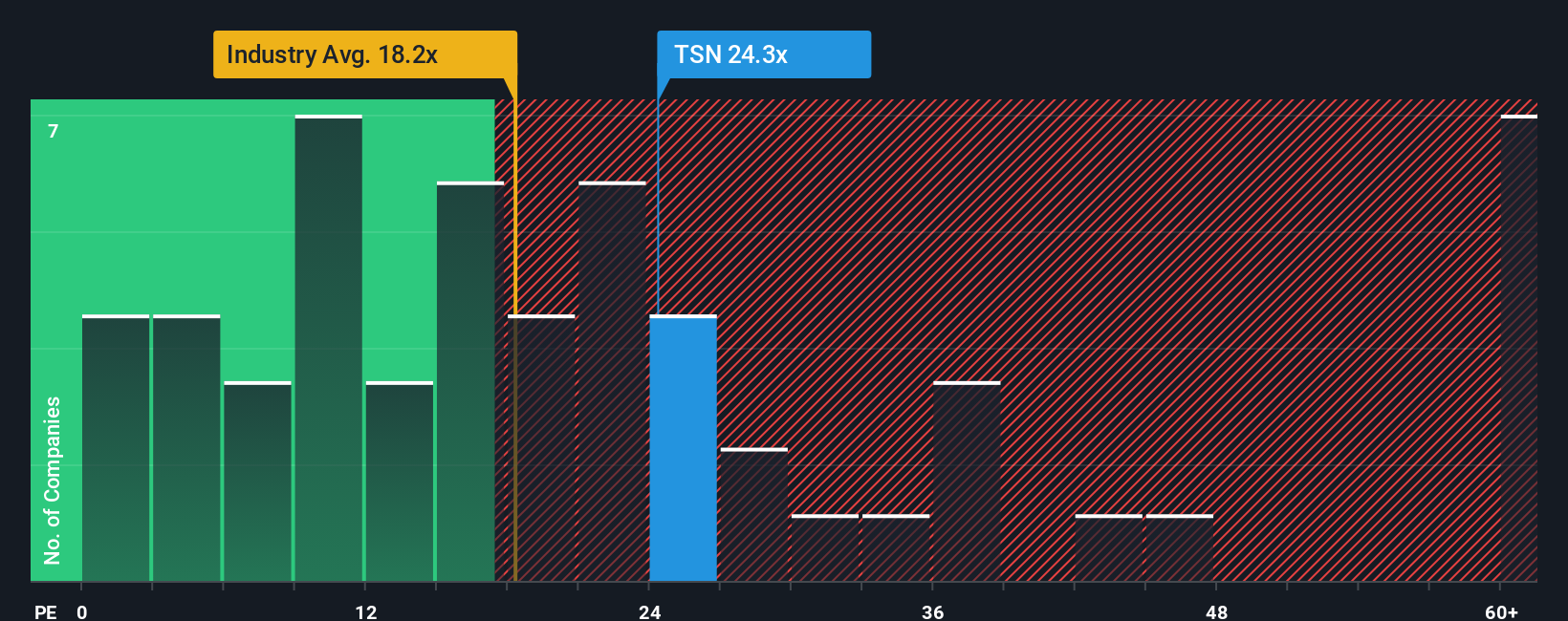

Tyson Foods is trading at a P/E ratio of 23.6x, which is above the average of its industry peers at 13.7x, and well ahead of the wider food industry average of 18.1x. While these benchmarks are a useful starting point, they may not tell the full story for Tyson Foods, since each company’s prospects and risks can vary meaningfully within an industry.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio is a more holistic benchmark that considers Tyson Foods’ actual growth prospects, profit margins, risk profile, industry dynamics, and market cap. By weighing these factors, the Fair Ratio aims to estimate the most appropriate P/E multiple for Tyson Foods, beyond simple averages.

Right now, Tyson Foods’ Fair Ratio is estimated at 32.5x, which is noticeably higher than its current P/E of 23.6x. Since Tyson is trading below its Fair Ratio, this suggests the shares could be undervalued relative to what a prudent investor might consider justified based on the fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tyson Foods Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a dynamic approach that connects the story you believe about Tyson Foods to its future financials and ultimately its fair value.

A Narrative is simply the investment story you tell: what do you expect for Tyson Foods in the years ahead, and why? Instead of just relying on numbers, you outline your assumptions for key metrics like future revenue, profit margins, and what a fair valuation looks like. This results in a forecast and personalized fair value that reflects your unique perspective.

Narratives are available right now on Simply Wall St’s Community page, where millions of investors share and update their outlooks. They help you see not only what you think Tyson is worth and why, but also how the consensus and outlier views from other investors stack up. This makes it easier to spot opportunities or risks that might otherwise be missed.

As new information emerges, Narratives update in real time, letting you compare your estimated fair value of Tyson Foods against the current price so you can confidently decide when it looks like a buy or needs a closer review.

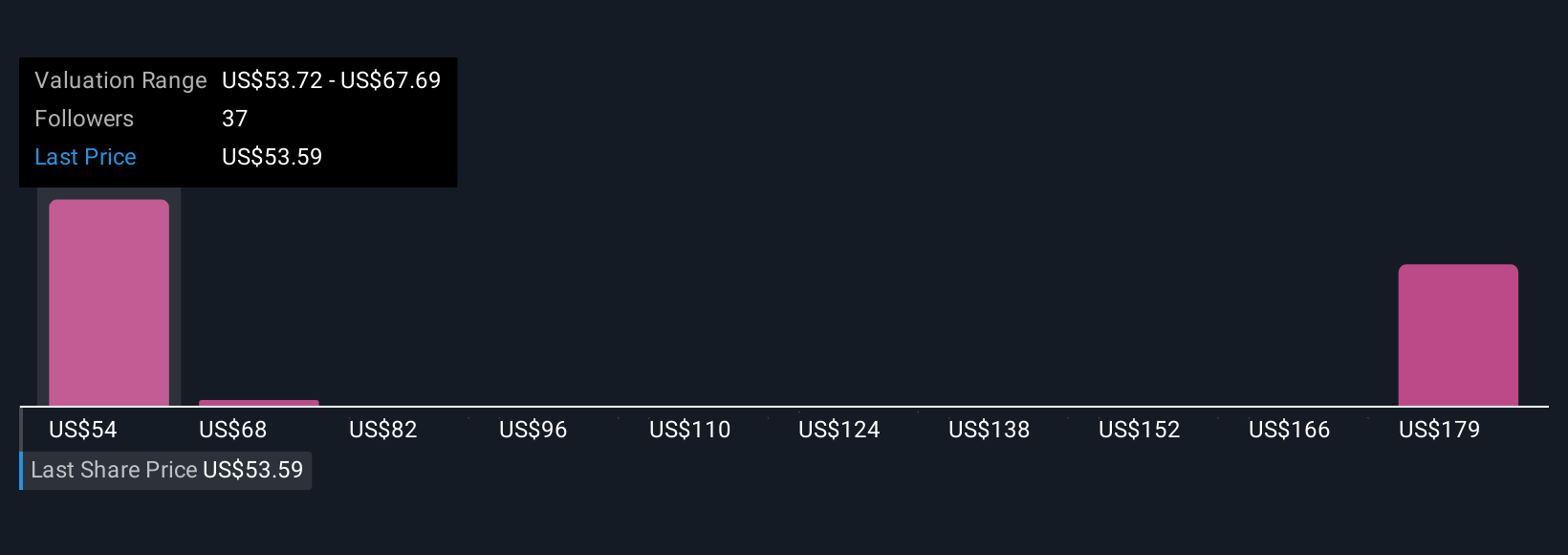

- For example, some investors currently see Tyson Foods’ fair value as low as $55, while others believe it could be worth up to $80 per share. This highlights just how much investor perspectives and underlying assumptions can differ.

Do you think there's more to the story for Tyson Foods? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives