- United States

- /

- Food

- /

- NasdaqGM:FRPT

Will Freshpet’s (FRPT) Interim CFO and Lower Sales Forecast Shift Management Priorities?

Reviewed by Sasha Jovanovic

- Freshpet, Inc. recently announced that Ivan Garcia, previously Vice President of Finance, has been appointed as Interim Chief Financial Officer following the departure of Todd Cunfer, effective October 17, 2025.

- This leadership transition comes as the company adjusts its full-year 2025 net sales growth forecast to a more conservative range than previously communicated.

- We'll explore how the combination of lower guidance and an interim CFO appointment could influence Freshpet's investment outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Freshpet Investment Narrative Recap

To be a Freshpet shareholder today, you need to believe in the company's ability to capitalize on category growth in premium, fresh pet food while efficiently expanding its footprint and household penetration. The recent appointment of Ivan Garcia as Interim CFO and the trimmed sales growth outlook do not materially change the central short-term catalyst, ongoing operational improvements and expense controls, but they may reinforce scrutiny around leadership stability, which remains a significant risk given current market conditions. Ultimately, Freshpet’s near-term story still hinges on execution, not just management transitions.

Of the recent company updates, the reduction in Freshpet’s full-year 2025 guidance for net sales growth, from 15-18% to 13-16%, stands out as most relevant. This update came alongside the CFO transition, amplifying attention on Freshpet’s ability to manage through sector headwinds while still pursuing margin and revenue expansion initiatives driven by investments in digital and retail channel growth.

However, while the fundamentals may appear resilient, investors should be aware that competitive pressures from well-established brands could...

Read the full narrative on Freshpet (it's free!)

Freshpet's narrative projects $1.5 billion in revenue and $137.7 million in earnings by 2028. This requires 13.7% yearly revenue growth and a $104 million increase in earnings from the current $33.7 million.

Uncover how Freshpet's forecasts yield a $79.31 fair value, a 54% upside to its current price.

Exploring Other Perspectives

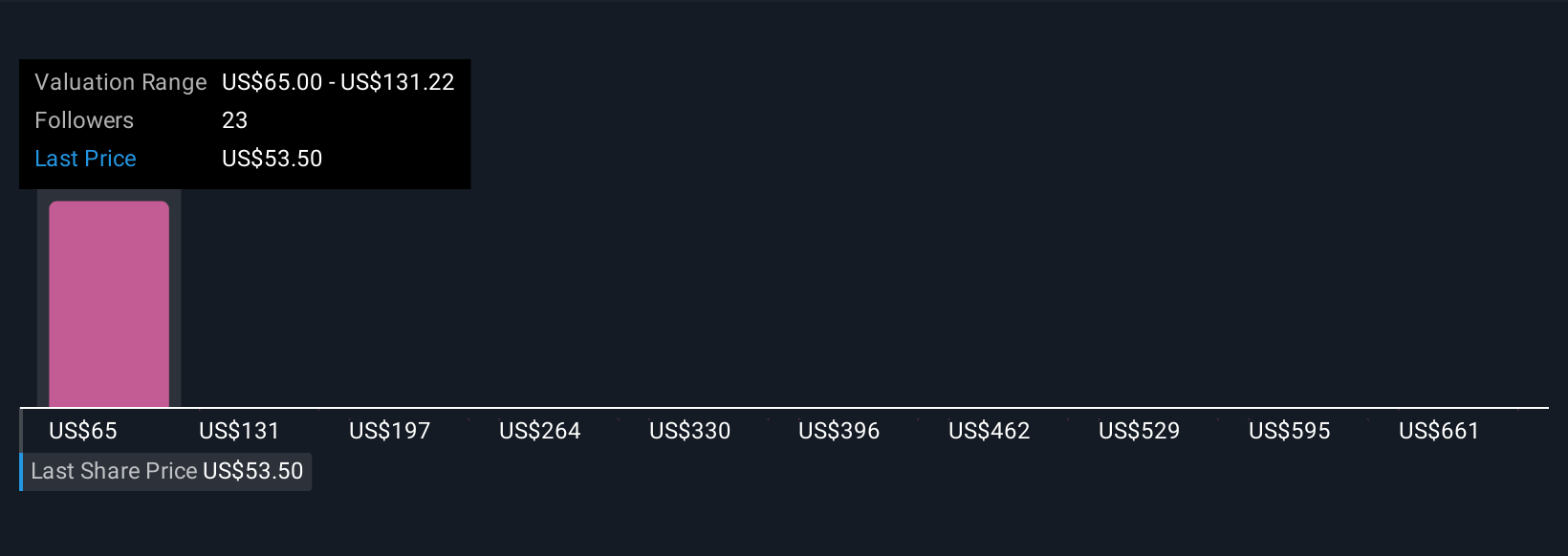

Five individual retail investors in the Simply Wall St Community place Freshpet’s fair value anywhere from US$79 to as high as US$727 per share. Yet, ongoing risks tied to slowing category growth and consumer price sensitivity may weigh on expectations and highlight why investor opinions on Freshpet’s prospects can vary widely.

Explore 5 other fair value estimates on Freshpet - why the stock might be worth just $79.31!

Build Your Own Freshpet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freshpet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freshpet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freshpet's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 39 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives