- United States

- /

- Beverage

- /

- NYSE:KO

Considering Coke at $70 After Strong 2024 Run and Growth Investment Plans

Reviewed by Bailey Pemberton

- Wondering if Coca-Cola at around $70 is still a refreshing buy or if most of the upside has already been poured into the price? You are not alone in asking whether KO is good value right now.

- The stock is up 13.8% year to date and 14.3% over the last year, even after a modest 1.1% pullback over the past month. This suggests that the market still sees KO as a relatively steady compounder rather than a high risk swing trade.

- Recently, investors have been digesting news around Coca-Cola's strategic brand investments and continued push into zero sugar and functional beverage categories. These moves speak to how the company plans to defend pricing power and volume over time. There has also been ongoing attention on how the company is navigating consumer demand shifts and cost pressures in key markets, all of which feeds into expectations for its long term cash generation.

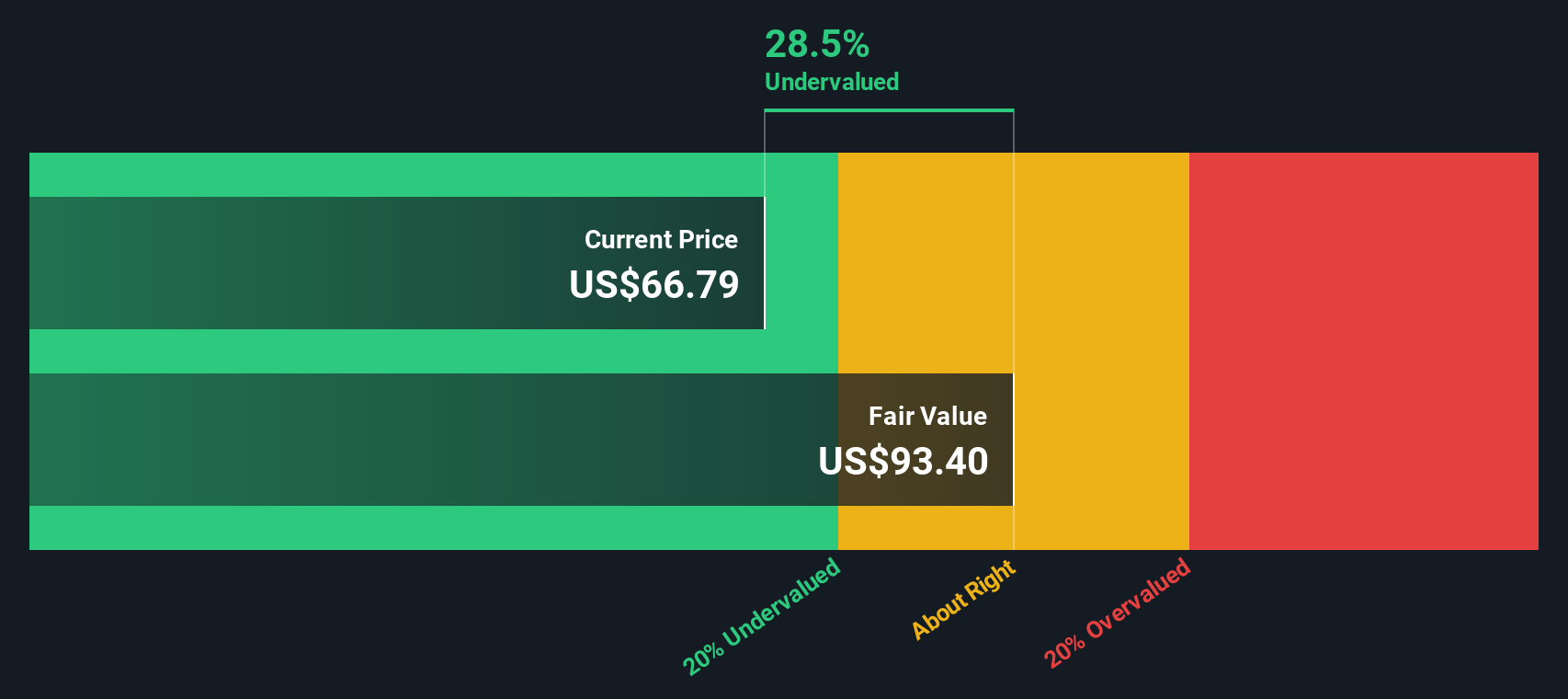

- Right now, Coca-Cola scores a 3/6 valuation check, suggesting it screens as undervalued on some measures but not all. Next, we will walk through the main valuation methods analysts use for KO, and then wrap up with a more holistic way to think about its true worth beyond any single metric.

Approach 1: Coca-Cola Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it is expected to generate in the future and discounting those cash flows back to today in $ terms.

For Coca-Cola, the latest twelve months Free Cash Flow sits at about $5.6 Billion. Analysts and Simply Wall St projections see this rising steadily, with free cash flow expected to reach around $15.2 Billion by 2029, and continuing to grow modestly into the mid 2030s. Simply Wall St uses a 2 Stage Free Cash Flow to Equity model, where analyst forecasts cover the nearer years and later years are extrapolated based on a slowing growth profile.

When these projected cash flows are discounted back to today, the model arrives at an intrinsic value of roughly $89.90 per share. Compared with the current share price near $70, this implies Coca-Cola is about 21.7% undervalued on a DCF basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coca-Cola is undervalued by 21.7%. Track this in your watchlist or portfolio, or discover 915 more undervalued stocks based on cash flows.

Approach 2: Coca-Cola Price vs Earnings

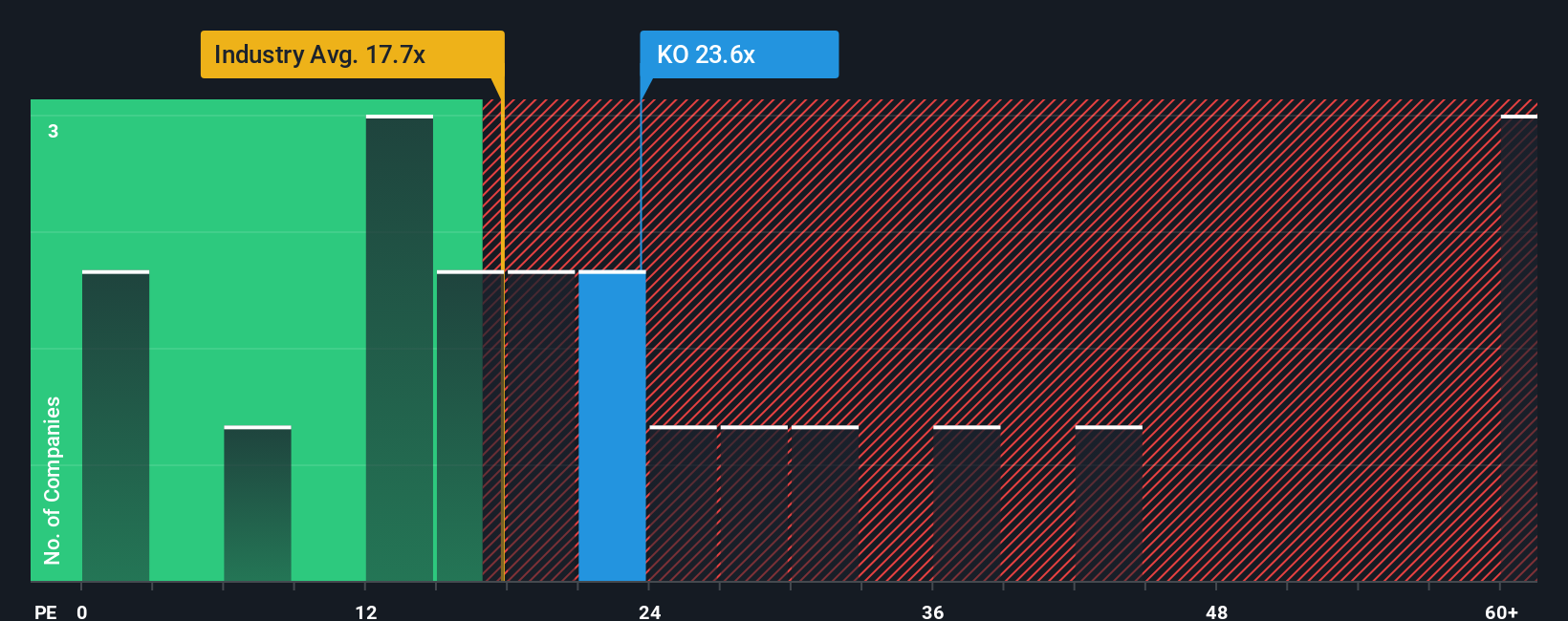

For a mature, consistently profitable business like Coca-Cola, the Price to Earnings, or PE, ratio is a practical way to gauge what investors are paying for each dollar of current earnings. In general, companies with stronger, more reliable growth and lower perceived risk can justify a higher PE, while slower growth or higher uncertainty should translate into a lower, more conservative multiple.

Coca-Cola currently trades on a PE of about 23.2x. That is above the broader Beverage industry average of roughly 17.4x, but below the peer group average near 27.7x. This suggests the market sees KO as higher quality than the average beverage name but not quite as expensive as the fastest growing peers. Simply Wall St also calculates a proprietary “Fair Ratio” of 23.1x, which is the PE you would expect once you factor in Coca-Cola’s earnings growth outlook, profitability, industry, market cap and specific risks.

This Fair Ratio is more informative than a plain comparison to industry or peers because it adjusts for KO’s fundamentals rather than assuming all beverage companies deserve the same multiple. With the actual PE of 23.2x sitting almost exactly on the 23.1x Fair Ratio, the shares look sensibly priced on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coca-Cola Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Coca-Cola’s business with a set of forecasts and a fair value you can actually act on.

A Narrative is your story behind the numbers, where you spell out how you think Coca-Cola’s revenue, earnings and margins will evolve, then link that story to a financial model that calculates a Fair Value per share.

On Simply Wall St, Narratives are an easy, accessible tool inside the Community page, used by millions of investors to turn big picture views into structured forecasts without needing to build spreadsheets from scratch.

Once you have a Narrative, you can quickly compare its Fair Value to Coca-Cola’s current share price to decide whether it looks like a buy, a hold, or a sell for your specific assumptions.

Because Narratives update dynamically when new information such as earnings releases, macro news or company announcements arrive, your view of KO’s value stays current rather than static.

For example, one Narrative currently values Coca-Cola at about $67.50 per share based on lower growth and a cautious discount rate. Another pegs Fair Value closer to $77.57 with stronger growth and margins. This shows how reasonable investors can disagree but still stay disciplined and data driven.

For Coca-Cola however we will make it really easy for you with previews of two leading Coca-Cola Narratives:

Fair value: $71.00 per share

Implied undervaluation: -0.89%

Revenue growth assumption: 6.64%

- Views Coca-Cola as a resilient, recession tested global leader with a wide product umbrella, strong distribution network and reliable cash flows that appeal to conservative, income focused investors.

- Highlights dividend royalty status, with over six decades of annual dividend increases, low share price volatility and ongoing buybacks supporting long term wealth preservation and compounding.

- Assumes steady mid single digit growth driven by emerging markets and digital transformation, while acknowledging risks from FX, tariffs, regulatory pressure and sustainability criticism, and concludes the stock is trading close to fair value.

Fair value: $67.50 per share

Implied overvaluation: 4.26%

Revenue growth assumption: 5.23%

- Frames Coca-Cola as a high quality, cash generative defensive with valuation that is very sensitive to interest rates and discount rate assumptions in DCF models.

- Projects moderate revenue growth, strong margins and robust free cash flow over the next decade, but with gradually compressing valuation multiples as growth decelerates.

- Argues that, despite its premium versus the industry and appeal as a bond substitute in a lower rate environment, the current price sits modestly above intrinsic value on the author’s model.

Do you think there's more to the story for Coca-Cola? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)