- United States

- /

- Banks

- /

- NasdaqCM:ISBA

US Market's Undiscovered Gems and 2 Other Promising Small Caps

Reviewed by Simply Wall St

As the U.S. stock market shows resilience with key indices like the Dow Jones and S&P 500 nearing all-time highs, investors are paying close attention to inflation data and Federal Reserve policy decisions that could influence small-cap stocks. In this dynamic environment, identifying promising small-cap companies can be crucial for investors seeking growth opportunities amidst broader market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Isabella Bank (ISBA)

Simply Wall St Value Rating: ★★★★★★

Overview: Isabella Bank Corporation, with a market cap of $311.01 million, operates as the bank holding company for Isabella Bank, offering banking and wealth management services to businesses, institutions, and individuals in Michigan.

Operations: Isabella Bank Corporation generates revenue primarily through its retail banking operations, which contribute $76.49 million.

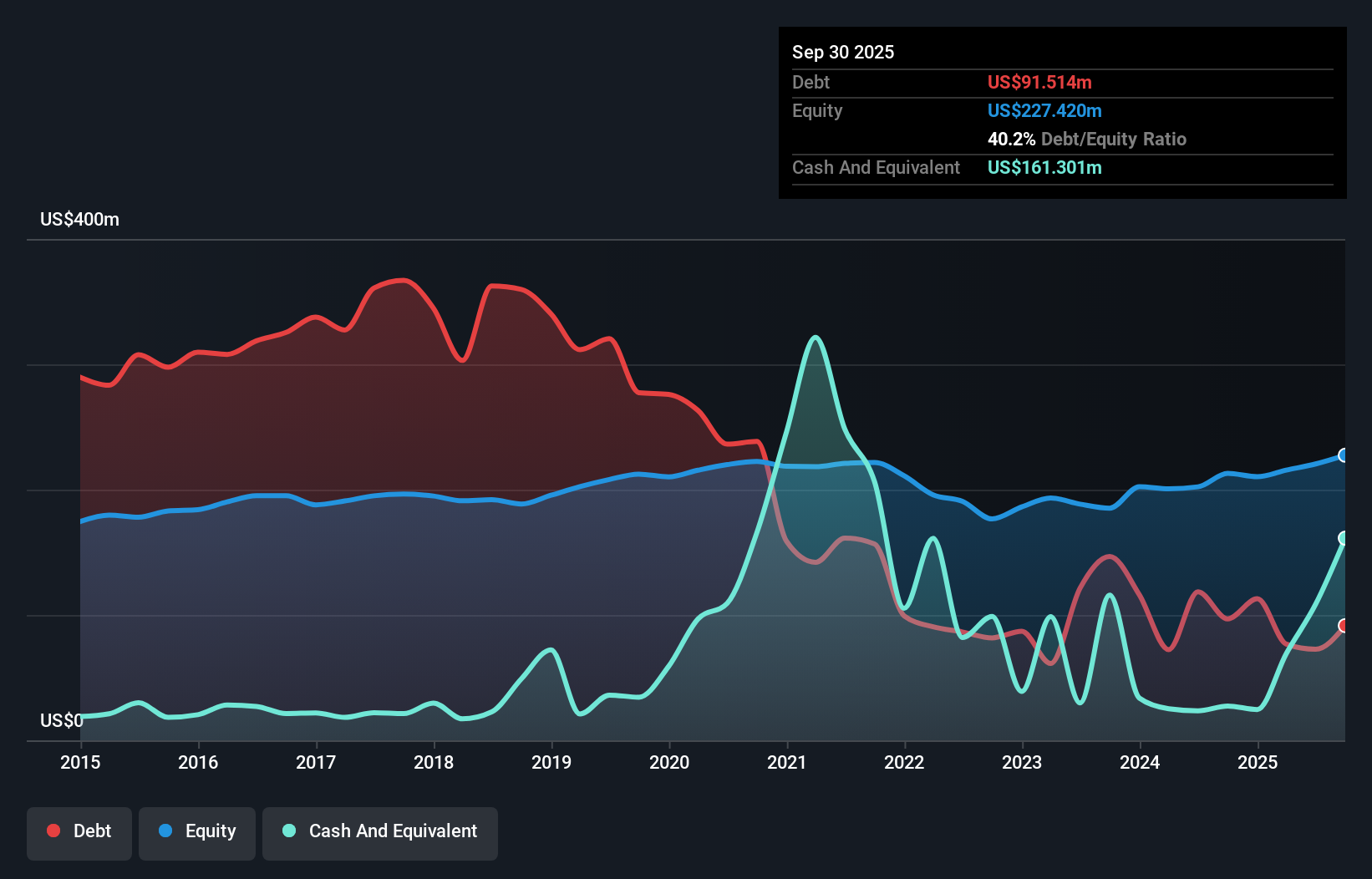

Isabella Bank, with total assets of US$2.3 billion and equity of US$227.4 million, stands out for its robust financial health, boasting a net interest margin of 2.9% and a sufficient allowance for bad loans at 380%. With earnings growth of 33% over the past year surpassing the industry average, it highlights strong performance in a competitive sector. The bank's liabilities are primarily low-risk due to customer deposits making up 95%, while non-performing loans remain low at just 0.2%. Recent strategic moves include repurchasing shares worth US$0.61 million and appointing Brian Tessin to their board, enhancing governance expertise.

- Delve into the full analysis health report here for a deeper understanding of Isabella Bank.

Evaluate Isabella Bank's historical performance by accessing our past performance report.

TrustCo Bank Corp NY (TRST)

Simply Wall St Value Rating: ★★★★★★

Overview: TrustCo Bank Corp NY is the holding company for Trustco Bank, offering personal and business banking services to individuals and businesses, with a market capitalization of $804.39 million.

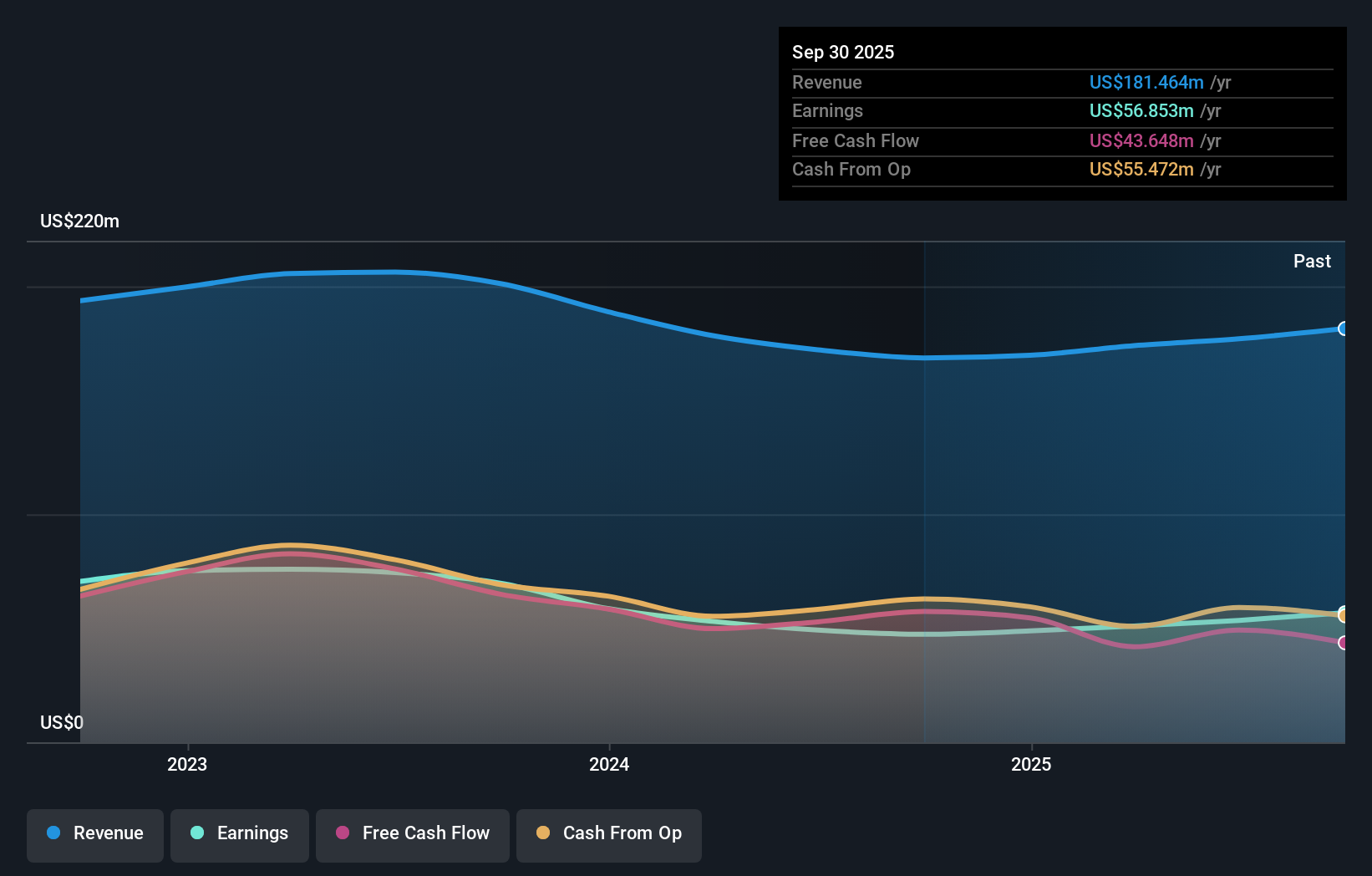

Operations: TrustCo Bank Corp NY generates revenue primarily through its community banking segment, amounting to $181.46 million. The company's financial performance is reflected in its net profit margin, which stands at 39.2%.

TrustCo Bank Corp NY stands out with its robust financial health, boasting total assets of US$6.3 billion and equity of US$692 million. It has a solid deposit base of US$5.5 billion, primarily from low-risk customer deposits, which accounts for 97% of its liabilities. With total loans at US$5.1 billion and an allowance for bad loans at 0.4%, the bank is well-prepared to handle potential defaults. Over the past year, earnings have grown by 19.9%, surpassing industry growth rates and reflecting high-quality earnings performance. Recently, TrustCo repurchased shares worth US$11.54 million, showing confidence in its valuation strategy.

Fresh Del Monte Produce (FDP)

Simply Wall St Value Rating: ★★★★★★

Overview: Fresh Del Monte Produce Inc. operates globally through its subsidiaries to produce, market, and distribute fresh and fresh-cut fruits and vegetables, with a market cap of approximately $1.79 billion.

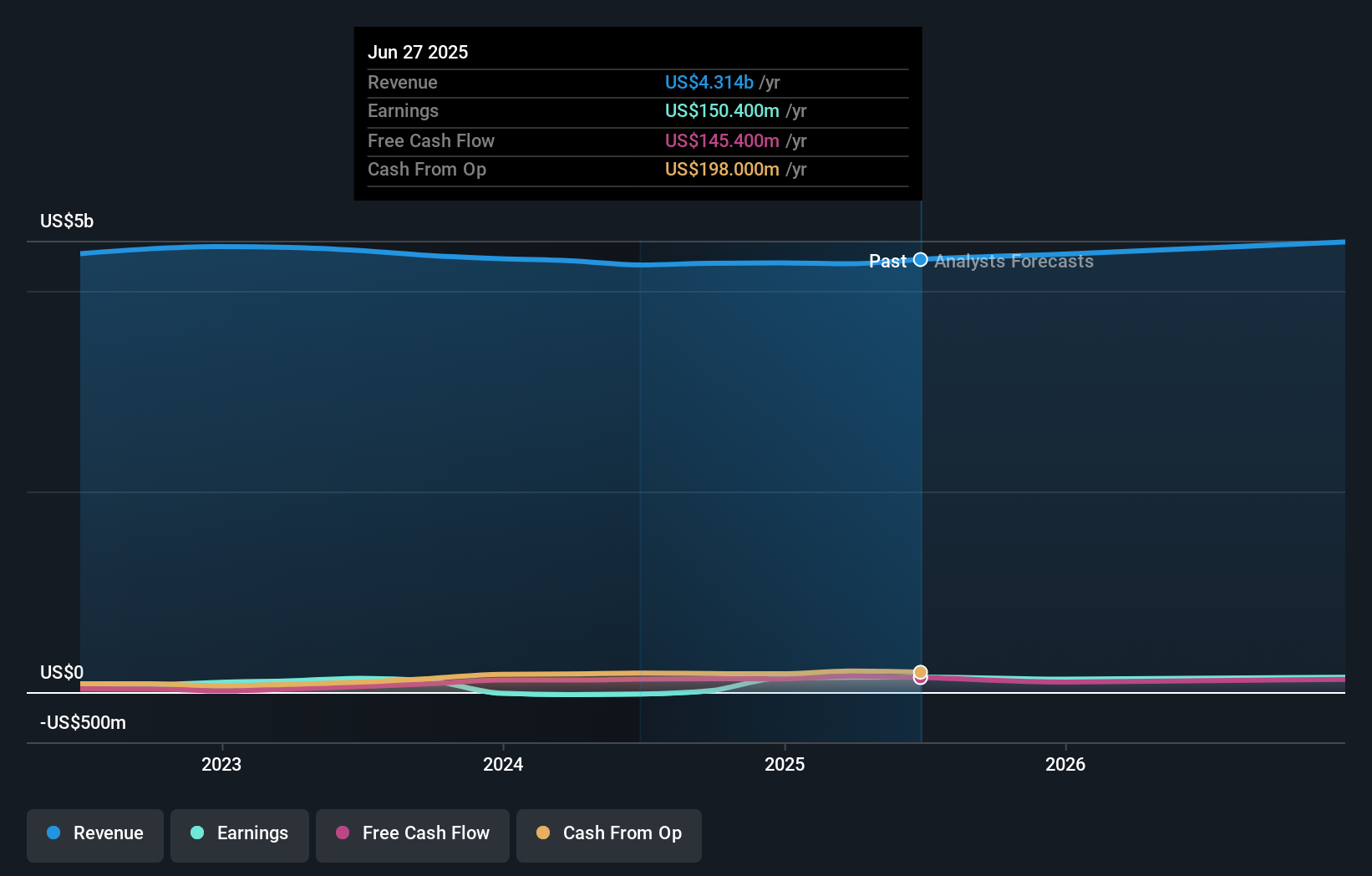

Operations: The company generates revenue primarily from its Fresh and Value-Added Products segment, which accounts for $2.63 billion, followed by the Banana segment at $1.49 billion. The net profit margin is an important financial metric to consider when evaluating the company's performance over time.

Fresh Del Monte Produce, a notable player in the food industry, is making waves with its strategic partnership with THACO Agri to enhance its banana and pineapple sourcing. Despite a recent net loss of US$29.1 million for Q3 2025 due to a significant one-off expense of US$39.9 million, the company shows resilience with earnings growth outpacing industry averages at 430.5%. Trading at 44% below estimated fair value and boasting a net debt to equity ratio of just 3.7%, Fresh Del Monte seems well-positioned for future growth, supported by strong EBIT coverage on interest payments and ongoing share repurchases totaling US$14.81 million this year.

Seize The Opportunity

- Navigate through the entire inventory of 297 US Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ISBA

Isabella Bank

Operates as the bank holding company for Isabella Bank that provides banking and wealth management services to businesses, institutions, and individuals and their families in Michigan, the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026