- United States

- /

- Food

- /

- NYSE:LW

Major Argentina Facility Launch and Export Push Might Change The Case For Investing In Lamb Weston Holdings (LW)

Reviewed by Sasha Jovanovic

- Lamb Weston Holdings recently celebrated the opening of its 40,000-square-meter potato processing facility in Mar del Plata, Argentina, designed to produce over 100 frozen potato product varieties and process up to 200 million pounds annually for Latin American export, primarily to Brazil.

- This significant expansion underscores the company’s commitment to regional growth, creating 250 direct jobs, strengthening relationships with over 100 local producers, and highlighting its role in supporting economic development in the area.

- We’ll explore how the Mar del Plata facility’s launch and export focus could shape Lamb Weston’s international growth outlook and strategic priorities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lamb Weston Holdings Investment Narrative Recap

To be a shareholder in Lamb Weston Holdings, you need to believe in the company's ability to grow global demand for frozen potato products through regional expansion and continual innovation, while managing margin pressures. The recent opening of the Mar del Plata facility targets market share growth in Latin America, but does not materially change the biggest short-term catalyst, the need to restore higher-margin performance amid highly competitive pricing, and the main risk remains the potential for continued margin compression and shifting consumer trends.

The company's reaffirmation of fiscal 2026 net sales guidance between US$6.35 billion and US$6.55 billion stands out as most relevant, reflecting a steady outlook that incorporates known tariff impacts but also recognizes ongoing challenges related to price competition and cost pressures. As Lamb Weston leans further into emerging markets, topline growth may be supported, but the thinner profit margins characteristic of these regions remain a concern for the company’s bottom line.

Yet, in contrast to expansion headlines, investors should be aware that margin recovery in less mature markets like Latin America is far from guaranteed...

Read the full narrative on Lamb Weston Holdings (it's free!)

Lamb Weston Holdings is projected to reach $6.7 billion in revenue and $550.7 million in earnings by 2028. This outlook reflects a 1.3% annual revenue growth rate and a $193.5 million increase in earnings from the current level of $357.2 million.

Uncover how Lamb Weston Holdings' forecasts yield a $66.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

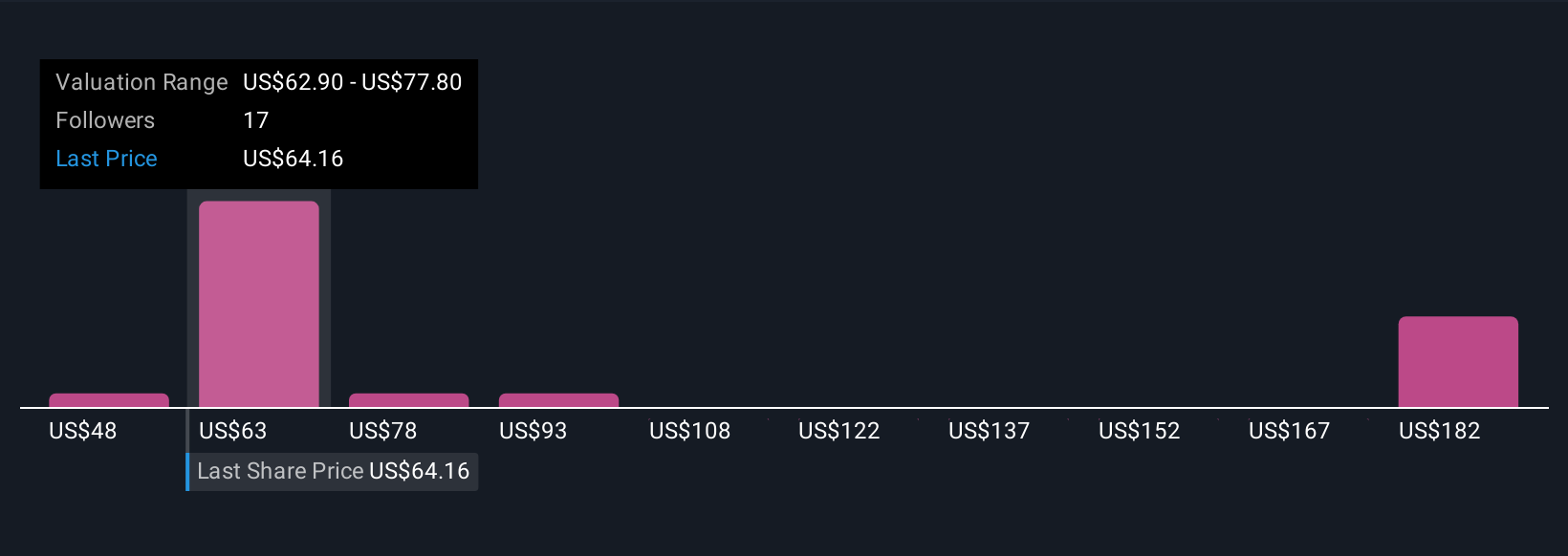

Private investors from the Simply Wall St Community estimate Lamb Weston’s fair value from US$48 to US$196.98, with eight individual perspectives represented. While some expect stronger returns from international expansion, many highlight how thinner margins abroad may weigh on long-term earnings growth, urging you to compare these diverse viewpoints before making up your mind.

Explore 8 other fair value estimates on Lamb Weston Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Lamb Weston Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lamb Weston Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lamb Weston Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lamb Weston Holdings' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LW

Lamb Weston Holdings

Engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives