- United States

- /

- Beverage

- /

- NYSE:STZ

There's Reason For Concern Over Constellation Brands, Inc.'s (NYSE:STZ) Price

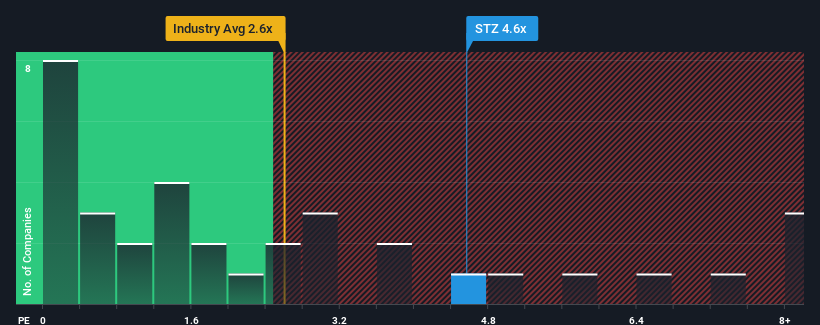

When close to half the companies in the Beverage industry in the United States have price-to-sales ratios (or "P/S") below 2.6x, you may consider Constellation Brands, Inc. (NYSE:STZ) as a stock to potentially avoid with its 4.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Constellation Brands

What Does Constellation Brands' P/S Mean For Shareholders?

Constellation Brands could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Constellation Brands will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Constellation Brands?

In order to justify its P/S ratio, Constellation Brands would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 5.4% gain to the company's revenues. Revenue has also lifted 16% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 6.8% per annum as estimated by the analysts watching the company. That's shaping up to be similar to the 5.6% per year growth forecast for the broader industry.

With this information, we find it interesting that Constellation Brands is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Constellation Brands' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given Constellation Brands' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Constellation Brands that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives