- United States

- /

- Food

- /

- NYSE:FLO

Flowers Foods (FLO): Assessing Valuation After Earnings Miss, Margin Pressures, and Management’s Guidance Cut

Reviewed by Simply Wall St

If you have been watching Flowers Foods (FLO) lately, the latest news likely caught your eye. Coming off a quarter where the company missed revenue expectations, faced shrinking margins, and cut its full-year guidance, investors are facing a crossroads. The management is candid, calling this a “transition” period driven by changing consumer tastes, particularly the growing demand for health and wellness options. The central question for shareholders is whether this phase marks a warning sign or presents a window of opportunity.

All this follows a challenging stretch for Flowers Foods. The stock has lost roughly 28% over the past year, and momentum continues to lag, with the company now trading at levels not seen in several years. Management’s decision to lower guidance and highlight industry headwinds comes after a disappointing earnings season that included declines in both sales and profitability. Annual revenue growth is advancing at just 1%, while net income shrank slightly, underscoring the company’s uphill battle as competition intensifies and legacy products lose their edge.

With the market reacting quickly to these updates, is Flowers Foods simply out of favor for the near term or has risk been overplayed? After such a pronounced slide, it is worth considering whether the current price already reflects the bad news, or if there could be more downside ahead.

Most Popular Narrative: 2.7% Undervalued

According to community narrative, Flowers Foods appears slightly undervalued based on its future profit projections and industry headwinds, but with clear catalysts at play. Analysts consider recent strategic shifts and tough market conditions to arrive at a price target just above today’s share price.

“Focus on premium, health-oriented innovation and margin protection positions Flowers Foods for resilient growth, strong market presence, and adaptability amid evolving consumer and industry trends.”

This narrative depends on whether the company’s innovations can power a comeback. Can Flowers Foods’ pivot toward healthier premium offerings really spark the next phase of growth? The story behind this forecast is based on analyst assumptions about the company’s future earnings, continued margin pressure, and its ability to command a stronger valuation multiple over time. Want to see what’s driving this fair value target? Explore the bold numbers and projections that could change the outlook for this iconic baker.

Result: Fair Value of $16.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, strong demand for premium brands and successful innovation launches could quickly shift sentiment. This may offer upside if Flowers Foods outperforms cautious expectations.

Find out about the key risks to this Flowers Foods narrative.Another View: Discounted Cash Flow Model

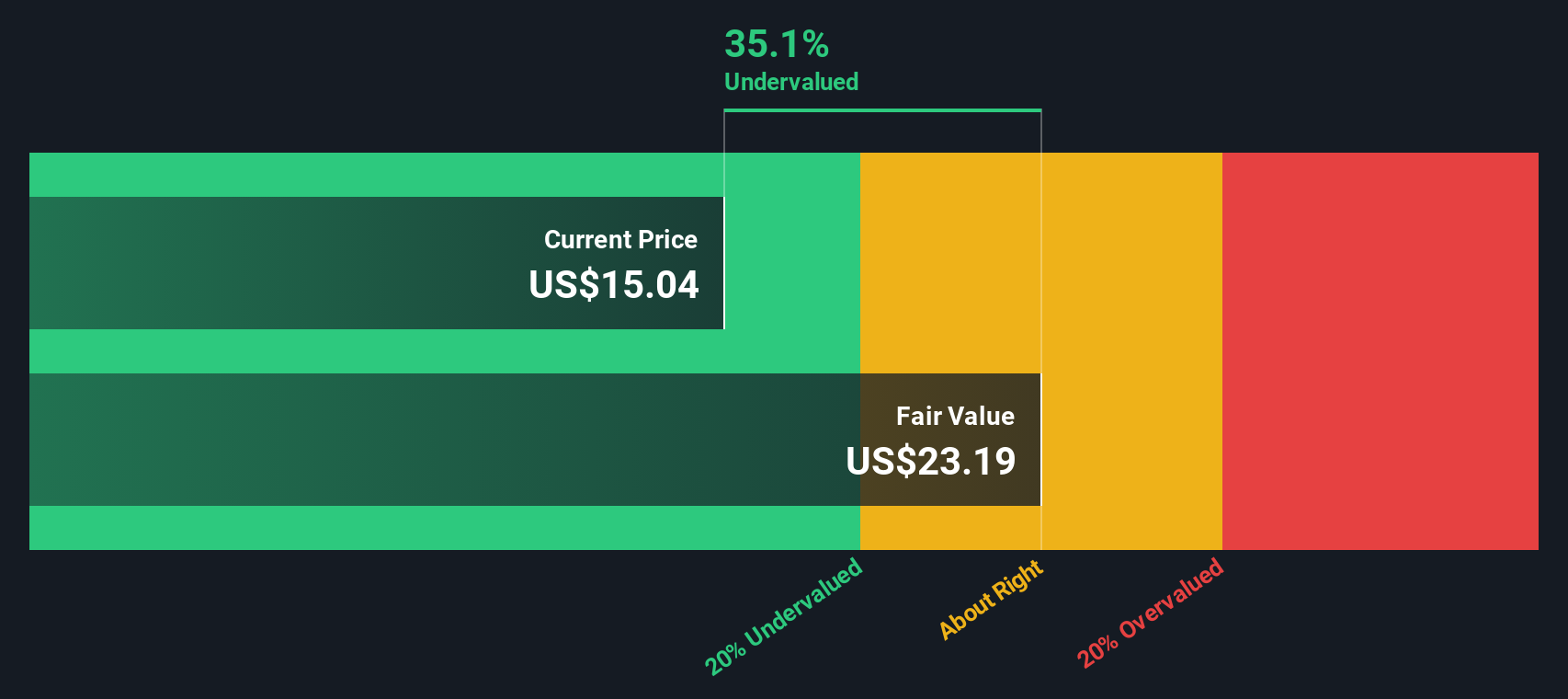

Looking at Flowers Foods through our DCF model paints a different picture from analyst consensus. This approach suggests the company’s shares may be trading well below their underlying value. Could the market be mispricing Flowers Foods’ long-term earnings power?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Flowers Foods Narrative

If you see things differently or want to delve deeper, you can analyze the numbers and build your own story in just a few minutes. So why not do it your way?

A great starting point for your Flowers Foods research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Winning Opportunities?

Do not let your momentum stop with just one stock. The market is alive with potential, and it pays to stay curious. For investors with a keen eye for value and growth, these handpicked strategies could signal your next smart move. Check them out. Your portfolio will thank you.

- Unleash the potential of tomorrow’s technology leaders by scanning the market for AI penny stocks that are experiencing rapid AI breakthroughs and shaping industries worldwide.

- Amplify your returns with steady income from stocks designed to pay out as you target dividend stocks with yields > 3% to bolster your regular cash flow.

- Spot undervalued gems and capitalize on market mispricing with our shortcut to undervalued stocks based on cash flows with attractive valuations based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLO

Flowers Foods

Produces and markets packaged bakery food products in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives