- United States

- /

- Medical Equipment

- /

- NasdaqGS:ATEC

3 US Growth Stocks With Insider Ownership As High As 24%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations, with technology shares recently leading a downturn, investors are closely monitoring economic indicators and Federal Reserve decisions for signs of stability. In such an environment, growth companies with high insider ownership can offer unique insights into potential resilience and commitment from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 23.7% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 43.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

We're going to check out a few of the best picks from our screener tool.

Alphatec Holdings (NasdaqGS:ATEC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alphatec Holdings, Inc. is a medical technology company focused on designing and developing technologies for the surgical treatment of spinal disorders, with a market cap of approximately $1.36 billion.

Operations: The company's revenue is primarily generated from its Medical Products segment, which accounts for $572.74 million.

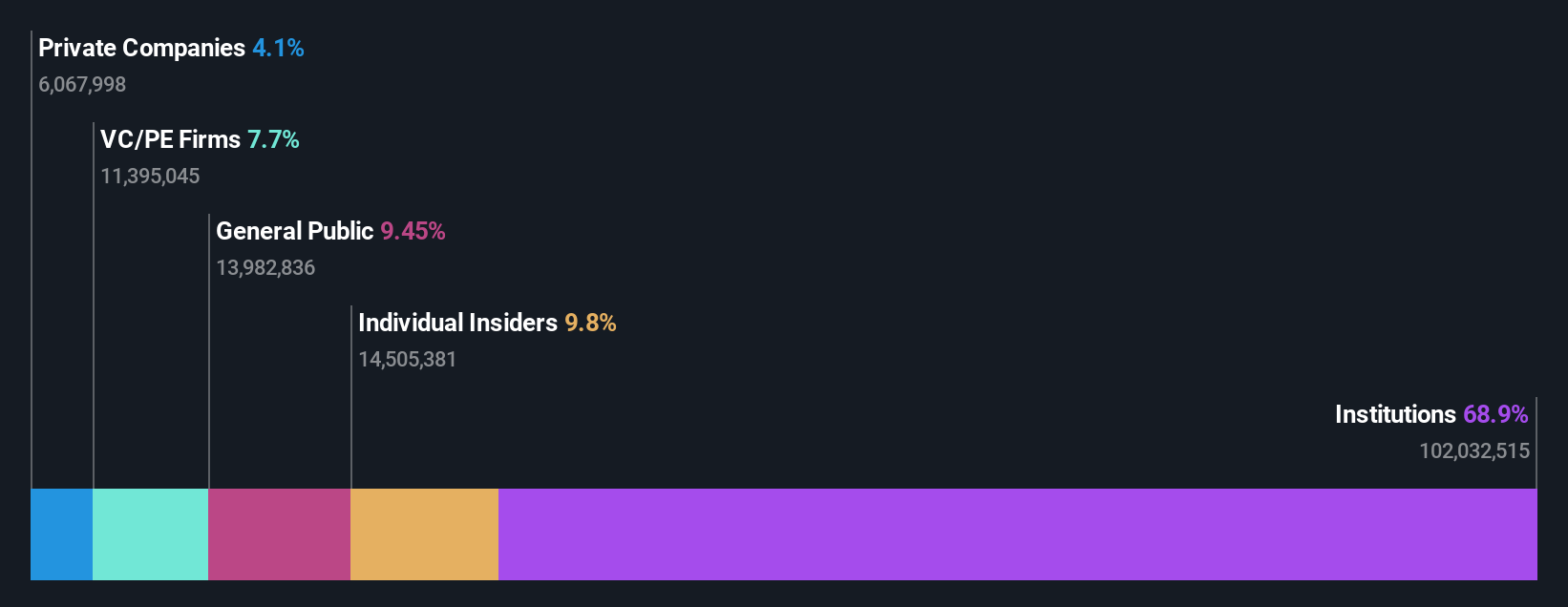

Insider Ownership: 12.1%

Alphatec Holdings, a US-based medical device company, demonstrates potential as a growth company with high insider ownership. Despite reporting net losses of US$128.79 million for the first nine months of 2024, its revenue is forecast to grow faster than the broader US market at 16.2% annually. The company aims to become profitable in three years and recently raised its annual revenue guidance to US$605 million. However, shareholder dilution has occurred over the past year.

- Click here and access our complete growth analysis report to understand the dynamics of Alphatec Holdings.

- In light of our recent valuation report, it seems possible that Alphatec Holdings is trading behind its estimated value.

Nordstrom (NYSE:JWN)

Simply Wall St Growth Rating: ★★★★☆☆

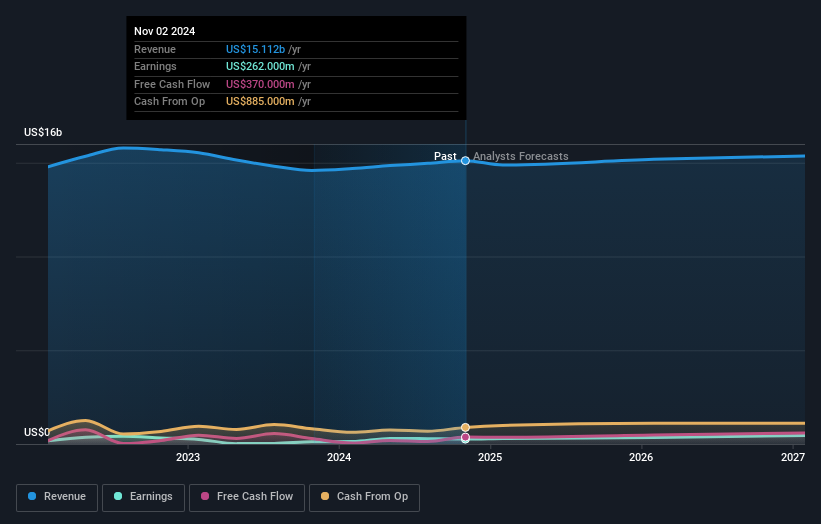

Overview: Nordstrom, Inc. is a fashion retailer offering apparel, shoes, beauty products, accessories, and home goods for all ages with a market cap of approximately $4.06 billion.

Operations: The company's revenue segments include apparel, shoes, beauty products, accessories, and home goods for women, men, young adults, and children.

Insider Ownership: 25%

Nordstrom's insider ownership aligns with its growth potential, as evidenced by significant insider buying recently. The company's earnings are forecast to grow at 20.45% annually, outpacing the broader US market, although revenue growth lags behind. Despite high debt levels and unstable dividends, Nordstrom trades below its estimated fair value and offers good relative value compared to peers. Recent expansions in Florida and Texas bolster its physical presence while a proposed acquisition by El Puerto de Liverpool could reshape ownership dynamics.

- Take a closer look at Nordstrom's potential here in our earnings growth report.

- According our valuation report, there's an indication that Nordstrom's share price might be on the cheaper side.

MoneyLion (NYSE:ML)

Simply Wall St Growth Rating: ★★★★★☆

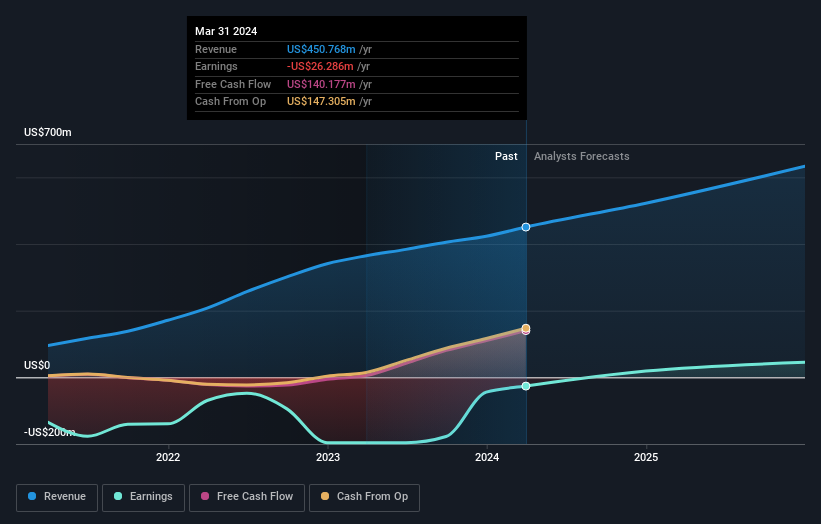

Overview: MoneyLion Inc. is a financial technology company that offers personalized financial products and content to American consumers, with a market cap of approximately $961.81 million.

Operations: The company's revenue primarily comes from its data processing segment, which generated approximately $500.28 million.

Insider Ownership: 19.2%

MoneyLion's high insider ownership supports its growth trajectory, with earnings expected to grow significantly faster than the US market at 89.9% annually. Recent refinancing of $70 million with Silicon Valley Bank reduces capital costs, reflecting strong financial health. Despite past shareholder dilution and share price volatility, MoneyLion's revenue is forecast to grow over 22% per year. The launch of MoneyLion Checkout enhances its platform by integrating financial services into a seamless consumer experience, potentially driving further growth.

- Get an in-depth perspective on MoneyLion's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that MoneyLion is trading beyond its estimated value.

Key Takeaways

- Delve into our full catalog of 210 Fast Growing US Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATEC

Alphatec Holdings

A medical technology company, designs, develops, and advances technologies for the surgical treatment of spinal disorders in the United States and internationally.

Undervalued with reasonable growth potential.