- United States

- /

- Beverage

- /

- NYSE:KO

Shareholders Urged Coca-Cola (NYSE:KO) To Align Executive Pay With DEI Goals

Reviewed by Simply Wall St

Coca-Cola (NYSE:KO) saw recent investor activism, led by the National Legal and Policy Center, urging a vote for a Diversity, Equity, and Inclusion proposal related to executive pay. This movement, along with a 5.2% dividend increase and confirmation of earnings guidance, might have supported positive investor sentiment contributing to Coca-Cola’s 15% price rise last quarter. While broader market declines followed new tariffs, resulting in a sell-off for many stocks, defensive consumer staples like Coca-Cola remained relatively resilient, even as significant investor attention focused on potential implications on global operations.

We've identified 3 warning signs for Coca-Cola (1 can't be ignored) that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

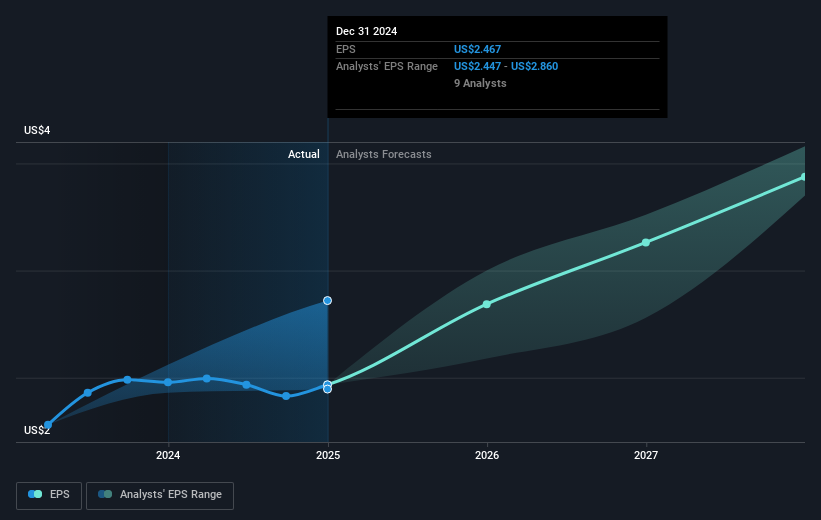

The last 5 years have seen Coca-Cola achieve a total return of 73.93%, a robust performance that reflects a combination of strategic initiatives and market conditions. Amid pressures from inflation and global tariffs, Coca-Cola has remained resilient, benefitting from consumer staples' defensive nature and its significant buyback programs, repurchasing over 73 million shares for US$4.52 billion. Additionally, the company has leveraged successful product expansions, exemplified by FUZE Tea's growth, and embraced AI in marketing to enhance efficiency.

Furthermore, Coca-Cola bolstered shareholder value with consistent dividend increases and strengthening partnerships like the MoU with Jubilant FoodWorks, expanding its market impact in regions like India. Despite external challenges like a slight earnings dip in the past year, its earnings growth over five years has been positive. Recently, Coca-Cola's one-year return exceeded both the US Beverage industry and the broader market by comfortably outperforming them both, illustrating its strong positioning in a competitive landscape.

Explore historical data to track Coca-Cola's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Coca-Cola, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives