- United States

- /

- Food

- /

- NYSE:INGR

Where Ingredion Stands After 11.4% Dip and Revised 2025 Cash Flow Outlook

Reviewed by Bailey Pemberton

If you’re holding shares of Ingredion or thinking about making a move, you’re not alone in wondering where the stock is heading. Over the past five years, Ingredion has quietly delivered an impressive 80.7% return, easily outpacing many of its food industry peers. Even after a recent dip of 11.4% year-to-date and a gentle 0.3% uptick in the last week, investors are paying close attention to what might come next. Changing dynamics in global food supply chains and new product initiatives have kept Ingredion top of mind for both risk-averse and opportunity-seeking investors. While the last month showed a 4.1% decline, the long-term picture is far more upbeat, suggesting that market jitters could be opening the door for value-focused buyers.

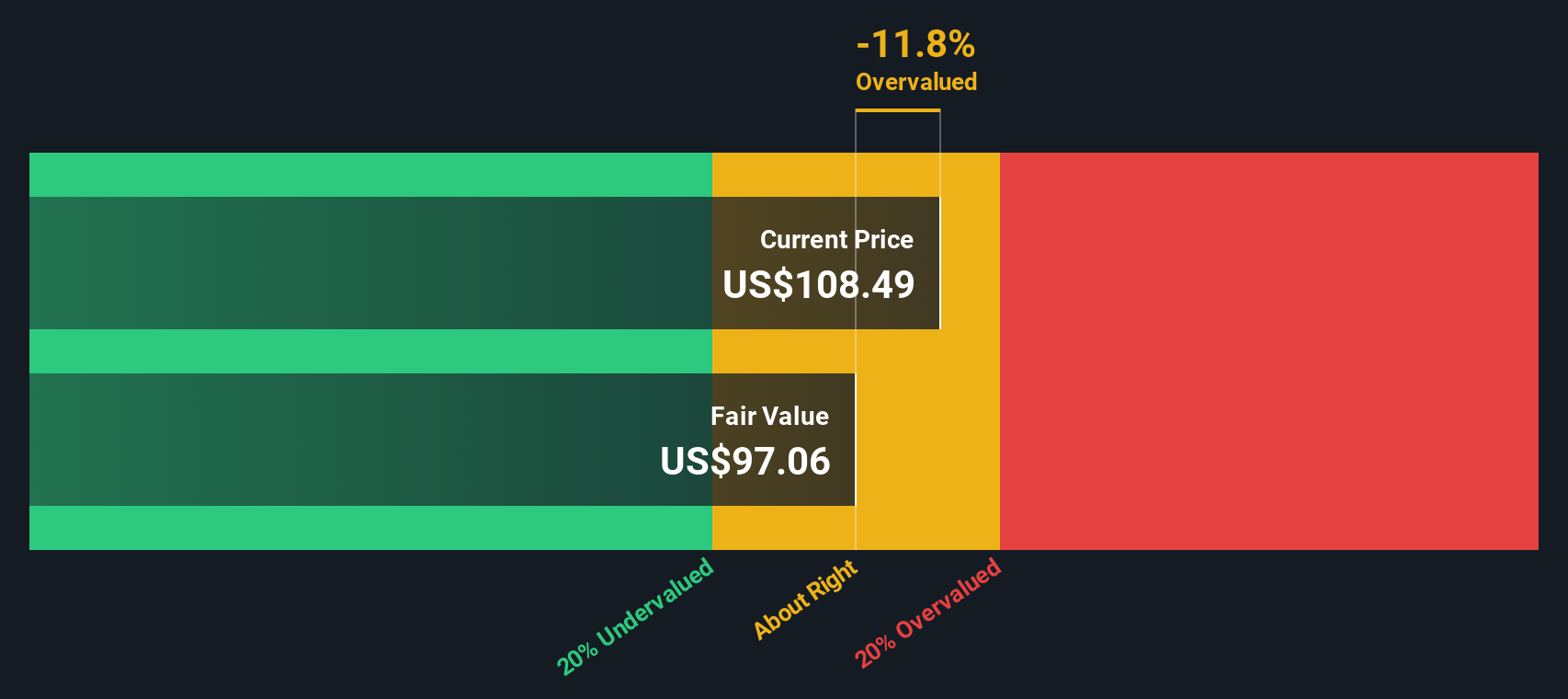

On the subject of value, Ingredion currently shines under the microscope. Our valuation score comes in at 6 out of 6, reflecting strength across all key metrics used to judge whether a stock is undervalued. This is the kind of signal that savvy investors love, especially when a company’s fundamentals seem to be overlooked in the wake of short-term volatility.

So, how do these valuation checks stand up in detail, and which traditional metrics tend to matter most for Ingredion? Next, we will break down the key approaches analysts use to evaluate a stock like this, before uncovering an even more insightful way to measure value at the end of our deep dive.

Approach 1: Ingredion Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and then discounting them back to the present using a suitable rate. For Ingredion, this approach focuses on the company's ability to generate cash both now and in the future, which is a critical factor in long-term valuation.

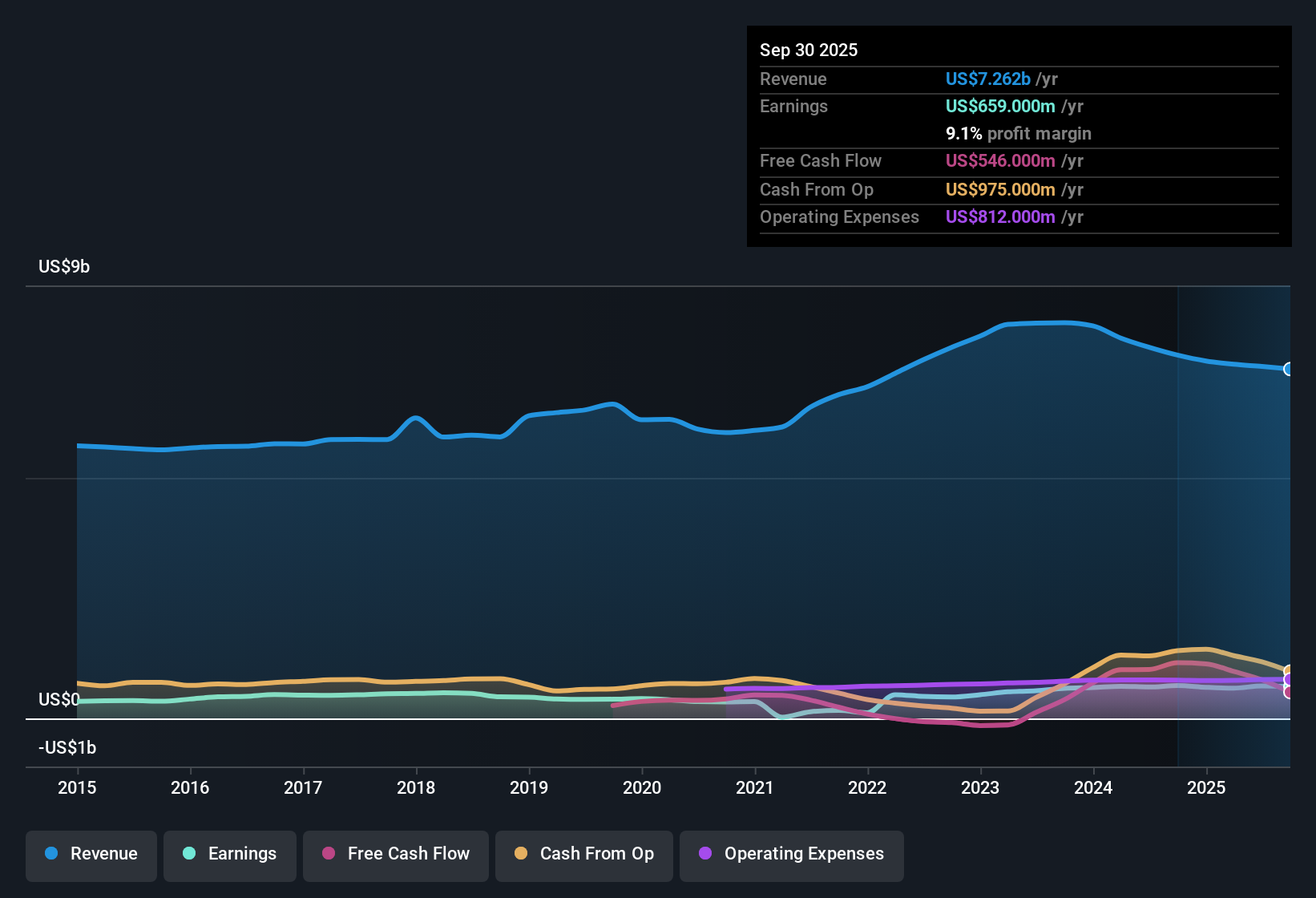

Currently, Ingredion is producing free cash flow of $872.98 million, with analysts expecting next year’s cash flows to come in slightly lower at $778 million. Looking forward, projections extend out over the next decade, with free cash flow estimates reaching roughly $869.7 million by 2035. These projections, combined with a steady growth rate assumption, form the basis of the DCF model's calculation.

As a result, the estimated intrinsic value of Ingredion shares is $285.06. This estimate is based on Simply Wall St's two-stage free cash flow to equity method. Compared to the current share price, this indicates the stock is about 57.6% undervalued. According to this analysis, the market may be underestimating Ingredion's future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ingredion is undervalued by 57.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Ingredion Price vs Earnings

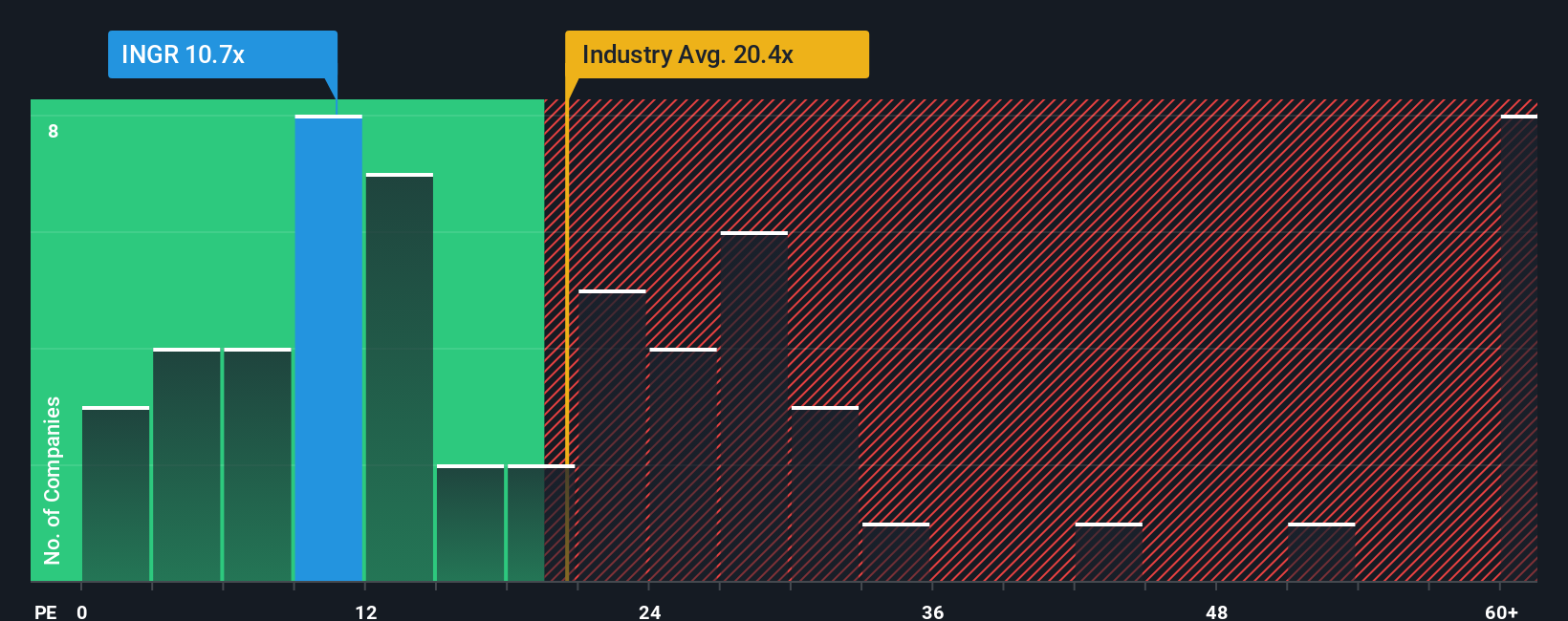

The Price-to-Earnings (PE) ratio is widely regarded as a key valuation tool for profitable companies like Ingredion, as it relates the company's current share price to its earnings per share. This metric helps investors judge how much they are paying for each dollar of the company’s profits. Generally, companies with stronger growth expectations or lower risks can justify higher PE ratios, while those facing more uncertainty or slower growth typically trade at lower multiples.

Ingredion’s current PE ratio stands at 11.5x. In comparison, the food industry average is around 18.3x, and the average of its close peers is a much higher 24.3x. At a glance, this could suggest that Ingredion is undervalued relative to both the industry and its peers.

However, simply comparing PE ratios can be misleading, since not all companies have the same growth prospects, risk profile, profit margins, or market caps. That is where Simply Wall St's "Fair Ratio" comes in, as a proprietary benchmark that considers all these factors together. Ingredion's Fair Ratio is calculated at 14.5x, which incorporates the company’s unique strengths and risks rather than just using headline benchmarks.

Stacking Ingredion’s current PE of 11.5x against its Fair Ratio of 14.5x shows that the stock is priced below what would be expected, even after accounting for its specific fundamentals and industry position. This points to a potential undervaluation in the current market.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ingredion Narrative

Earlier, we mentioned an even better way to understand valuation. Let’s introduce you to Narratives, a smarter and more dynamic approach to making investment decisions that goes beyond just numbers.

A Narrative is simply your own story about a company. It combines what you believe the business can achieve (like future revenue, earnings, and margins) with how these expectations translate into a fair value. Narratives make investing approachable by connecting a company’s story, your financial forecast, and the resulting fair value in one transparent tool.

On Simply Wall St’s platform, Narratives are brought to life within the Community page and used by millions of investors to share perspectives, test scenarios, and compare outcomes before deciding when to buy or sell. You can easily see whether a stock looks attractive by checking if the Fair Value from a Narrative is higher or lower than the current Price.

Because Narratives update automatically with new news or earnings releases, your assessment always stays relevant. For example, one investor might craft a bullish Narrative for Ingredion with a $168 fair value based on aggressive margin expansion. Another investor might take a more cautious view and estimate it at $140, reflecting macroeconomic risks. Narratives help you find the version of the story that fits your understanding and goals, empowering smarter investment decisions.

Do you think there's more to the story for Ingredion? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INGR

Ingredion

Manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives