- United States

- /

- Food

- /

- NYSE:BG

Bunge (BG): Assessing Valuation After Recent Share Price Momentum and Viterra Merger Integration

Reviewed by Kshitija Bhandaru

See our latest analysis for Bunge Global.

Bunge Global’s share price has seen a significant uptick, with a 1-day share price return of nearly 13% and a 1-year total shareholder return just above break-even. While short-term momentum is building after recent gains, the long-term returns suggest steadier and more gradual value creation for patient investors.

If this kind of renewed momentum has you thinking bigger, now is a great chance to discover fast growing stocks with high insider ownership

But with a share price now above analyst targets and recent gains accumulating, is Bunge Global still undervalued, or has the market already factored in all its potential upside?

Most Popular Narrative: 6% Overvalued

With Bunge Global’s fair value pegged at $87.62 by the most popular narrative, shares recently closed at $93.09, notably above this target. The market’s optimism may indicate belief in ambitious expansion, but the fair value implies more caution among analysts tracking the company’s transformation.

The completion and integration of the Viterra merger provides substantial cost and commercial synergies, expands Bunge's global origination, processing, and distribution footprint, and positions the company to capture greater market share in high-growth markets, set to drive higher topline growth and improved operating margins.

Curious what key assumptions fuel this ambitious outlook? The narrative’s fair value hinges on big moves, bold bets, and a financial formula not every investor will expect. What is behind the valuation—steady earnings, savvy cost cuts, or something else entirely? Pull back the curtain on this story to discover the critical numbers and forecasts shaping analyst consensus.

Result: Fair Value of $87.62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected regulatory changes or delays in Viterra integration could challenge Bunge Global’s optimistic outlook and could put pressure on future earnings growth.

Find out about the key risks to this Bunge Global narrative.

Another View: Multiple-Based Valuation Tells a Different Story

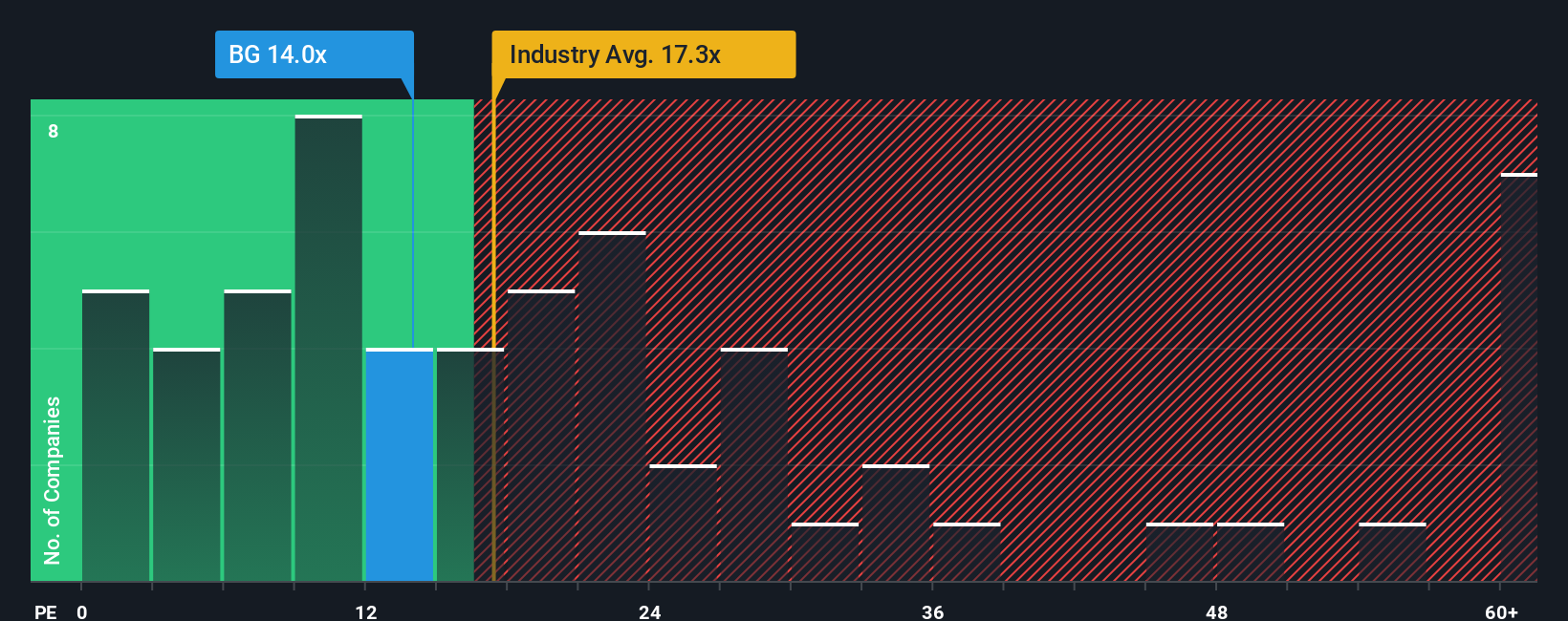

Looking from another angle, Bunge Global trades at a price-to-earnings ratio of 13.5x, which is well below the US Food industry average of 18.3x and the peer average of 24.3x. This sizable gap suggests the market could be overlooking potential upside or mispricing future risks. Could this relative discount signal an opportunity, or is it a warning to tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bunge Global Narrative

If you prefer a hands-on approach or want to test your own ideas, try building your personal perspective on Bunge Global's story in just minutes with Do it your way.

A great starting point for your Bunge Global research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great returns often come to those who move first. Uncover new opportunities by using Simply Wall Street’s intelligent screeners and get ahead of the crowd now.

- Accelerate your hunt for overlooked bargains by checking out these 874 undervalued stocks based on cash flows to see which companies offer strong cash flow value today.

- Unlock future growth trends and stay on the pulse of medical innovation with these 33 healthcare AI stocks in the rapidly growing healthcare technology sector.

- Boost your returns with regular income by tapping into these 18 dividend stocks with yields > 3% and find stocks delivering yields over 3% for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bunge Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BG

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives