- United States

- /

- Food

- /

- NYSE:SJM

Is Smucker Trading Below Fair Value After a 7% Slide in 2025?

Reviewed by Bailey Pemberton

- Wondering if J. M. Smucker is priced right for your portfolio or if the market has it all wrong? You are not alone, and getting the valuation right can make all the difference.

- The stock has seen its ups and downs lately, ticking up 1.4% over the past week but still down 4.6% in the last month and 7.0% so far this year.

- Recent headlines have centered around the shifting landscape in consumer staples, with bigger trends in food inflation and shifting consumer preferences impacting sentiment. Analysts have pointed to an evolving competitive environment, which may help explain the mixed signals from recent share price movements.

- J. M. Smucker scores a 3/6 when we check how undervalued the business is across six key metrics. If you are looking for a better way to cut through the noise on what makes a stock truly undervalued, keep reading as we break down the usual valuation methods and reveal a smart alternative at the end.

Approach 1: J. M. Smucker Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today's value using an interest rate that reflects risk. This helps investors understand what a business is really worth, beyond just its current stock price.

For J. M. Smucker, the latest reported Free Cash Flow stands at $533.5 Million. Analysts forecast steady growth, with Free Cash Flow expected to reach $1.22 Billion by 2028. The projections continue through the next decade with estimates extrapolated beyond analyst forecasts, ultimately reaching $1.61 Billion by 2035 as calculated by Simply Wall St.

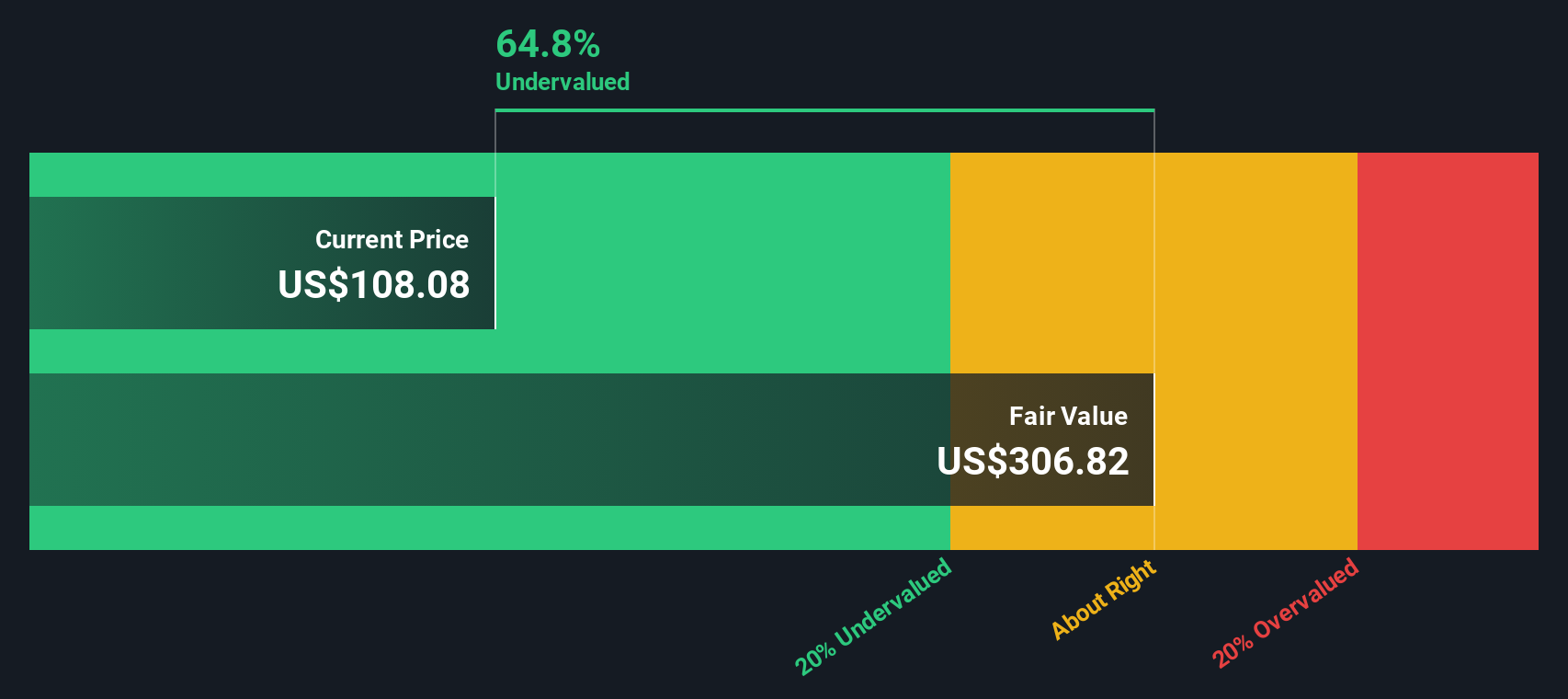

Using these cash flow projections, the DCF model arrives at an intrinsic value of $306.82 per share. Comparing this figure to J. M. Smucker's current share price, the model implies the stock is trading at a 66.3% discount to its fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests J. M. Smucker is undervalued by 66.3%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: J. M. Smucker Price vs Sales

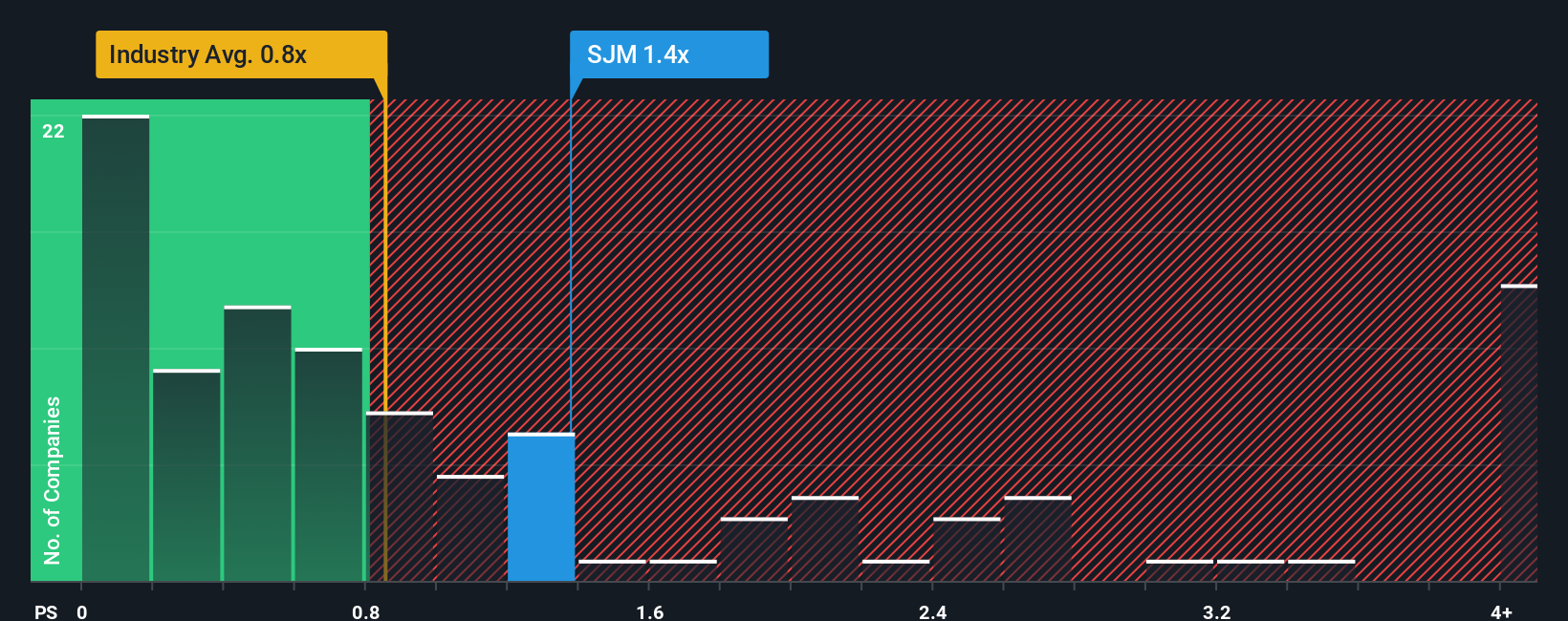

The Price-to-Sales (P/S) ratio is widely used for valuing consumer staple companies like J. M. Smucker, especially when profits may fluctuate due to one-off charges or accounting adjustments. Because sales tend to be more stable over time than earnings, the P/S multiple provides a reliable measure for comparing valuation across companies with steady revenue but variable profits.

A company's growth outlook, profitability, and the risks it faces all factor into what a "normal" or fair P/S ratio should look like. Generally, higher expected growth or better margins command higher multiples, while increased risk or slower growth pull them lower.

J. M. Smucker currently trades at a P/S ratio of 1.27x. In comparison, the average for its Food industry peers is 0.73x, and the broader industry average stands at 0.87x. Simply Wall St's proprietary Fair Ratio for J. M. Smucker is 1.30x, calibrated using factors like the company's growth prospects, profit margins, market cap, and the specific characteristics of its industry.

Unlike simple peer or industry comparisons, the Fair Ratio offers a tailored benchmark that accounts for the nuances of each business. This provides a more precise indicator of whether the stock is attractively valued relative to its own fundamentals and outlook.

With J. M. Smucker's current P/S multiple just 0.03x below its Fair Ratio, the stock is trading very close to its intrinsic value indicated by this method.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your J. M. Smucker Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives—a smarter, more dynamic approach to investing that is available right now on Simply Wall St’s Community page. A Narrative connects your personal story about a company to its financial outlook by letting you set your own fair value using your assumptions about future revenue, profit margins, and company risks. Instead of treating valuations like fixed numbers, Narratives allow you (and millions of other investors) to build a story behind the numbers, tie it directly to your forecast, and watch your fair value update when new news or earnings are released.

With Narratives, you can easily see whether your story means J. M. Smucker is trading above or below your own fair value estimate, which can help you decide if it is time to buy, hold, or sell. For example, using publicly available ranges, a more bullish investor might believe coffee segment strategies will boost future earnings and set a fair value close to $130. Meanwhile, a more cautious investor could point to margin risks and legacy brands to support a fair value closer to $105. Narratives empower you to compare these stories side by side, adjust your own expectations, and invest based on what you truly believe about J. M. Smucker’s future.

Do you think there's more to the story for J. M. Smucker? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)