- United States

- /

- Beverage

- /

- NYSE:KO

Does Coca-Cola’s Current Price Reflect Its Cash Flow Strength and Growth Outlook in 2025?

Reviewed by Bailey Pemberton

Why Coca-Cola's Valuation Deserves a Closer Look

Coca-Cola has long been viewed as a classic defensive stock, but its current share price is raising fresh questions about whether investors are paying up for safety or getting a fair deal. To figure that out, it can help to break down its value using a few different lenses rather than relying on reputation alone.

On the surface, Coke still appears to be the steady compounder it has long been, with dependable cash flows and one of the strongest brands in the world. Underneath that stability, though, shifting consumer preferences toward low sugar and healthier options are quietly reshaping where and how the company generates growth.

That matters for valuation because a business that can successfully reposition its portfolio, expand margins, and lean on its distribution moat often commands a premium. The key question for investors today is whether the price of Coca-Cola shares already reflects that future, or if the market is still anchored on its past.

Instead of jumping straight to a single fair value number, it can be useful to explore how different valuation methods, such as discounted cash flow and relative multiples, line up or disagree on what Coke is worth. A more narrative-driven way to understand valuation can also help tie these numbers together by the end of the article.

Approach 1: Coca-Cola Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those dollars back to today using a required rate of return.

For Coca-Cola, the model starts with last twelve month Free Cash Flow of about $5.6 Billion and then uses analyst forecasts for several years before extrapolating further out. On this basis, Coca-Cola’s Free Cash Flow is projected to reach roughly $15.2 Billion by 2029, with estimates continuing to rise gradually over the following years as the business scales and margins expand.

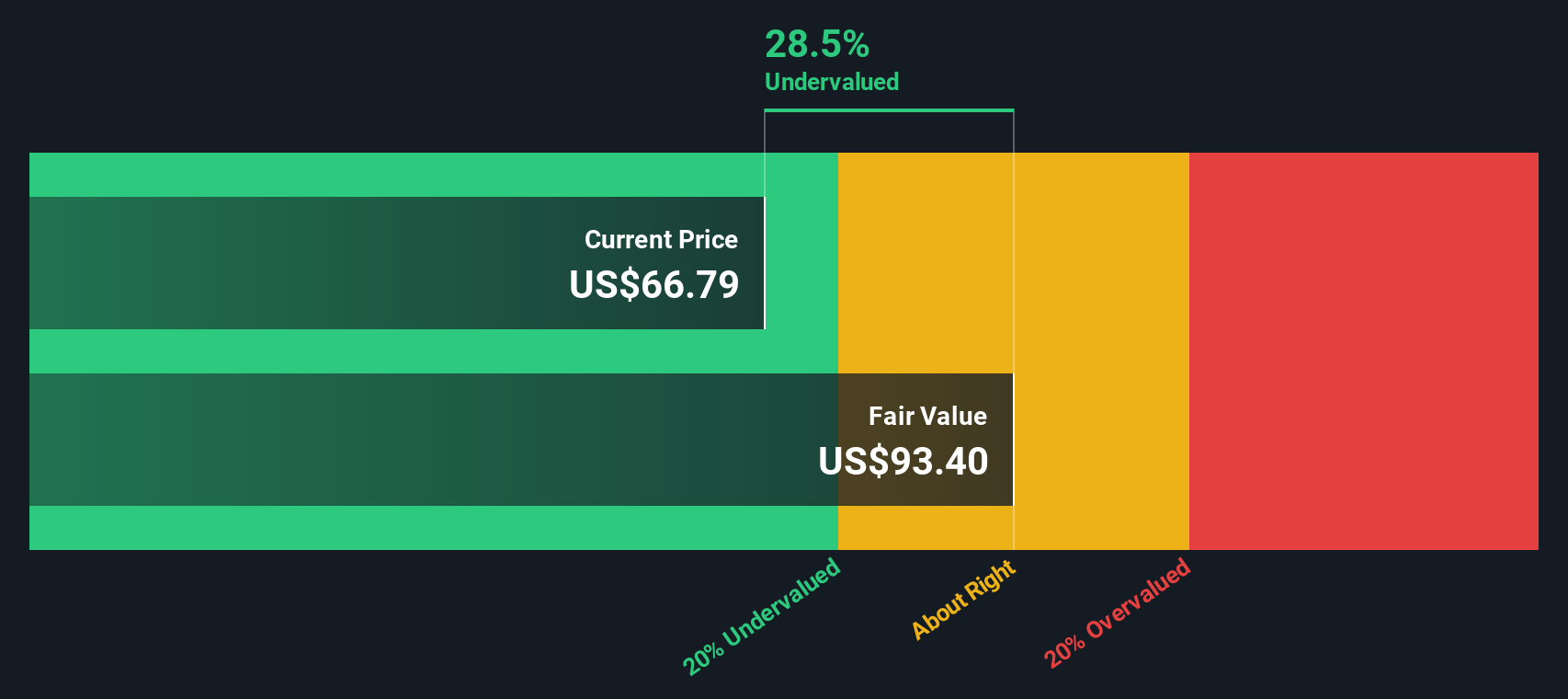

When those future cash flows are discounted back to today in a 2 Stage Free Cash Flow to Equity framework, the implied intrinsic value is about $89.90 per share. Compared with the current share price, this output suggests Coca-Cola is trading at roughly a 22.0% discount to this estimated fair value.

Result: UNDERVALUED (based on this model)

Our Discounted Cash Flow (DCF) analysis suggests Coca-Cola is undervalued by 22.0%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Coca-Cola Price vs Earnings

For a mature, consistently profitable business like Coca-Cola, the Price to Earnings ratio is a practical way to gauge what investors are willing to pay for each dollar of current earnings. It captures not only today’s profitability, but also the market’s expectations for how quickly those earnings will grow and how risky they are perceived to be.

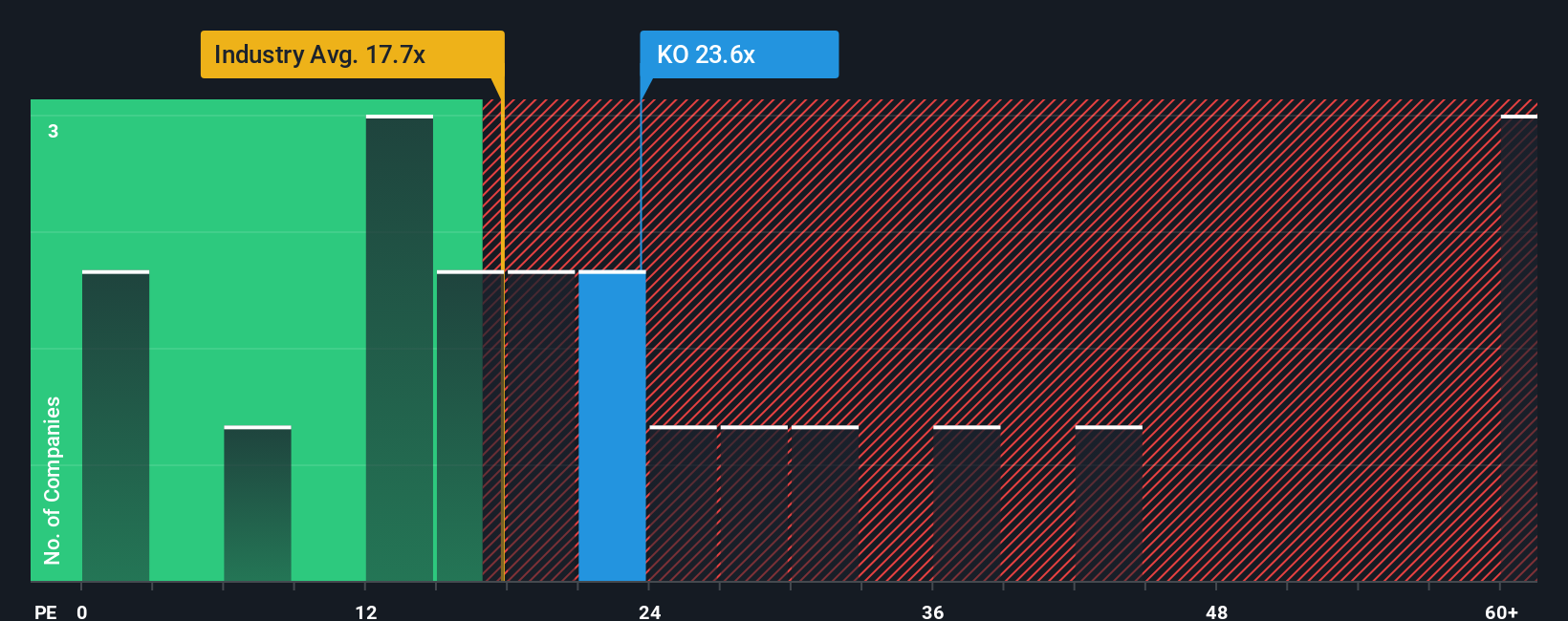

In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty should pull that multiple down. Coca-Cola currently trades on a PE of about 23.1x, which is comfortably above the broader Beverage industry average of roughly 17.4x, but actually a discount to its listed peers, which sit closer to 27.3x. That spread suggests investors already recognize Coca-Cola’s quality, but are not assigning it the richest peer level multiple.

Simply Wall St’s Fair Ratio framework estimates what PE Coca-Cola should trade at given its earnings growth outlook, margins, industry, size, and risk profile. For Coke, that Fair Ratio is around 23.1x, almost identical to its current market PE. This points to a stock that, on an earnings multiple basis, is priced broadly in line with its fundamentals rather than offering a clear bargain or looking stretched.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coca-Cola Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach a clear story to your numbers by linking what you believe about a company’s future to a specific forecast for its revenue, earnings, and margins, and then to a fair value you can compare against today’s price.

On Simply Wall St’s Community page, Narratives are an accessible tool used by millions of investors to spell out their assumptions, automatically turn those into financial projections, and highlight whether a stock looks undervalued or overvalued. This can help you decide when to buy or sell and see how your view stacks up against other investors.

Narratives are also dynamic, updating as new information such as earnings, news, or macro changes arrives. For Coca-Cola, you might see one investor argue that lower discount rates and resilient demand justify a fair value near $67.50. Another, more growth-focused investor might emphasize emerging markets and premium categories to reach a fair value closer to $77.57. Together these views give you a clear sense of the range of reasonable perspectives around the current share price.

For Coca-Cola however we will make it really easy for you with previews of two leading Coca-Cola Narratives:

Fair value: $71.00 per share

Implied undervaluation vs last close: -1.28%

Revenue growth assumption: 6.64%

- Views Coca-Cola as a resilient, recession tested global brand whose diversified portfolio and vast distribution network underpin stable cash flows.

- Emphasizes its long dividend track record and low share price volatility as key attractions for income focused, conservative investors.

- Sees emerging markets, digital transformation, and disciplined buybacks supporting mid single digit growth but concludes the stock is roughly fairly valued around its modeled fair value.

Fair value: $67.50 per share

Implied overvaluation vs last close: 3.83%

Revenue growth assumption: 5.23%

- Frames Coca-Cola as a high quality cash generator whose valuation is very sensitive to small moves in discount rates, especially in DCF models.

- Projects modest revenue growth and strong margins over 3, 5, and 10 year horizons but with gradually compressing valuation multiples as growth slows.

- Argues that while KO’s premium and dividend profile are justified, the shares trade a few percent above intrinsic value on current assumptions, leaving limited upside from here.

Do you think there's more to the story for Coca-Cola? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026