- United States

- /

- Food

- /

- NasdaqGM:FRPT

How Will Freshpet’s (FRPT) CFO Transition Influence Its Pursuit of Margin Improvements and Efficiency?

Reviewed by Sasha Jovanovic

- Freshpet, Inc. recently announced that Ivan Garcia, previously Vice President of Finance, has been appointed Interim Chief Financial Officer following the departure of Todd Cunfer, with the formal transition completed on October 17, 2025.

- This CFO change marks a significant leadership transition for Freshpet at a time when the company is actively pursuing operational efficiencies and margin improvements.

- We'll examine how the CFO transition could affect Freshpet's investment narrative amid continued focus on operational and margin enhancements.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Freshpet Investment Narrative Recap

To be a Freshpet shareholder, you need to believe the company can capitalize on rising demand for premium pet food by driving operational efficiencies, enhancing margins, and growing household penetration, despite stiff category competition and slowing pet adoption trends. The recent interim CFO appointment appears non-disruptive to Freshpet’s immediate operational and margin improvement efforts, although leadership continuity and financial stewardship are points to monitor as the company approaches its next earnings release. The key short-term catalyst remains the delivery of margin gains, while the most significant risk continues to be slower revenue growth from a softening pet adoption rate.

Among Freshpet's recent updates, the company’s lowered 2025 net sales growth target, now 13% to 16% year-over-year, is especially relevant alongside the CFO transition. While management continues to emphasize operational efficiency and margin expansion as drivers for earnings growth, this updated outlook points to broader challenges in stimulating top-line growth, highlighting how the company’s narrative has shifted from aggressive expansion to prudent execution.

Yet, against ongoing cost pressures and evolving consumer trends, investors should not overlook the possibility that...

Read the full narrative on Freshpet (it's free!)

Freshpet's outlook anticipates $1.5 billion in revenue and $137.7 million in earnings by 2028. This scenario assumes 13.7% annual revenue growth and a $104 million earnings increase from current earnings of $33.7 million.

Uncover how Freshpet's forecasts yield a $84.56 fair value, a 60% upside to its current price.

Exploring Other Perspectives

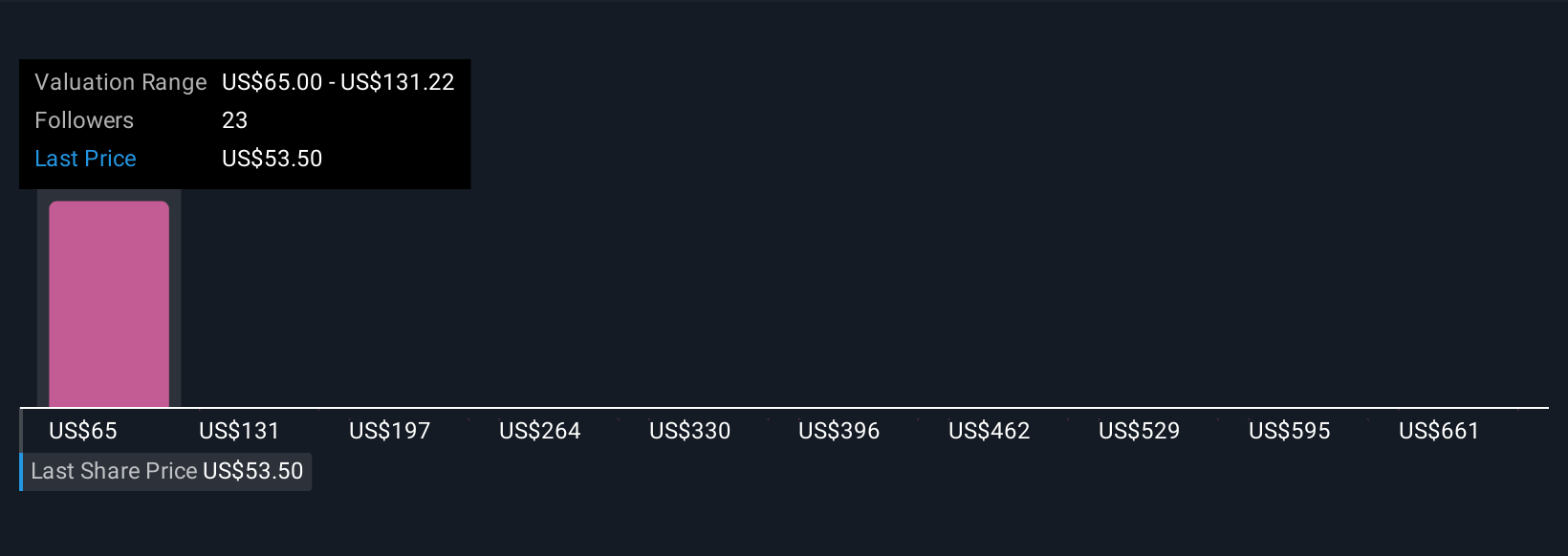

Retail investors in the Simply Wall St Community have published five fair value estimates for Freshpet ranging from US$84.56 to US$727.18 per share. While management focuses on operational efficiency to support earnings, these varied investor expectations emphasize how perspectives can differ, explore more viewpoints for a fuller picture.

Explore 5 other fair value estimates on Freshpet - why the stock might be a potential multi-bagger!

Build Your Own Freshpet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freshpet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freshpet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freshpet's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives