Jim Snee became the CEO of Hormel Foods Corporation (NYSE:HRL) in 2016. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at other big companies. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Hormel Foods

How Does Jim Snee's Compensation Compare With Similar Sized Companies?

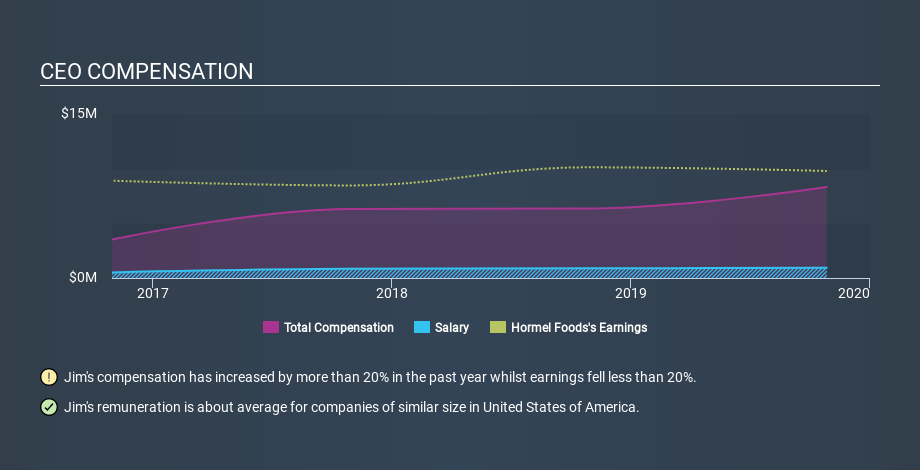

At the time of writing, our data says that Hormel Foods Corporation has a market cap of US$25b, and reported total annual CEO compensation of US$8.3m for the year to October 2019. We note that's an increase of 31% above last year. While we always look at total compensation first, we note that the salary component is less, at US$933k. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. We took a group of companies with market capitalizations over US$8.0b, and calculated the median CEO total compensation to be US$11m. There aren't very many mega-cap companies, so we had to take a wide range to get a meaningful comparison figure.

That means Jim Snee receives fairly typical remuneration for the CEO of a large company. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context.

The graphic below shows how CEO compensation at Hormel Foods has changed from year to year.

Is Hormel Foods Corporation Growing?

On average over the last three years, Hormel Foods Corporation has grown earnings per share (EPS) by 4.5% each year (using a line of best fit). In the last year, its revenue changed by just 0.5%.

I generally like to see a little revenue growth, but I'm happy with the EPS growth. These two metric are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. It could be important to check this free visual depiction of what analysts expect for the future.

Has Hormel Foods Corporation Been A Good Investment?

I think that the total shareholder return of 39%, over three years, would leave most Hormel Foods Corporation shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Jim Snee is paid around what is normal the leaders of larger companies.

While we would like to see improved growth metrics, there is no doubt that the total returns have been great, over the last three years. So we can conclude that on this analysis the CEO compensation seems pretty sound. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Hormel Foods (free visualization of insider trades).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:HRL

Hormel Foods

Develops, processes, and distributes various meat, nuts, and other food products to foodservice, convenience store, and commercial customers in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)