- United States

- /

- Beverage

- /

- NYSE:KOF

Does Coca-Cola FEMSA. de (NYSE:KOF) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Coca-Cola FEMSA. de (NYSE:KOF). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Coca-Cola FEMSA. de

How Quickly Is Coca-Cola FEMSA. de Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. I, for one, am blown away by the fact that Coca-Cola FEMSA. de has grown EPS by 55% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

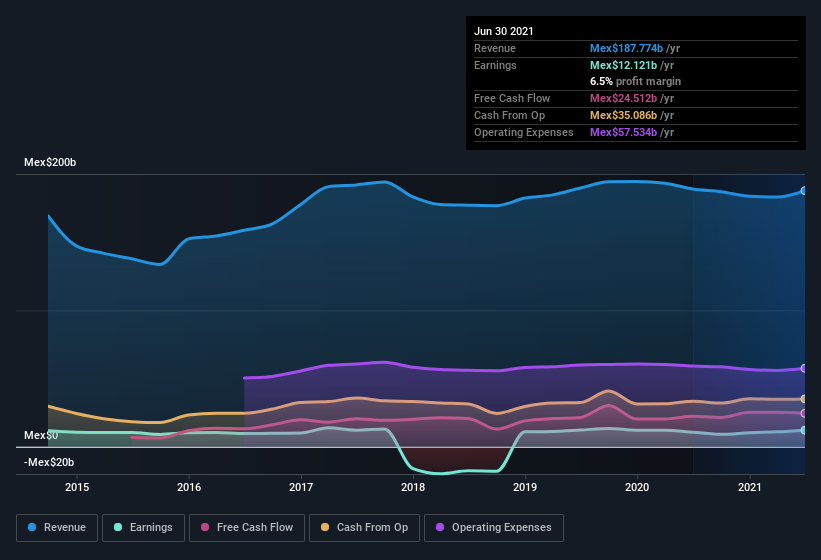

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. This approach makes Coca-Cola FEMSA. de look pretty good, on balance; although revenue is flattish, EBIT margins improved from 13% to 15% in the last year. That's something to smile about.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Coca-Cola FEMSA. de.

Are Coca-Cola FEMSA. de Insiders Aligned With All Shareholders?

Since Coca-Cola FEMSA. de has a market capitalization of US$12b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Notably, they have an enormous stake in the company, worth Mex$146m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Is Coca-Cola FEMSA. de Worth Keeping An Eye On?

Coca-Cola FEMSA. de's earnings per share have taken off like a rocket aimed right at the moon. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Coca-Cola FEMSA. de for a spot on your watchlist. What about risks? Every company has them, and we've spotted 1 warning sign for Coca-Cola FEMSA. de you should know about.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Coca-Cola FEMSA. de or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:KOF

Coca-Cola FEMSA. de

A franchise bottler, produces, markets, sells, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina, and Uruguay.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives