- United States

- /

- Beverage

- /

- NasdaqGS:KDP

Keurig Dr Pepper (NasdaqGS:KDP) Partners With MSG To Launch Snapple Mini Mart

Reviewed by Simply Wall St

Keurig Dr Pepper (NasdaqGS:KDP) recently announced a multi-year partnership with Madison Square Garden Sports Corp. and Entertainment Corp., naming Snapple as the Official Tea Partner for significant events like those hosted by the New York Knicks and Rangers. This collaboration introduces the Snapple Mini Mart at the arena, showcasing heightened brand visibility. Despite an 11% price increase in the last quarter, notable market-wide declines set a contrasting backdrop, with significant drops in the Dow and Nasdaq. The partnership, alongside corporate leadership changes and completed equity offerings, provided some resilience amid broader market challenges.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The new partnership with Madison Square Garden, positioning Snapple as the Official Tea Partner, could elevate Keurig Dr Pepper's brand visibility and enhance its market position, potentially impacting revenue positively. This aligns with their strategy to expand into high-growth segments and reinforce distribution networks, which could lead to improved earnings over time when integrated with their existing Direct-Store-Delivery model.

Over a five-year period, Keurig Dr Pepper shares delivered a total return of 45.14%, indicating strong longer-term performance. Comparing with recent one-year performance against the US market's 5.8% decline and the US beverage industry's 4.9% decline, KDP demonstrated resilience, outperforming both benchmarks. This reflects its capacity to withstand broader market pressures.

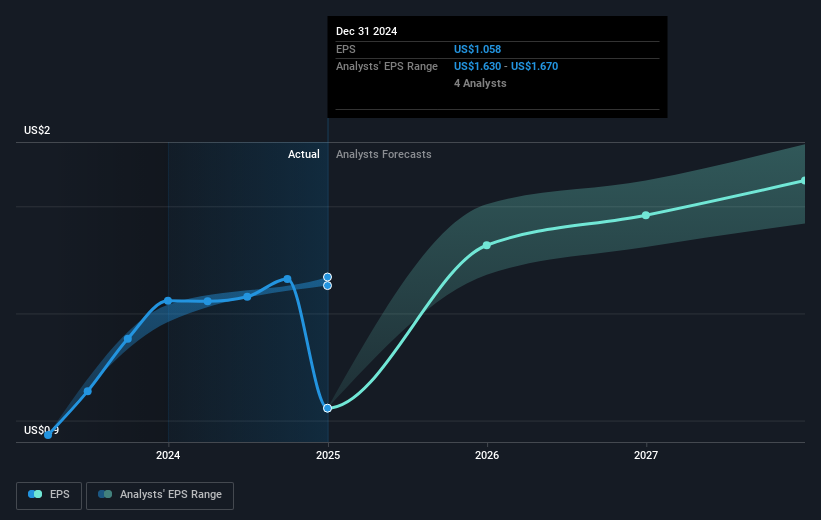

Regarding earnings forecasts, the enhanced brand partnerships might bolster revenue streams, reinforcing analyst expectations of revenue reaching $17.4 billion by 2028 and earnings of US$2.8 billion. As reflected in the price target of US$38.21, the current share price, slightly below at US$33.57, indicates a potential upside, deliberating market confidence in its future growth. However, investors should consider the potential catalysts and risks, including competitive pressures and inflationary costs, that could sway financial outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Keurig Dr Pepper, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Keurig Dr Pepper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KDP

Keurig Dr Pepper

Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

Second-rate dividend payer low.

Similar Companies

Market Insights

Community Narratives