- United States

- /

- Food

- /

- NYSE:TSN

Tyson Foods (TSN): A Fresh Look at Valuation as Investors Weigh Recent Market Shifts

Reviewed by Kshitija Bhandaru

Tyson Foods (NYSE:TSN) has caught investor attention after its recent trading activity, even though there has not been a single headline event driving the move. Sometimes the market’s quiet shifts can be just as telling as the high-profile announcements, especially for those weighing whether to buy, hold, or move on from a stock that quietly takes center stage.

Although Tyson’s share price bounced slightly in the last day, the stock has been trending lower over the past month and year. Despite a long-term history of modest gains, recent months have seen a more cautious mood around the shares. The company’s annual revenue and net income did manage to grow, which contrasts with the lackluster performance of the stock itself and hints at a disconnect that could be worth a closer valuation look.

With this back-and-forth in performance, the big question now is whether the market has already factored in Tyson’s future earnings or if the weaker share price means there may be a buying opportunity on the table.

Most Popular Narrative: 14.6% Undervalued

According to the most widely followed narrative, Tyson Foods appears to be undervalued by a meaningful margin based on projected earnings growth, expanding profit margins, and operational discipline.

Momentum in prepared and value-added foods, driven by a robust innovation pipeline and product launches targeting convenience and protein-oriented lifestyles, is shifting the product mix toward higher-margin categories and is expected to improve net margins and top-line growth.

Curious what is fueling this under-the-radar value signal? The narrative is built on bold growth expectations and a shift in profitability. These are the kinds of assumptions most investors do not see coming. Think you know the factors that led to the fair value call? Only a closer look reveals the projections underpinning this standout valuation.

Result: Fair Value of $63.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as ongoing beef supply constraints or rising raw material costs could challenge expectations and shift sentiment around Tyson’s future performance.

Find out about the key risks to this Tyson Foods narrative.Another View: What Do the Market Ratios Say?

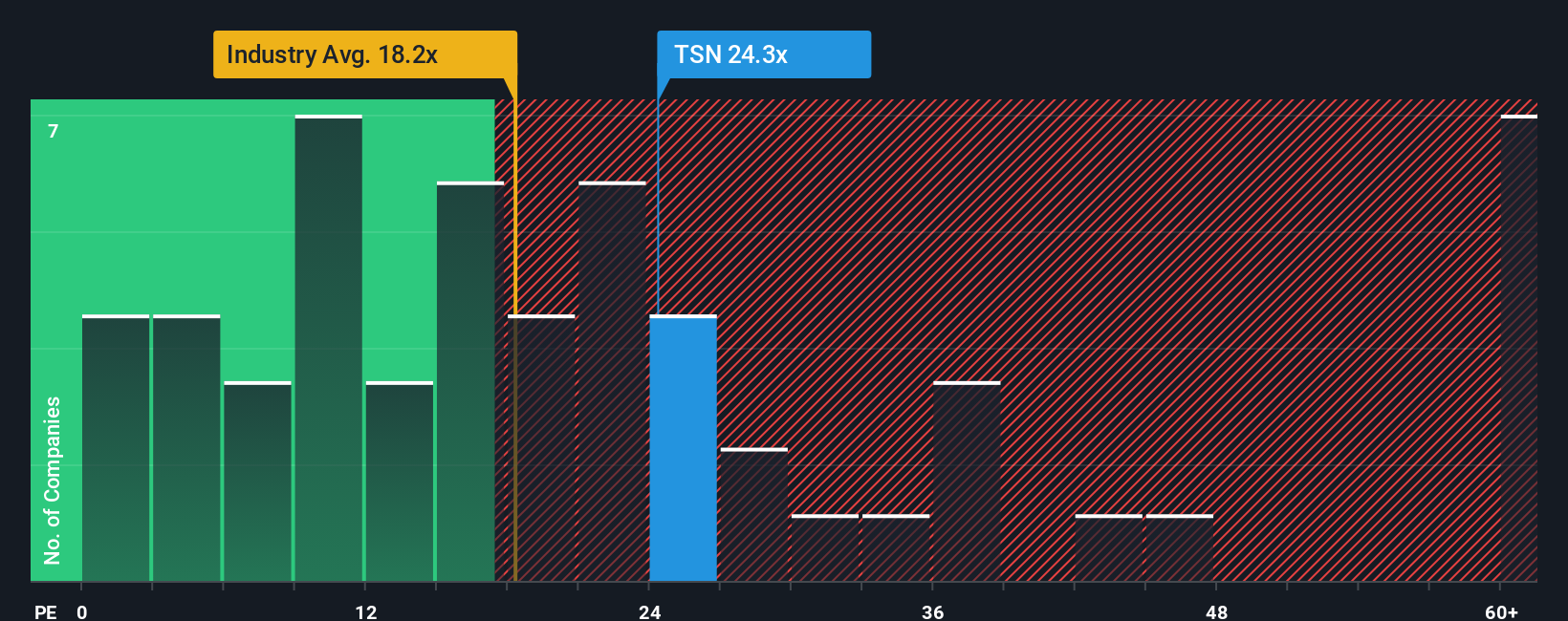

While the analyst-driven view sees potential undervaluation, a look at Tyson Foods' price-to-earnings ratio compared to the broader industry paints a different picture. This suggests a stock that is relatively expensive. Can both methods be correct or is something missing?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Tyson Foods to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Tyson Foods Narrative

If you want to dig into the numbers for yourself or see things from a different angle, you can craft your own view on Tyson in just a few minutes. Do it your way

A great starting point for your Tyson Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More High-Potential Opportunities?

Your next big winner could be hiding in plain sight. Simply Wall Street’s powerful screeners let you uncover standout stocks poised for growth, income, or innovation, so you do not get left behind.

- Amplify your portfolio with fast-growing, low-priced companies by using our penny stocks with strong financials tool that spotlights hidden gems making waves on the market.

- Capture the future of healthcare and technology by pinpointing innovators at the intersection of medicine and machine through our healthcare AI stocks.

- Supercharge your long-term returns and cash flow with companies offering reliable yields using our dividend stocks with yields > 3% for strong dividend payers over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives