- United States

- /

- Food

- /

- NYSE:HSY

Hershey (NYSE:HSY) Appoints Tiffany Menyhart As Chief Customer Officer To Lead U.S. Confection Sales

Reviewed by Simply Wall St

The recent appointment of Tiffany Menyhart as Chief Customer Officer marks a leadership shift for The Hershey Company (NYSE:HSY) aligned with its vision to dominate the snacking industry. This executive change happened alongside a noticeable rise in Hershey's stock price of 20% over the past month. Additionally, the company's robust earnings report for Q4 and the full year of 2024, highlighting significant YoY improvements, might align with this positive share price movement. In contrast, broader markets experienced a 2% decline, with tech stocks particularly hit by tariff concerns. Consequently, Hershey's performance stands out as it diverges from the overall market sentiment, likely reflecting investor confidence in its leadership changes and positive financial outcomes amidst heightened market volatility. This positions Hershey as resilient against broader market swings characterized by uncertainty, offering a potential haven for investors amid tech sector headwinds.

Get an in-depth perspective on Hershey's performance by reading our analysis here.

Over the past five years, The Hershey Company has achieved a total shareholder return of 33.1%, bolstered by consistent earnings growth averaging 12.3% annually. This performance reflects a robust execution of its core business strategies despite challenges such as slower revenue growth forecasts relative to the broader US market. Hershey's favorable Price-To-Earnings Ratio, trading lower than both peer and industry averages, has positioned it as a compelling investment choice within the food sector.

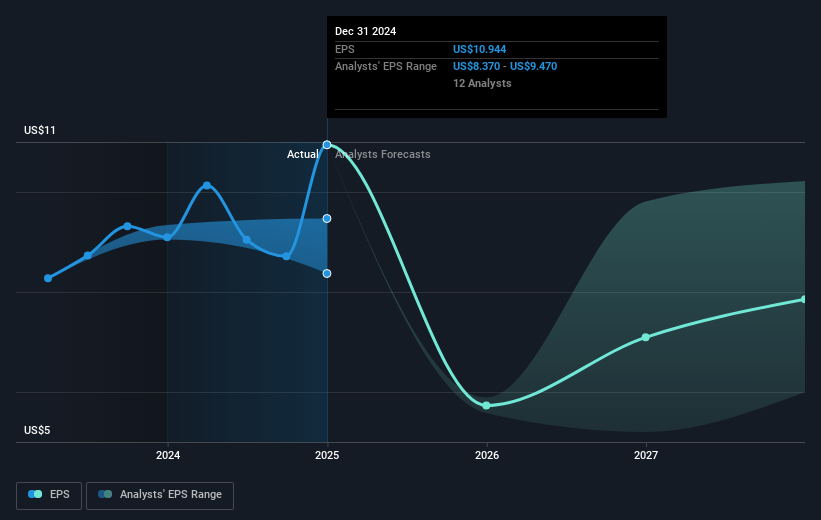

Key factors influencing this return include consistent dividend payouts of $1.37 per quarter and notable improvements in earnings, evident from last year’s 19.3% growth—surpassing its five-year average. These metrics underscore investor confidence, despite recent guidance indicating expected declines in reported EPS for 2025. Additionally, the market remains attentive to acquisition talks with Mondelez, a potential move that could significantly reshape Hershey's future market landscape.

- Understand the fair market value of Hershey with insights from our valuation analysis—click here to learn more.

- Uncover the uncertainties that could impact Hershey's future growth—read our risk evaluation here.

- Are you invested in Hershey already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Solid track record established dividend payer.