- United States

- /

- Beverage

- /

- NasdaqGS:KDP

Here's Why Keurig Dr Pepper (NASDAQ:KDP) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Keurig Dr Pepper (NASDAQ:KDP). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Keurig Dr Pepper with the means to add long-term value to shareholders.

Check out our latest analysis for Keurig Dr Pepper

How Quickly Is Keurig Dr Pepper Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Keurig Dr Pepper managed to grow EPS by 14% per year, over three years. That's a pretty good rate, if the company can sustain it.

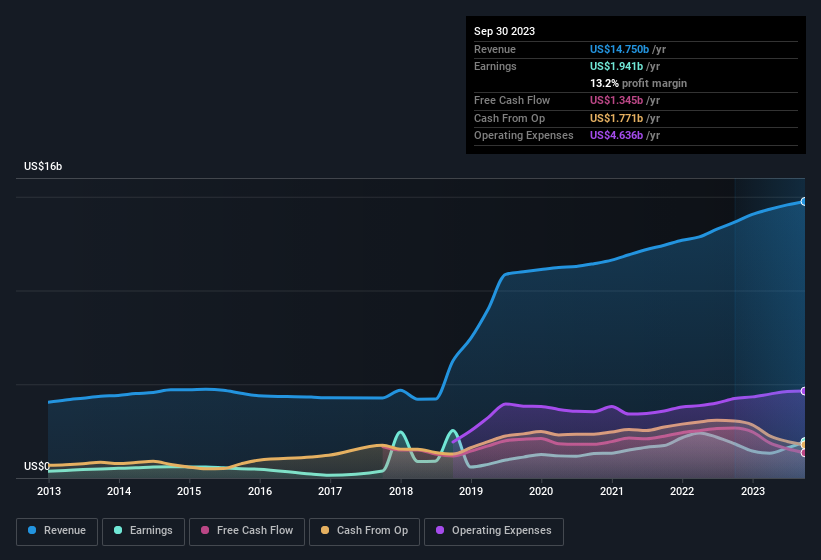

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Keurig Dr Pepper maintained stable EBIT margins over the last year, all while growing revenue 8.1% to US$15b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Keurig Dr Pepper.

Are Keurig Dr Pepper Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold US$8.3m worth of shares. But that's far less than the US$12m insiders spent purchasing stock. This bodes well for Keurig Dr Pepper as it highlights the fact that those who are important to the company having a lot of faith in its future. It is also worth noting that it was Chief Operating Officer Timothy Cofer who made the biggest single purchase, worth US$3.1m, paying US$31.26 per share.

The good news, alongside the insider buying, for Keurig Dr Pepper bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth US$508m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does Keurig Dr Pepper Deserve A Spot On Your Watchlist?

As previously touched on, Keurig Dr Pepper is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. You should always think about risks though. Case in point, we've spotted 2 warning signs for Keurig Dr Pepper you should be aware of, and 1 of them is significant.

Keen growth investors love to see insider buying. Thankfully, Keurig Dr Pepper isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Keurig Dr Pepper, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Keurig Dr Pepper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KDP

Keurig Dr Pepper

Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

Second-rate dividend payer low.

Similar Companies

Market Insights

Community Narratives