- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (NasdaqGS:PEP) Completes Buyback; Reports US$1.8 Billion Net Income In Q1 2025

Reviewed by Simply Wall St

PepsiCo (NasdaqGS:PEP) recently reported its first-quarter earnings, highlighting a decrease in sales and net income compared to the previous year, alongside an updated share buyback strategy. Despite these developments, PepsiCo's stock saw minimal movement, reflecting the broader market trends. While the company's financial performance and buyback efforts might have added downward pressure, the overall market environment, characterized by strong performances in the technology sector and a general market upswing, likely offset any significant impact on the company's share price. Consequently, PepsiCo's stock remained relatively stable amidst these mixed influences.

We've identified 3 warning signs for PepsiCo that you should be aware of.

The recent earnings report, coupled with the updated share buyback strategy, highlights PepsiCo's efforts to manage its financial performance amidst fluctuating market forces. Despite short-term volatility, PepsiCo's stock stability reflects a longer-term resilience, with a total return of 24.42% over the past five years. This period saw a combination of share price appreciation and dividends, offering context to current price movements. Over the last year, PepsiCo underperformed the US Beverage industry, which experienced a 1.2% decline, further emphasizing the company's contrasting long-term strength.

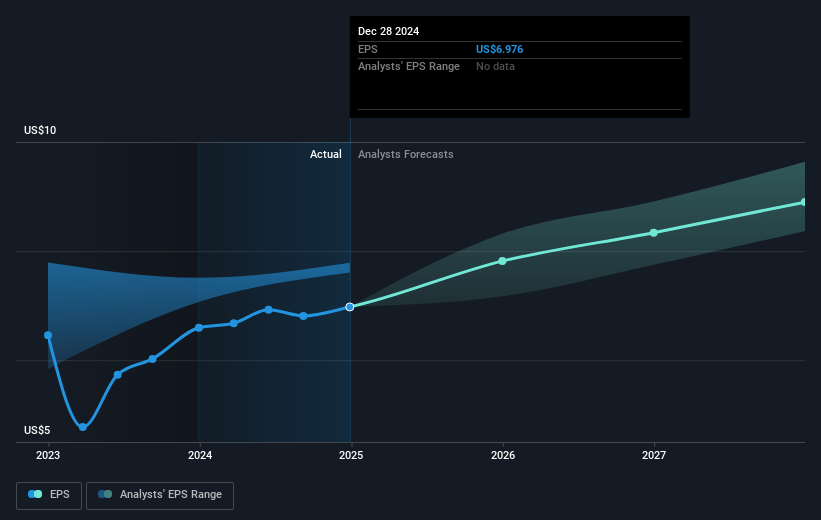

The implications of the recent report on revenue and earnings forecasts are critical. Investments in the Frito business and international expansions are poised to drive future growth; however, potential inefficiencies in capital allocation may pose challenges. Analysts predict revenue growth of 2.5% annually over the next three years, with earnings projected to reach US$12.2 billion by April 2028. These forecasts are reflected in a consensus price target of US$160.41, which is 10.6% above the current share price of US$143.46, suggesting a degree of optimism regarding PepsiCo's future performance. Evaluating these elements provides insight into how recent developments might influence the company's financial trajectory.

Evaluate PepsiCo's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives