- United States

- /

- Beverage

- /

- NasdaqGS:KDP

Getting In Cheap On Keurig Dr Pepper Inc. (NASDAQ:KDP) Is Unlikely

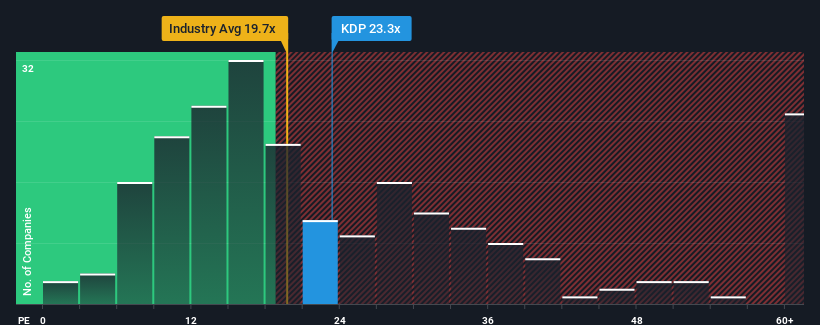

Keurig Dr Pepper Inc.'s (NASDAQ:KDP) price-to-earnings (or "P/E") ratio of 23.3x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Keurig Dr Pepper as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Keurig Dr Pepper

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Keurig Dr Pepper's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.3% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 50% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 12% each year, which is not materially different.

With this information, we find it interesting that Keurig Dr Pepper is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Keurig Dr Pepper's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Keurig Dr Pepper you should be aware of, and 1 of them makes us a bit uncomfortable.

If these risks are making you reconsider your opinion on Keurig Dr Pepper, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Keurig Dr Pepper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KDP

Keurig Dr Pepper

Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

Undervalued with solid track record.