- United States

- /

- Beverage

- /

- NYSE:SAM

Boston Beer Company (SAM): Evaluating Valuation Following Strong Q2 Earnings Boost and New Product Momentum

Reviewed by Kshitija Bhandaru

Boston Beer Company (SAM) delivered a 24% boost to earnings per share in Q2 2025, crediting strategic pricing, a refined product mix, and margin gains. The company highlighted new products like Sun Cruiser as key contributors in the competitive ready-to-drink spirits market.

See our latest analysis for Boston Beer Company.

After a strong Q2 driven by new products and improved margins, Boston Beer Company's momentum is facing bigger-picture challenges. The share price has climbed nearly 16% over the past 90 days, recapturing some ground. However, longer-term total shareholder returns show a tough stretch, with a 1-year loss of 19.7% and a steep 5-year total return of -75.6%. Recent collaborative releases and ongoing innovation signal management’s commitment to reigniting growth, even if broader sentiment remains cautious for now.

If you’re interested in taking your search further, why not discover fast growing stocks with high insider ownership next?

With earnings jumping but long-term returns still deeply negative, does Boston Beer’s current price reflect all the risks and future growth? Or could there be a genuine buying opportunity for those looking ahead?

Most Popular Narrative: 7% Undervalued

Boston Beer Company's last close of $222.70 sits below the most widely followed narrative's fair value estimate of $239.36, suggesting some room for upside. The stage is set for a pivotal growth story in a challenging sector, with margin expansion and innovation leading the way.

Ongoing productivity initiatives (brewery efficiency, procurement and waste reduction) are structurally raising gross margins, which should continue to benefit earnings as volume normalizes and new, margin-accretive products (e.g., Sun Cruiser) scale.

Want a look behind the curtain? The price target in this narrative is powered by big expectations for margins, product launches, and profit growth. But what is the linchpin in their math? Read the full story. One overlooked detail could change your view of Boston Beer’s potential.

Result: Fair Value of $239.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. If core beer demand continues to decline or new product launches fail to gain traction, Boston Beer's growth story could quickly unravel.

Find out about the key risks to this Boston Beer Company narrative.

Another View: What Do Multiples Suggest?

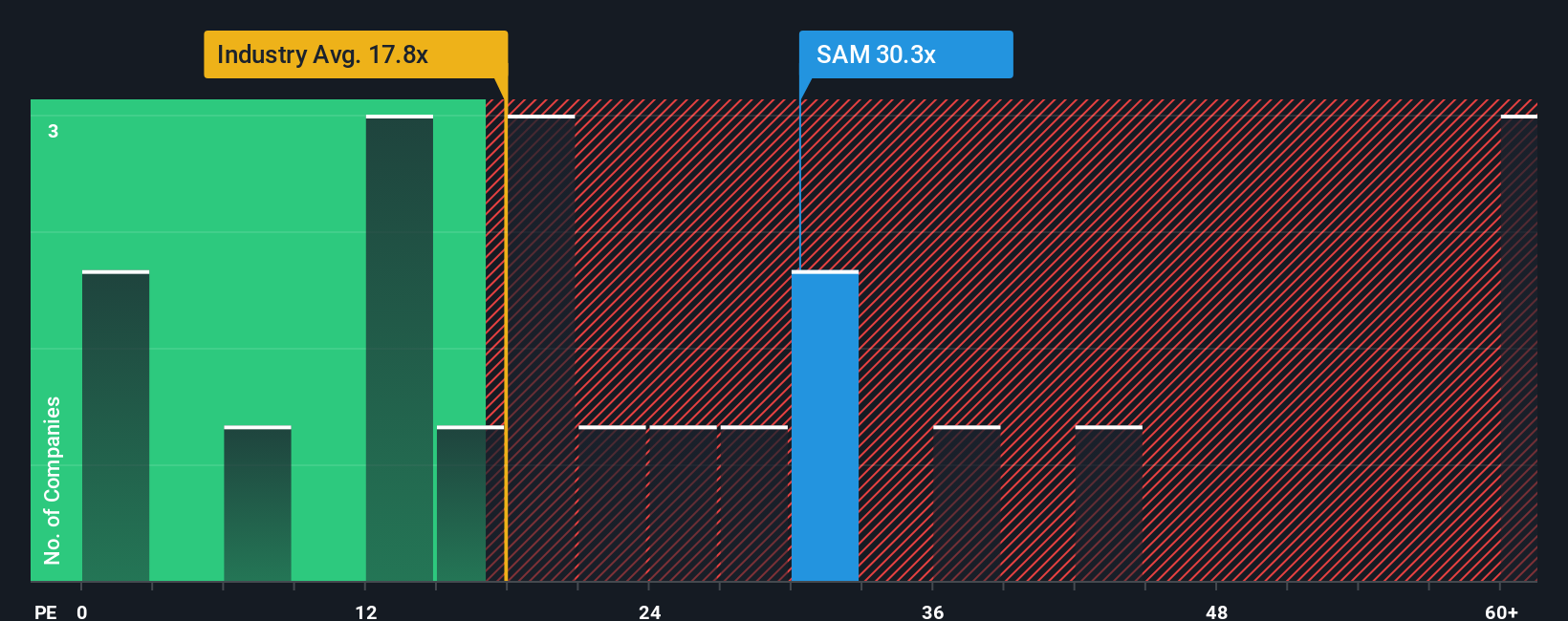

Looking through the lens of price-to-earnings, Boston Beer trades at 29.9x, which is far above both the global beverage industry average of 17.8x and its peer group at 18.4x. The fair ratio sits even lower at 17.8x, highlighting a valuation premium that could be hard to justify if growth lags. Is the market overlooking risk, or does it see a turnaround others don't?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boston Beer Company Narrative

If you see things differently or want to dig into the numbers yourself, why not shape your own perspective? It only takes a few minutes. Do it your way

A great starting point for your Boston Beer Company research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the next big move by using the Simply Wall Street Screener. You could spot winning trends before the crowd and never miss your shot at smart investing.

- Tap into potential high-yield opportunities with these 18 dividend stocks with yields > 3%, offering attractive yields above 3% for income-focused investors.

- Catch early movers in artificial intelligence by accessing these 25 AI penny stocks, where the sector’s most promising innovators are making headlines.

- Uncover stocks trading below their intrinsic value by browsing these 881 undervalued stocks based on cash flows, helping you target hidden bargains others might be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Beer Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAM

Boston Beer Company

Produces and sells alcohol beverages primarily in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives