- United States

- /

- Food

- /

- NYSE:LW

Lamb Weston (LW): Examining Valuation After Strong Results and Upbeat Guidance Boost Investor Confidence

Reviewed by Kshitija Bhandaru

Lamb Weston Holdings (NYSE:LW) reported quarterly results that came in ahead of forecasts, driven by higher sales volumes in North America and Asia. The company also reaffirmed its financial targets for fiscal 2026, reinforcing its operational outlook.

See our latest analysis for Lamb Weston Holdings.

Lamb Weston Holdings’ latest quarterly results and reaffirmed guidance sparked a meaningful rally in its share price, as investors responded positively to the company’s steady operational outlook and strong sales momentum. While the share price return over the past year is slightly negative, the recent burst of momentum reflects renewed optimism about the business’s prospects and its capacity to navigate challenges in the frozen foods market.

If you’re looking to widen your investment lens beyond just food producers, this is a good moment to discover fast growing stocks with high insider ownership

Given the recent outperformance and steady outlook, is Lamb Weston stock now undervalued after a challenging year? Or has the latest rally already priced in its next phase of growth for investors?

Most Popular Narrative: 4.7% Undervalued

Based on the most widely followed narrative, Lamb Weston's fair value stands slightly above its recent closing price of $62.90, signaling upside potential even after the rally. This narrative is built from the latest analyst models and sets expectations for long-term growth and margin recovery alongside improved business momentum.

Gross margins have exceeded previous forecasts, reflecting operational efficiency and pricing power in a challenging market. There is increased confidence in the company's ability to recover commercially, with recent new business wins and the resumption of a previously curtailed production line serving as evidence.

Want to see what’s fueling this bullish thesis? The narrative’s fair value rests on a mix of earnings resurgence, operational adjustments, and a profit margin inflection point that might surprise you. Discover which bold assumptions drive the analysts’ target for Lamb Weston; some numbers may be unexpected.

Result: Fair Value of $66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure and slower restaurant traffic could still weigh on Lamb Weston’s margin recovery and present challenges to the current upbeat outlook.

Find out about the key risks to this Lamb Weston Holdings narrative.

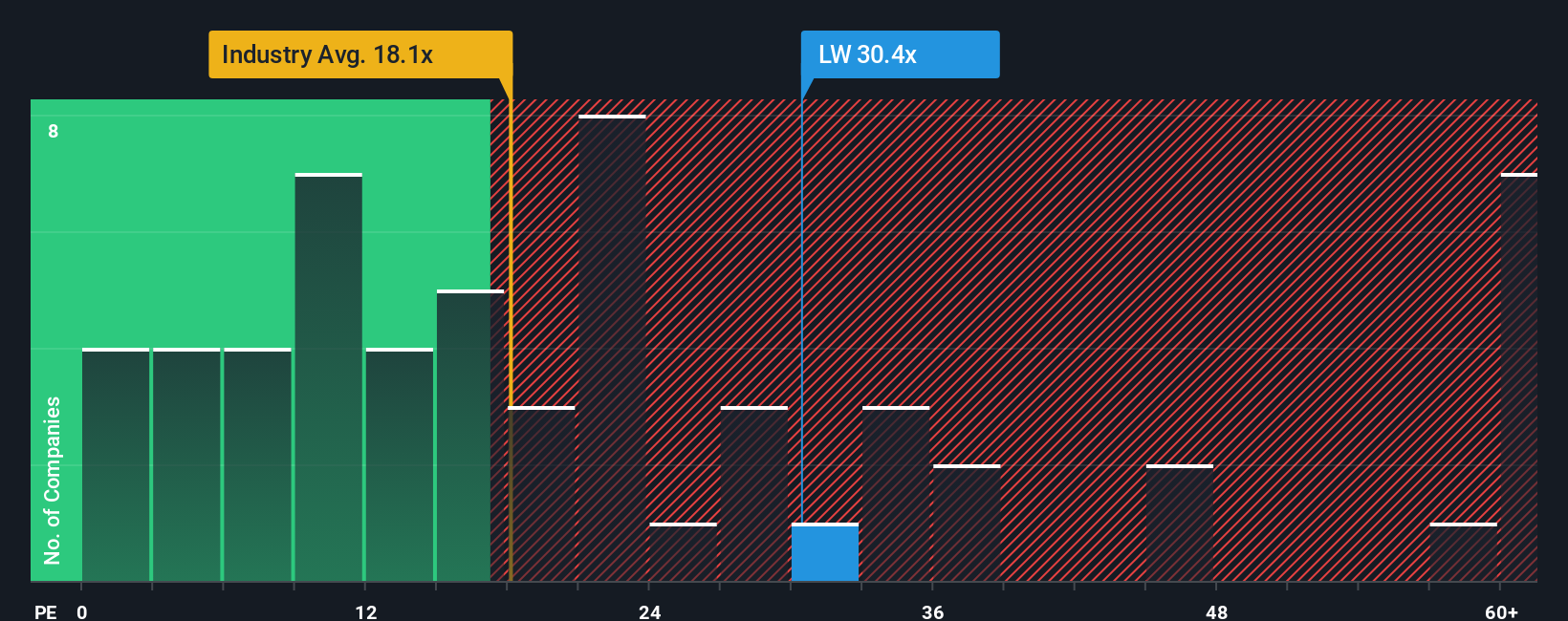

Another View: Market Valuation Comparison

Taking a closer look at valuation multiples, Lamb Weston currently trades at 29.8 times earnings. This is much higher than both the US Food industry average of 18 times and its peer average of 11.5 times. Even compared to its fair ratio of 26.1 times, the stock seems pricey, exposing investors to potential downside if market sentiment shifts. Does the market see something special, or is risk being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lamb Weston Holdings Narrative

If these perspectives don't fully align with your own, or you’d rather dig into the numbers personally, it only takes a few minutes to construct your own view. Start here: Do it your way

A great starting point for your Lamb Weston Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one opportunity when there could be better options waiting. Use these smart screeners now to shape your next investment move before others spot them.

- Boost your portfolio's growth by tapping into the potential of up-and-comers with strong fundamentals using these 3563 penny stocks with strong financials.

- Capture income opportunities and steady cash flow by finding these 19 dividend stocks with yields > 3% that offer attractive yields above 3%.

- Ride the wave of innovation by targeting tomorrow’s breakthroughs and seeking out these 24 AI penny stocks powering advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LW

Lamb Weston Holdings

Engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives