- United States

- /

- Food

- /

- NYSE:HSY

Can Hershey’s Valuation Hold Up After Recent Earnings as Shares Tick Higher in 2025?

Reviewed by Bailey Pemberton

If you are wondering what to do with Hershey shares right now, you are not alone. For a company synonymous with chocolate comfort, Hershey’s stock has taken investors on a less-than-sweet ride lately. Just in the last week, shares have ticked up 2.0%, but looking a little further back, the year-to-date gain is a respectable 12.0%, even as the one-year return stands at just 2.3%. Meanwhile, over three years, shareholders have faced a -7.4% total return, making that five-year leap of 48.0% seem like a distant memory.

What is driving these moves? Much of the recent bounce can be traced back to shifting market sentiment about defensive stocks, as investors look for safe havens in times of economic uncertainty. Consumer staples companies like Hershey often benefit when the markets get choppy, and there is renewed debate about whether staples should command a premium in today's environment. But with new competition, changing candy trends, and a landscape where risk appetites shift quickly, Hershey's price can just as easily cool off.

With all this in mind, how does Hershey look from a value perspective? Here is where it gets interesting. On a commonly used valuation checklist, Hershey is considered undervalued according to exactly zero out of six key checks, which gives it a valuation score of 0. Depending on your approach, that might sound concerning or simply par for the course for an iconic name in consumer goods.

Let us break down what those valuation checks mean for you as a potential investor, and why the usual metrics may not tell the whole story. Keep reading for a closer look at how the numbers add up, as well as the perspective that could matter more than any spreadsheet.

Hershey scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hershey Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is one of the most widely used tools for determining a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. For Hershey, the latest reported Free Cash Flow stands at just over $1.4 billion, a solid position in the context of the food industry.

Analysts predict relatively stable results for Hershey's Free Cash Flow over the next decade. Projections begin with $1.5 billion in 2026; however, the estimates trend slightly downward, forecasting $1.4 billion by the end of 2028 and continuing to taper in subsequent years, with extrapolated figures reaching approximately $824 million by 2035. The decreasing trend in these forward-looking numbers is largely due to conservative analyst expectations and modest growth scenarios applied by the modelers at Simply Wall St.

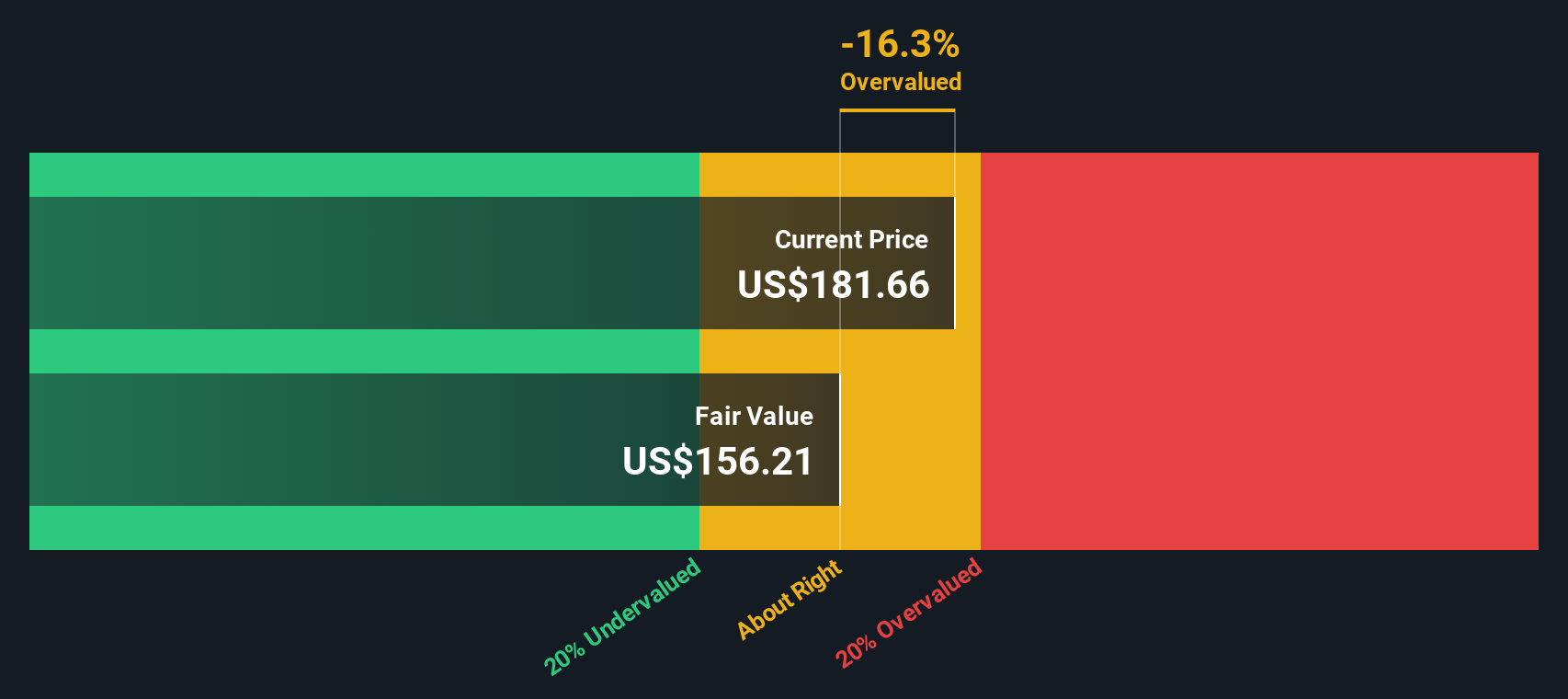

When these cash flows are discounted back to present value, the DCF model estimates Hershey's intrinsic value at $100.50 per share. That is almost 88.1% below its current market price, indicating that the stock is significantly overvalued according to this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hershey may be overvalued by 88.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hershey Price vs Earnings

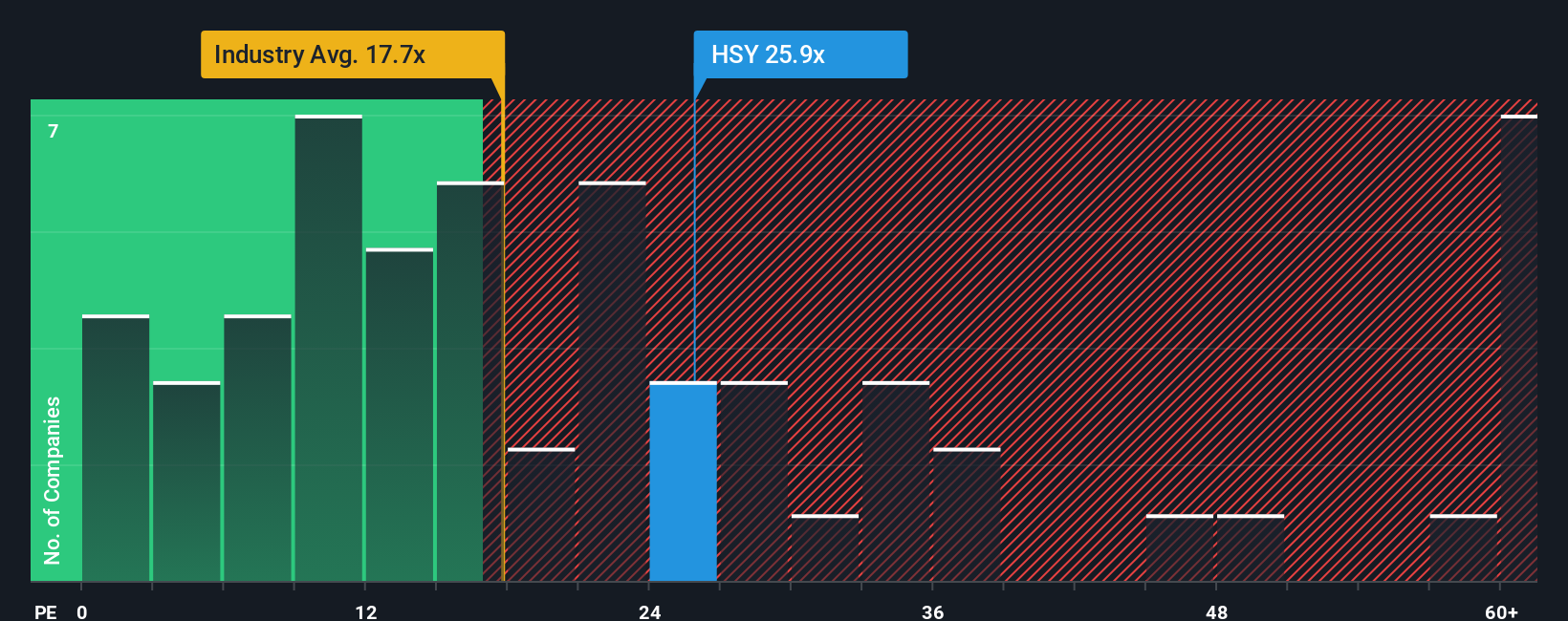

For profitable companies like Hershey, the Price-to-Earnings (PE) ratio is a central tool for valuation, since it shows how much investors are willing to pay for each dollar of reported profit. The “right” PE ratio can vary widely; fast-growing or less risky businesses typically command higher multiples, while slower-growth or riskier firms trade at lower PE ratios.

Currently, Hershey trades at a PE ratio of 25x. For context, its industry peers in Food average a PE of 17.98x, and the broader peer group averages about 19.75x. This means that Hershey's valuation commands a clear premium to both its industry and peer benchmarks, which may indicate that investors see additional value in its brand or profitability.

However, a simple comparison to industry or peer averages is only part of the picture. Simply Wall St’s proprietary “Fair Ratio” factors in Hershey’s profit margins, earnings growth prospects, size, and risks to calculate a custom benchmark. For Hershey, the Fair Ratio stands at 22.42x, a level that takes into account more nuance than blunt averages do.

Comparing Hershey’s current PE of 25x to this Fair Ratio, the multiple is notably higher than what these fundamentals suggest is justified. This makes the stock look somewhat expensive based on earnings alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hershey Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story behind Hershey’s numbers. It is a way to translate your perspective on what really matters (like growth drivers, risks, or new products) into forecasts for its revenue, earnings, margins, and ultimately, your own fair value for the stock.

Narratives bridge the gap between the company’s story, its expected financial performance, and what you think shares are truly worth. This approach makes investing more personal and reflective of your actual beliefs. On Simply Wall St’s Community page, a resource used by millions of investors, you can easily explore, create, and update Narratives for Hershey and other stocks in just a few clicks.

Why does this matter? Narratives give you a dynamic way to make better buy or sell decisions by letting you compare your calculated Fair Value to Hershey’s current Price. They also update automatically as new news, earnings, or events unfold, keeping your investment thinking fresh without constant number crunching.

For example, the most optimistic investors use bullish revenue growth and margin forecasts to justify a Hershey fair value of $211 per share, while the most cautious see it as low as $123. This demonstrates that your Narrative can (and should) reflect your unique outlook.

Do you think there's more to the story for Hershey? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives