- United States

- /

- Beverage

- /

- NYSE:KO

Insider Selling is Picking Up With New Highs for The Coca-Cola Company (NYSE:KO)

The Coca-Cola Company (NYSE: KO) is moving to new highs propelled by the surprisingly strong organic sales, doubling the estimates.

While the iconic brand has been a favorite of consumers and investors alike, sitting at all-time highs, we're cautious about its valuation, especially after noticing the insider selling trend in recent months.

View our latest analysis for Coca-Cola

Q1 Earnings Release

- Non-GAAP EPS: US$0.64 (beat by US$0.06)

- Revenue: US$10.5b (beat by US$670m)

- Revenue growth: +16.7% Y/Y

Estimated Impact of business suspension in Russia

- 1% to unit case volume

- 1-2% to net revenues

- US$0.04 to comparable EPS

Meanwhile, organic sales were up 18%, far ahead of the 9.5% consensus estimates, with Latin America leading the growth with 39%. Operating margin grew as well, topping at 32.5% vs. 30.2% the last year. These results were primarily driven by the topline growth but partially offset by higher marketing costs, currency headwinds, and BodyArmor acquisition.

Coca-Cola Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the Executive VP & CFO, John Murphy, sold US$3.3m worth of shares at a price of US$62.29 per share. That means that even when the share price was below the current price of US$65.94, an insider wanted to cash in some shares. When an insider sells below the current price, they consider that lower price fair. That makes us wonder what they think of the (higher) recent valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders believe the shares are fully valued, so it's only a weak sign. This single sale was 28% of John Murphy's stake.

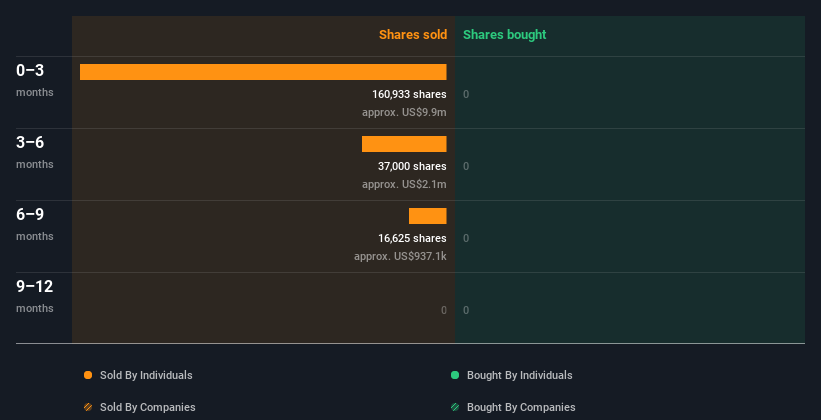

Coca-Cola insiders didn't buy any shares over the last year. Below, you can see a visual depiction of insider transactions (by companies and individuals) in the previous 12 months. By clicking on the graph below, you can see the precise details of each insider transaction!

If you're looking for the companies with insider buying check out this free list of growing companies with considerable, recent, insider buying.

Coca-Cola Insiders Are Selling The Stock

The last quarter saw substantial insider selling of Coca-Cola shares. In total, insiders dumped US$10.0m worth of shares in that time, and we didn't record any purchases whatsoever. In light of this, it's hard to argue that all the insiders think that the shares are a bargain.

What Might The Insider Transactions At Coca-Cola Tell Us?

Coca-Cola has been a steady performer over the last several months, going in the opposite direction of the broad market. Yet, with a 29.2x price-to-earnings ratio and a 7.4x price-to-sales ratio, we find it relatively fairly valued at this moment.

So far, the insiders agree with us, as their activity has been picking up steadily with gains in valuation.These insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. While conducting our analysis, we found that Coca-Cola has 2 warning signs, and it would be unwise to ignore these.

Of course, Coca-Cola may not be the most attractive stock to buy. So you may wish to see this free collection of high-quality companies.

For this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives