- United States

- /

- Beverage

- /

- NYSE:KOF

Coca-Cola FEMSA. de (NYSE:KOF) Is Paying Out A Larger Dividend Than Last Year

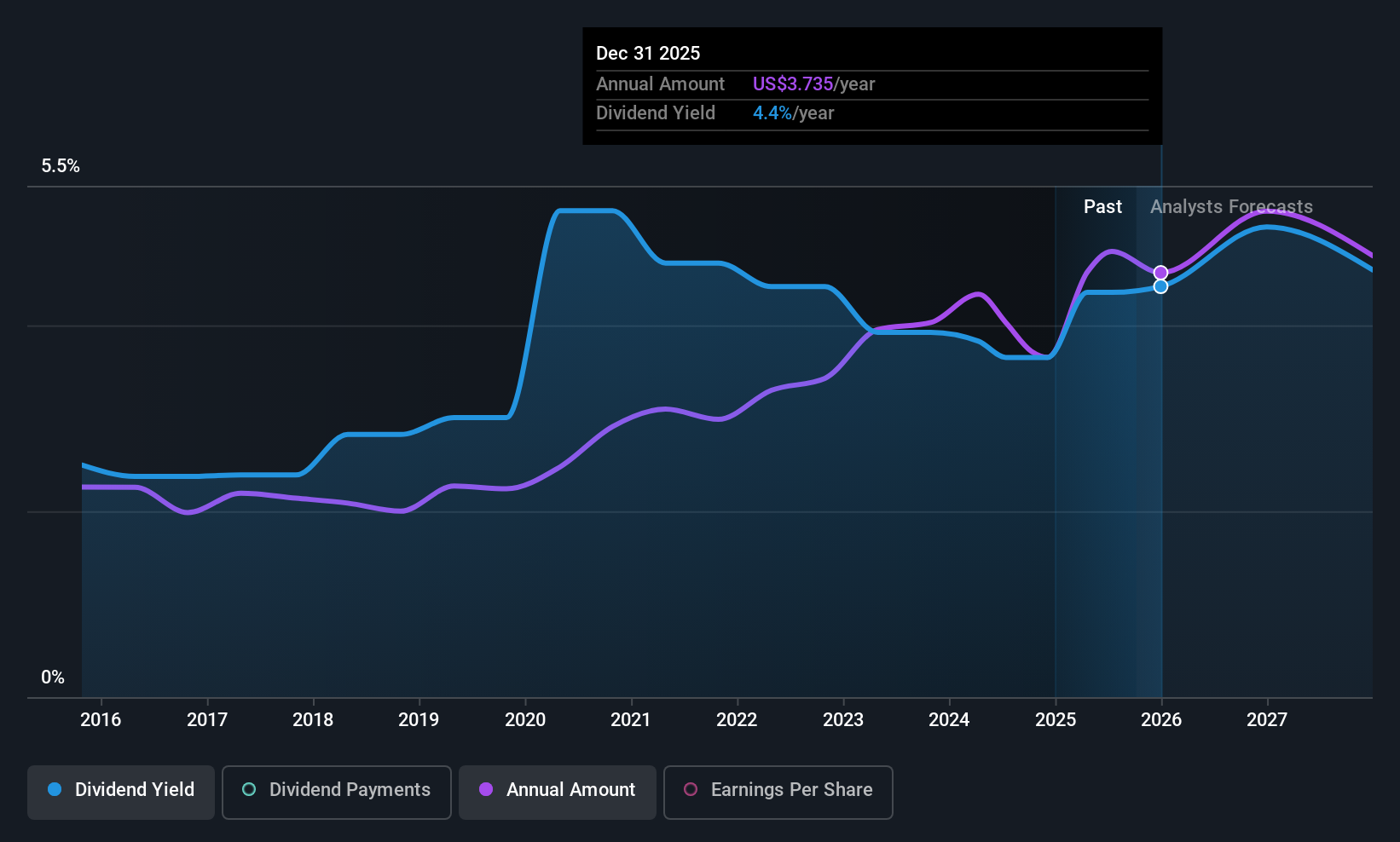

The board of Coca-Cola FEMSA, S.A.B. de C.V. (NYSE:KOF) has announced that it will be paying its dividend of MX$0.9005 on the 27th of October, an increased payment from last year's comparable dividend. This will take the annual payment to 4.8% of the stock price, which is above what most companies in the industry pay.

Coca-Cola FEMSA. de's Projected Earnings Seem Likely To Cover Future Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last payment was quite easily covered by earnings, but it made up 234% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Over the next year, EPS is forecast to expand by 23.9%. Assuming the dividend continues along recent trends, we think the payout ratio could be 2.6% by next year, which is in a pretty sustainable range.

View our latest analysis for Coca-Cola FEMSA. de

Coca-Cola FEMSA. de Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from an annual total of MX$30.90 in 2015 to the most recent total annual payment of MX$73.60. This works out to be a compound annual growth rate (CAGR) of approximately 9.1% a year over that time. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Coca-Cola FEMSA. de has seen EPS rising for the last five years, at 17% per annum. The lack of cash flows does make us a bit cautious though, especially when it comes to the future of the dividend.

Our Thoughts On Coca-Cola FEMSA. de's Dividend

In summary, while it's always good to see the dividend being raised, we don't think Coca-Cola FEMSA. de's payments are rock solid. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for Coca-Cola FEMSA. de that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KOF

Coca-Cola FEMSA. de

A franchise bottler, produces, markets, sells, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina, and Uruguay.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026