- United States

- /

- Food

- /

- NasdaqGS:CPB

Pinning Down Campbell Soup Company's (NYSE:CPB) P/E Is Difficult Right Now

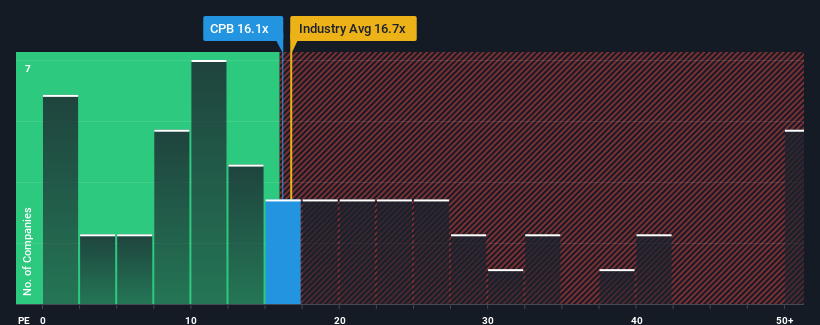

It's not a stretch to say that Campbell Soup Company's (NYSE:CPB) price-to-earnings (or "P/E") ratio of 16.1x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

There hasn't been much to differentiate Campbell Soup's and the market's earnings growth lately. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Check out our latest analysis for Campbell Soup

How Is Campbell Soup's Growth Trending?

In order to justify its P/E ratio, Campbell Soup would need to produce growth that's similar to the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Fortunately, a few good years before that means that it was still able to grow EPS by 10% in total over the last three years. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 7.7% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 13% each year, which is noticeably more attractive.

In light of this, it's curious that Campbell Soup's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Campbell Soup's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Campbell Soup's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Campbell Soup, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Campbell Soup, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives