- United States

- /

- Beverage

- /

- NYSE:STZ

Constellation Brands (STZ) Profit Margin Surge Challenges Mixed Investor Narratives

Reviewed by Simply Wall St

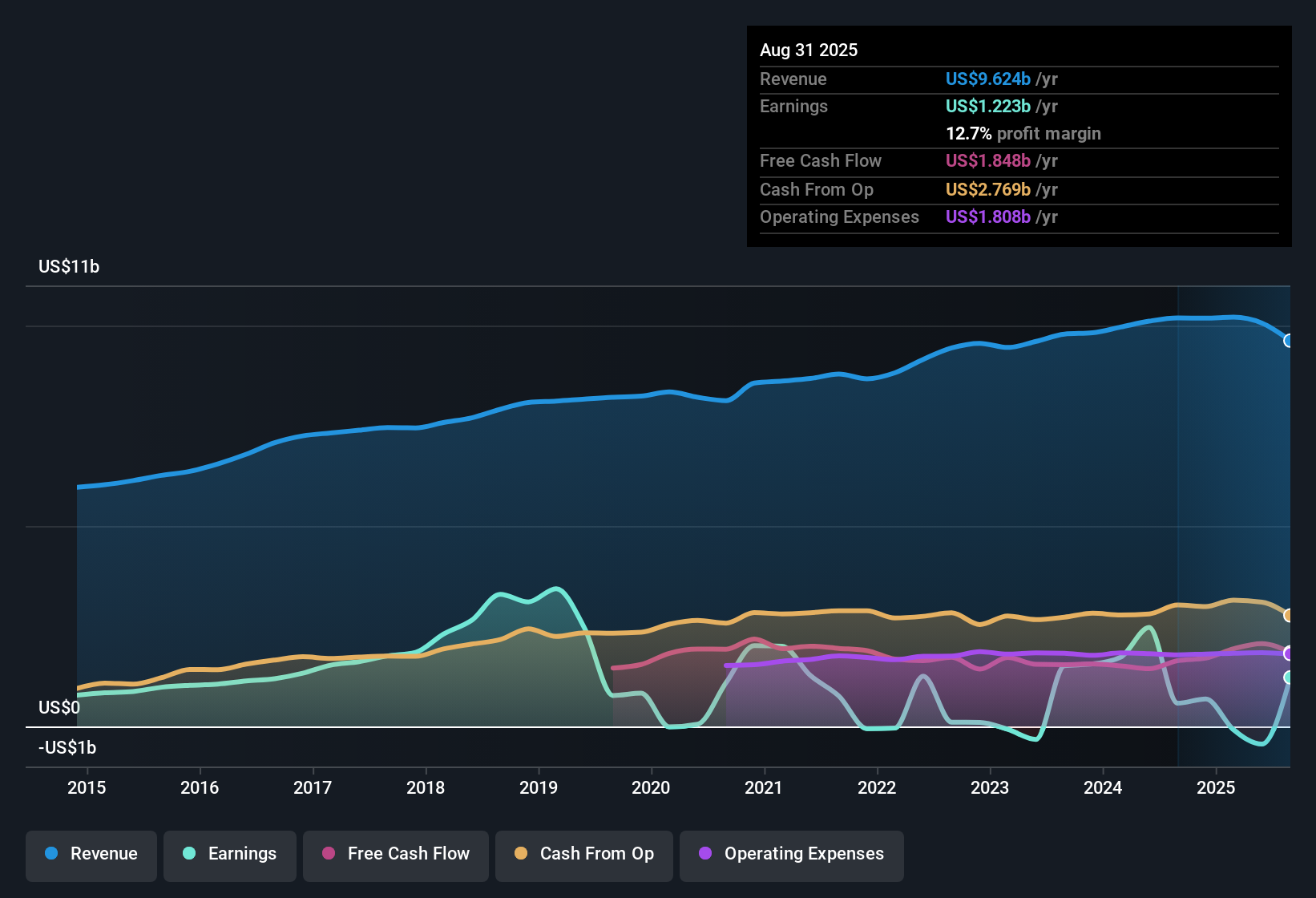

Constellation Brands (STZ) just posted a meaningful turnaround in profitability, with net profit margin climbing to 12.7% from 5.7% and earnings notching 111% growth over the past year. This bounce contrasts with its five-year track record, where annual earnings had slipped by 11% on average. For investors, the notable recovery is set against forecasts calling for more moderate gains ahead, as revenue is expected to rise just 1.1% annually and earnings by 12.8%. Both measures are pacing behind the US market, and a $442.8 million non-recurring loss still lingers in the numbers.

See our full analysis for Constellation Brands.Next, we will see how these latest results align with the most widely held narratives about Constellation Brands, revealing where the numbers support the story and where fresh debate may be in order.

See what the community is saying about Constellation Brands

Cost Savings Drive Operating Margins

- Recent restructuring and divestitures in Wine & Spirits are expected to generate over $200 million in annualized cost savings by fiscal 2028, improving margins over the long run.

- According to the analysts' consensus view, these savings should support profit margin gains, while investments in brewery expansions and brand marketing aim to keep margins stable, even as revenue growth remains modest.

- Constellation has guided that its beer business will maintain operating margins of 39% to 40%. This would be resilient if new tariffs or inflation pressures intensify.

- The company expects operating cash flow to reach $9 billion and free cash flow to hit $6 billion from fiscal 2026 to 2028, supporting ongoing investments.

- Consensus expects restructuring actions to yield margin upside. See where the story aligns with a balanced view. 📊 Read the full Constellation Brands Consensus Narrative.

Margin Gains Versus Revenue Headwinds

- While analysts see profit margins climbing from -4.4% today to 22.8% by 2028, they estimate annual revenue will drop 1.2% over the next three years. This rare divergence highlights profit focus over top-line growth.

- The consensus narrative highlights that, even as the company invests in beer capacity, incrementally higher marketing, and brand loyalty, the lagging revenue projections are a core point of tension.

- Consensus expects lower long-term sales growth in beer, revising forecasts from 7%-9% to 2%-4%. However, improved earnings are expected as margin initiatives play out.

- Socioeconomic pressures among key consumer groups, especially Hispanic beer drinkers, pose ongoing risk to volume growth even as profit margins appear set to rise.

Valuation Stands Out Against Industry Peers

- Constellation’s current price-to-earnings multiple is higher than sector and peer averages, reflecting an expensive valuation. Even so, the stock is trading at a discount to its $334.08 DCF fair value.

- The analysts’ consensus view acknowledges that while the current share price of $142.76 is below their $173.17 target, this gap depends on profit margins hitting aggressive forecasts. This is something investors will want to monitor.

- If margins and earnings targets for 2028 are met, the prospective 16.3x PE ratio will actually be lower than the current US Beverage industry average of 24.4x.

- Share buybacks, authorized up to $4 billion over three years, are positioned to boost earnings per share and potentially close the valuation gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Constellation Brands on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity the consensus might have missed? Shape your analysis and build your personal narrative in just a few minutes: Do it your way.

A great starting point for your Constellation Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Constellation Brands faces sluggish revenue growth and relies on aggressive margin improvements, making future gains highly sensitive to execution and market conditions.

If you’d like more reliable growth, check out stable growth stocks screener for companies consistently expanding revenues and earnings, designed for steadier performance across all market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives