- United States

- /

- Professional Services

- /

- NasdaqGS:RGP

US Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations, with technology shares leading a recent decline, investors are keenly observing economic indicators and Federal Reserve policies for guidance. In this environment, dividend stocks can offer a measure of stability and income, making them an attractive consideration for those looking to navigate the current market dynamics effectively.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.33% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.55% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.50% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.33% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.32% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Resources Connection (NasdaqGS:RGP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Resources Connection, Inc. operates under the Resources Global Professionals (RGP) brand, providing consulting services to businesses across North America, the Asia Pacific, and Europe, with a market cap of approximately $282.50 million.

Operations: Resources Connection, Inc. generates its revenue through consulting services offered under the Resources Global Professionals brand across North America, the Asia Pacific, and Europe.

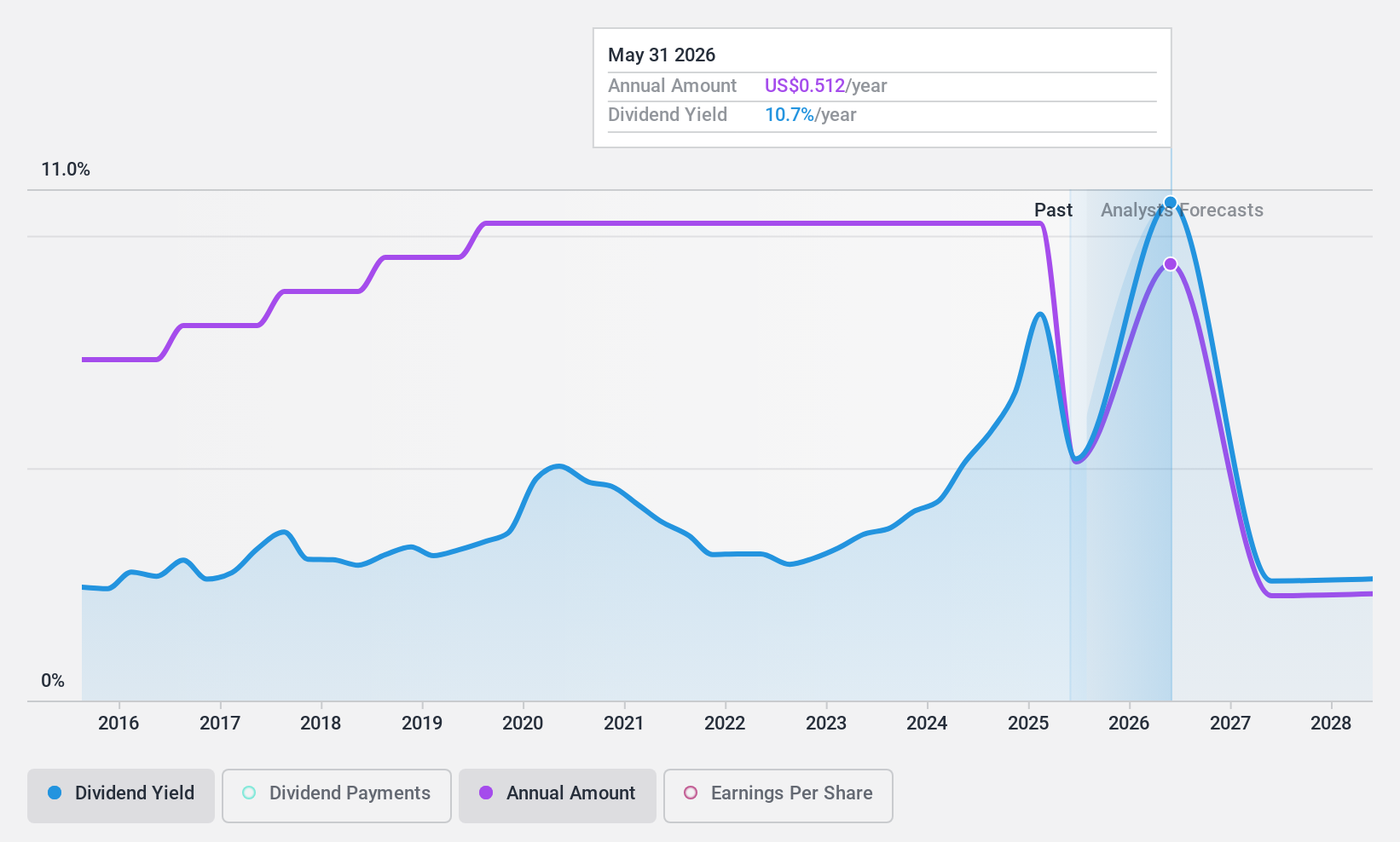

Dividend Yield: 6.6%

Resources Connection offers a stable dividend history with reliable payments over the past decade, though its high payout ratio of 153.4% suggests dividends are not well covered by earnings. Despite a top-tier yield of 6.64%, profit margins have declined, and recent earnings showed a net loss. The company has initiated a $50 million share repurchase program but faces challenges like delayed SEC filings and reduced revenue compared to last year, impacting its overall financial health.

- Click to explore a detailed breakdown of our findings in Resources Connection's dividend report.

- In light of our recent valuation report, it seems possible that Resources Connection is trading behind its estimated value.

Coca-Cola FEMSA. de (NYSE:KOF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Coca-Cola FEMSA, S.A.B. de C.V., a franchise bottler, operates by producing, marketing, selling, and distributing Coca-Cola trademark beverages across several Latin American countries including Mexico and Brazil with a market cap of $16.63 billion.

Operations: Coca-Cola FEMSA generates its revenue primarily from non-alcoholic beverages, amounting to MX$267.59 billion.

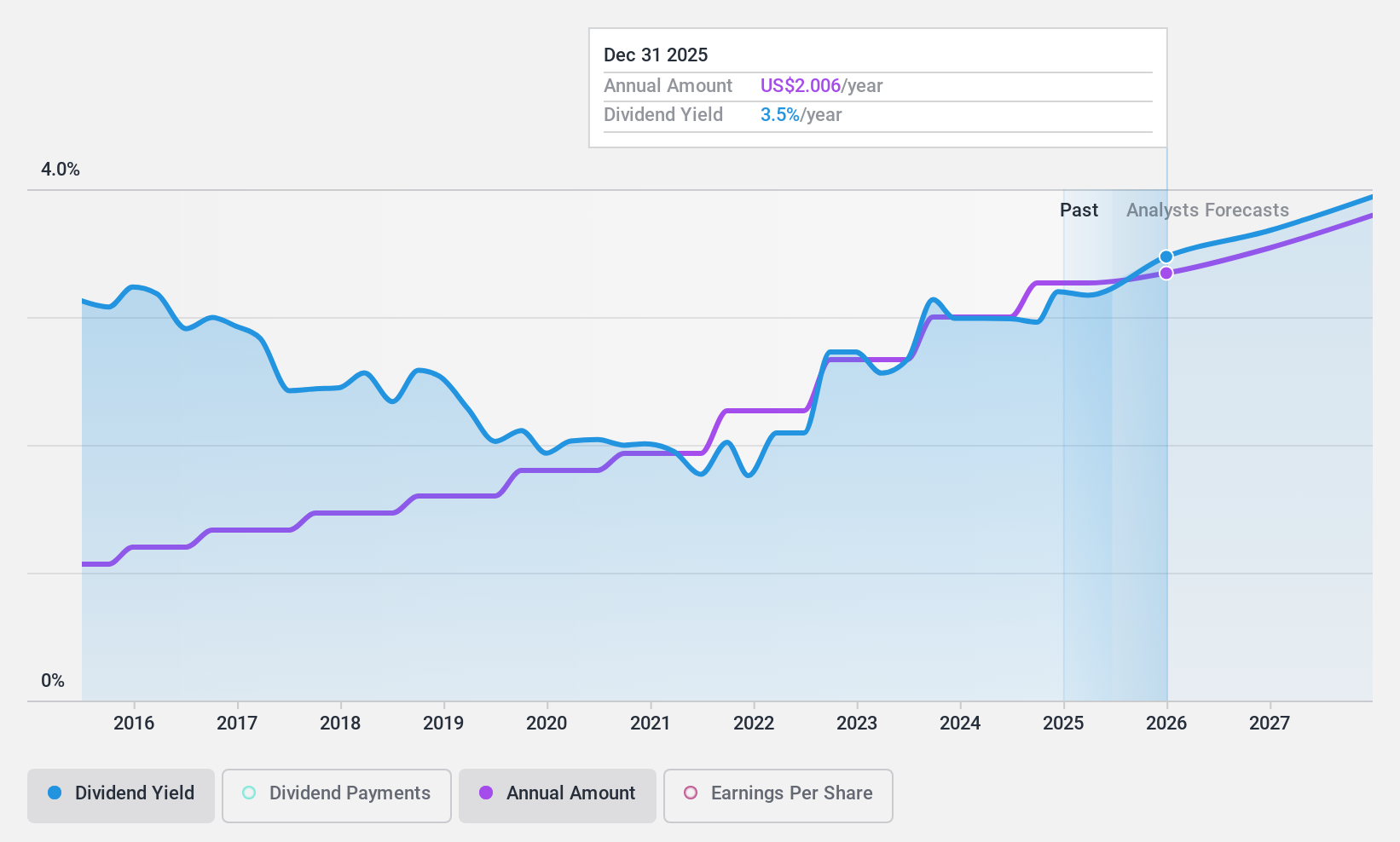

Dividend Yield: 3.7%

Coca-Cola FEMSA's dividends are well-covered, with a payout ratio of 58.7% from earnings and 65.9% from cash flows, ensuring sustainability. Trading at a good value compared to peers, the stock is priced below its estimated fair value. While offering a stable and growing dividend history over the past decade, its yield of 3.72% is slightly below top-tier US market payers. Recent earnings showed growth in sales and net income year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of Coca-Cola FEMSA. de.

- Our comprehensive valuation report raises the possibility that Coca-Cola FEMSA. de is priced lower than what may be justified by its financials.

Terreno Realty (NYSE:TRNO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Terreno Realty Corporation acquires, owns, and operates industrial real estate in six major coastal U.S. markets with a market cap of approximately $6.03 billion.

Operations: Terreno Realty Corporation generates revenue primarily from investing in real estate, amounting to $365.40 million.

Dividend Yield: 3.2%

Terreno Realty's dividends are sustainably covered by earnings and cash flows, with payout ratios of 74.9% and 88.7%, respectively. The dividend yield of 3.2% is reliable but lower than top-tier US payers, though it has shown stability over the past decade. Recent earnings reports indicate growth in sales and net income year-over-year, supported by strategic lease agreements in key coastal markets like New Jersey and Florida, enhancing revenue potential.

- Click here and access our complete dividend analysis report to understand the dynamics of Terreno Realty.

- The valuation report we've compiled suggests that Terreno Realty's current price could be inflated.

Next Steps

- Unlock our comprehensive list of 135 Top US Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGP

Resources Connection

Engages in the provision of consulting services to business customers under the Resources Global Professionals (RGP) name in North America, the Asia Pacific, and Europe.

Flawless balance sheet established dividend payer.