- United States

- /

- Mortgage REITs

- /

- NYSE:PMT

Exploring US Undervalued Small Caps With Insider Buying In December 2024

Reviewed by Simply Wall St

The United States market has experienced a flat performance over the last week but has seen an impressive 32% increase over the past year, with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying small-cap stocks that are potentially undervalued and exhibit insider buying can be an intriguing strategy for investors seeking opportunities in this segment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Capital Bancorp | 15.0x | 3.1x | 44.42% | ★★★★☆☆ |

| Hanover Bancorp | 13.7x | 2.8x | 33.82% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 42.11% | ★★★★☆☆ |

| German American Bancorp | 16.2x | 5.4x | 43.64% | ★★★☆☆☆ |

| USCB Financial Holdings | 19.0x | 5.4x | 48.74% | ★★★☆☆☆ |

| First United | 14.4x | 3.3x | 43.91% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -240.18% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| HighPeak Energy | 11.6x | 1.7x | 32.70% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -80.77% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

B&G Foods (NYSE:BGS)

Simply Wall St Value Rating: ★★★★★☆

Overview: B&G Foods is a company that manufactures, sells, and distributes a diverse portfolio of branded shelf-stable and frozen foods across the United States, with a market capitalization of approximately $1.37 billion.

Operations: BGS generates revenue primarily from product sales, with cost of goods sold (COGS) being a significant expense. Over the years, gross profit margin has shown variability, reaching 22.39% by late 2024. Operating expenses include general and administrative costs, which consistently contribute to the company's financial structure. Net income margin has fluctuated significantly, turning negative in recent periods due to increased non-operating expenses.

PE: -20.6x

B&G Foods, a smaller company in the U.S., has been drawing attention due to insider confidence, as Stephen Sherrill recently purchased 125,000 shares valued at approximately US$1.07 million. This activity coincides with improved financial performance; Q3 2024 saw net income of US$7.46 million compared to a loss last year. Despite sales declining to US$461 million from US$502 million year-over-year, earnings per share turned positive at US$0.09 from a prior loss of US$1.11 per share, highlighting potential for recovery amidst higher-risk external funding challenges and revised annual sales guidance between $1.92 billion and $1.95 billion for 2024.

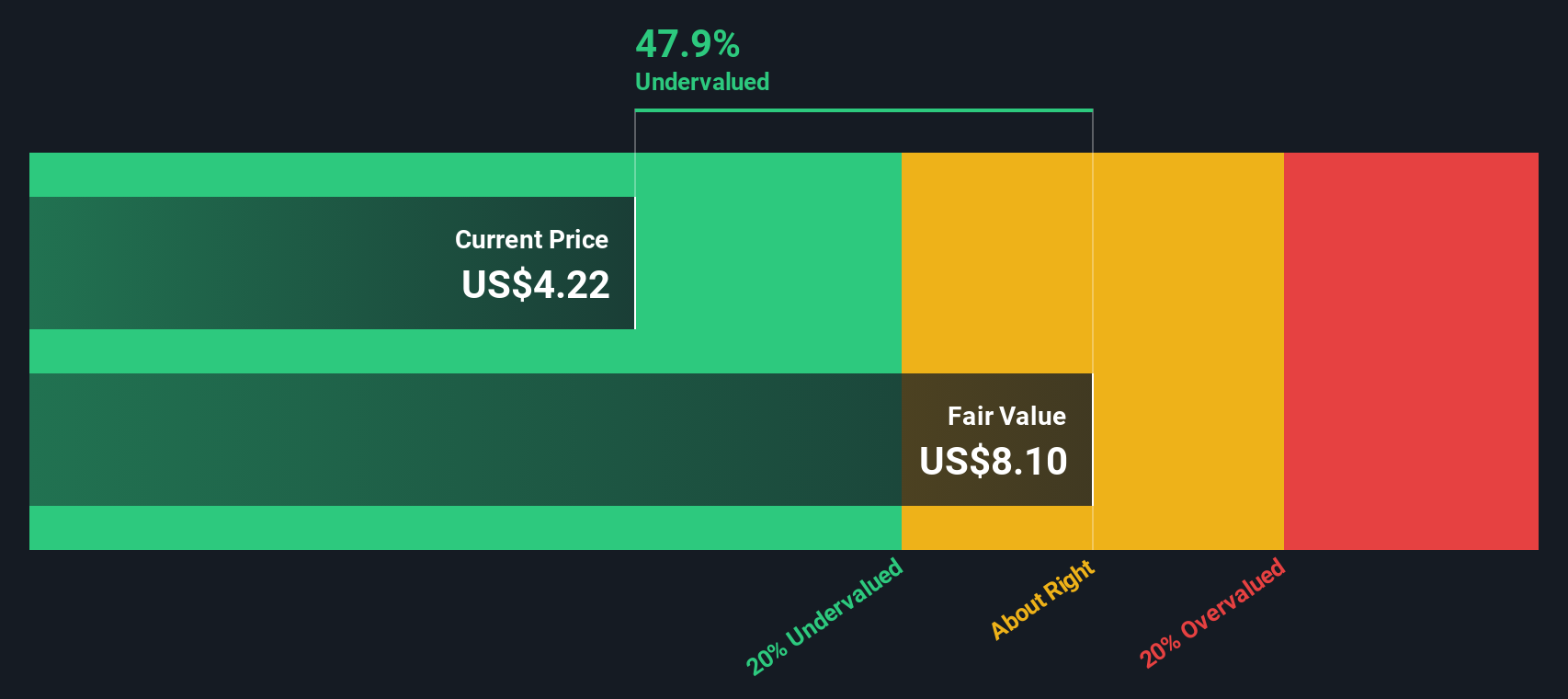

PennyMac Mortgage Investment Trust (NYSE:PMT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: PennyMac Mortgage Investment Trust is a specialty finance company primarily engaged in mortgage-related investments and activities, with a market capitalization of approximately $1.14 billion.

Operations: The company generates revenue primarily from Credit Sensitive Strategies and Correspondent Production. A notable trend in its financials is the fluctuation in net income margin, which reached a high of 57.27% in Q1 2021 but also experienced negative margins, such as -54.12% in Q1 2020. Operating expenses have varied significantly over time, impacting net income outcomes across different periods.

PE: 9.4x

PennyMac Mortgage Investment Trust, a small cap player in the mortgage sector, has shown insider confidence with recent share purchases. Despite a drop in net income to US$41.41 million for Q3 2024 from US$61.42 million last year, its strategic leadership changes aim to drive future value. The firm declared dividends on its preferred shares and common stock, reflecting steady cash flow management despite reliance on higher-risk funding sources. Earnings are projected to grow annually by 8.38%.

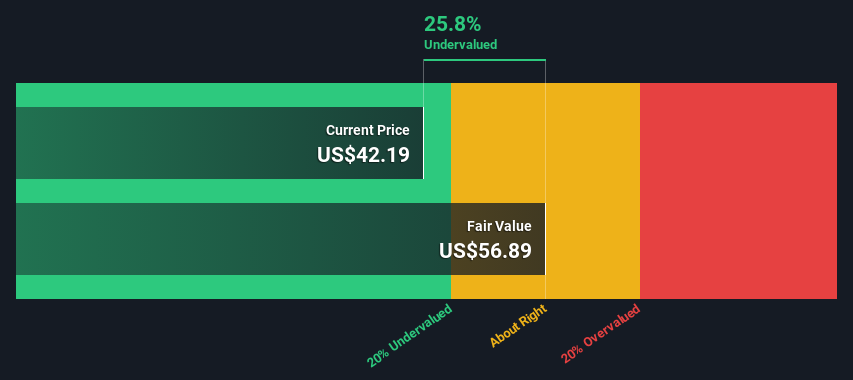

Proto Labs (NYSE:PRLB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Proto Labs is a digital manufacturing company specializing in custom prototypes and low-volume production for various industries, with a market cap of approximately $0.98 billion.

Operations: Proto Labs' revenue primarily comes from its operations in the machinery and industrial equipment sector, with recent figures showing $504.19 million. The company's gross profit margin has shown a downward trend, reaching 44.03% by the end of 2024. Operating expenses are significant, with sales and marketing being a major component at $90.90 million for the same period. Net income was recorded at $23.99 million, reflecting a net income margin of 4.76%.

PE: 42.2x

Proto Labs, a smaller company in the U.S. market, recently reported third-quarter sales of US$125.34 million, down from US$130.52 million the previous year, with net income at US$7.19 million compared to US$7.95 million previously. Despite volatile share prices and reliance on external borrowing for funding, insider confidence is evident as President Robert Bodor purchased 3,480 shares valued at approximately US$99,800 in October 2024. Looking ahead to Q4 2024, Proto Labs anticipates revenue between US$115 and $123 million with diluted earnings per share ranging from $0.10 to $0.18.

- Unlock comprehensive insights into our analysis of Proto Labs stock in this valuation report.

Assess Proto Labs' past performance with our detailed historical performance reports.

Taking Advantage

- Access the full spectrum of 51 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PMT

PennyMac Mortgage Investment Trust

Through its subsidiary, primarily invests in mortgage-related assets in the United States.

Proven track record and fair value.