- United States

- /

- Food

- /

- NasdaqGS:OTLY

The one-year earnings decline has likely contributed toOatly Group's (NASDAQ:OTLY) shareholders losses of 61% over that period

It is doubtless a positive to see that the Oatly Group AB (NASDAQ:OTLY) share price has gained some 55% in the last three months. But that's small comfort given the dismal price performance over the last year. During that time the share price has sank like a stone, descending 61%. The share price recovery is not so impressive when you consider the fall. It may be that the fall was an overreaction.

Since Oatly Group has shed US$124m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Oatly Group

Because Oatly Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Oatly Group increased its revenue by 22%. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 61% in that time. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

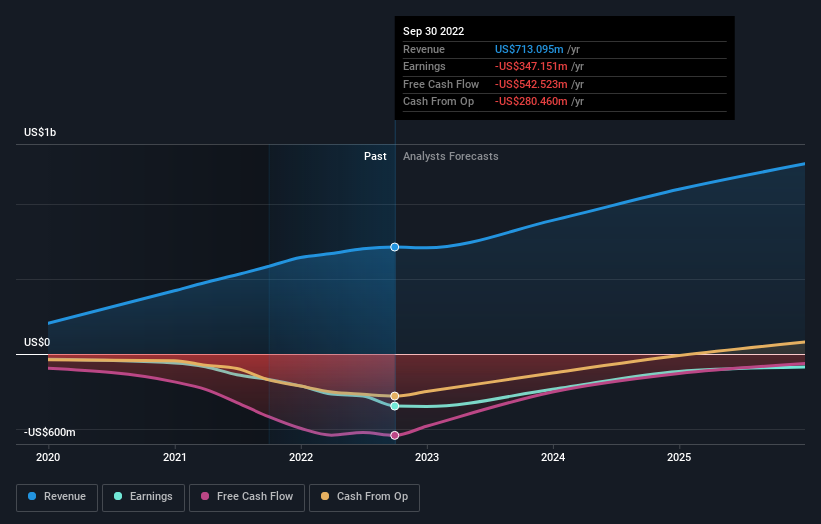

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Oatly Group is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Oatly Group will earn in the future (free analyst consensus estimates)

A Different Perspective

We doubt Oatly Group shareholders are happy with the loss of 61% over twelve months. That falls short of the market, which lost 10%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it's good to see the share price has rebounded by 55%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Oatly Group better, we need to consider many other factors. For instance, we've identified 3 warning signs for Oatly Group (1 is concerning) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OTLY

Oatly Group

An oatmilk company, provides a range of plant-based dairy products made from oats in Europe, the Middle East, Africa, the Asia Pacific, Latin America, the United States, Canada, Mainland China, Hong Kong, and Taiwan.

Fair value low.

Similar Companies

Market Insights

Community Narratives