- United States

- /

- Food

- /

- NasdaqGS:CPB

Does the Share Price Drop Signal Opportunity for Campbell's in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Campbell's stock right now? You are definitely not alone. With the share price closing at $29.89 recently, Campbell's has caught the eye of many investors wondering whether the old-school staple just got stuck in the pantry or if there is value waiting for discovery. Over the past week, shares dipped 5.4%, carving out a notable drop; stretch that timeline to a month and the slide turns steeper at -11.4%. Year-to-date, the stock is down an eye-opening 28.9%, and if you zoom out to the past five years, Campbell's has shed 27.8% of its value. These numbers reflect not only shifting tastes but also market sentiment around consumer staples, especially as investors weigh opportunities elsewhere and ponder the pace of post-pandemic recovery.

Recent sector shifts and changing risk perceptions—such as worries about input costs, evolving consumer habits, and competitive pressures—have definitely played a role in Campbell's long-term slide. But here is where things get interesting: using a six-point valuation checklist, Campbell's scores a 4, which means it is undervalued according to four out of six key measures. With that in mind, is the market being overly pessimistic, or is there real trouble bubbling beneath the surface?

Let us break down exactly how Campbell's stands up under different valuation frameworks. Stick around, because at the end, I will share an even sharper lens for assessing value, one that can help you look past the usual numbers.

Why Campbell's is lagging behind its peers

Approach 1: Campbell's Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its expected future cash flows and then discounting them back to today's dollars. This method is especially useful for understanding what a business is fundamentally worth, rather than simply looking at price trends or earnings multiples.

For Campbell's, the current Free Cash Flow is $670.7 million, according to the latest report. Analysts expect steady growth over the next several years, with projections reaching $779 million by 2028. Going further, extrapolated estimates suggest Campbell's annual free cash flow could rise to about $913.9 million by 2035. All figures are in U.S. dollars and reflect ongoing operations. This steady climb in cash flow forms the basis for the DCF calculation using the 2 Stage Free Cash Flow to Equity model.

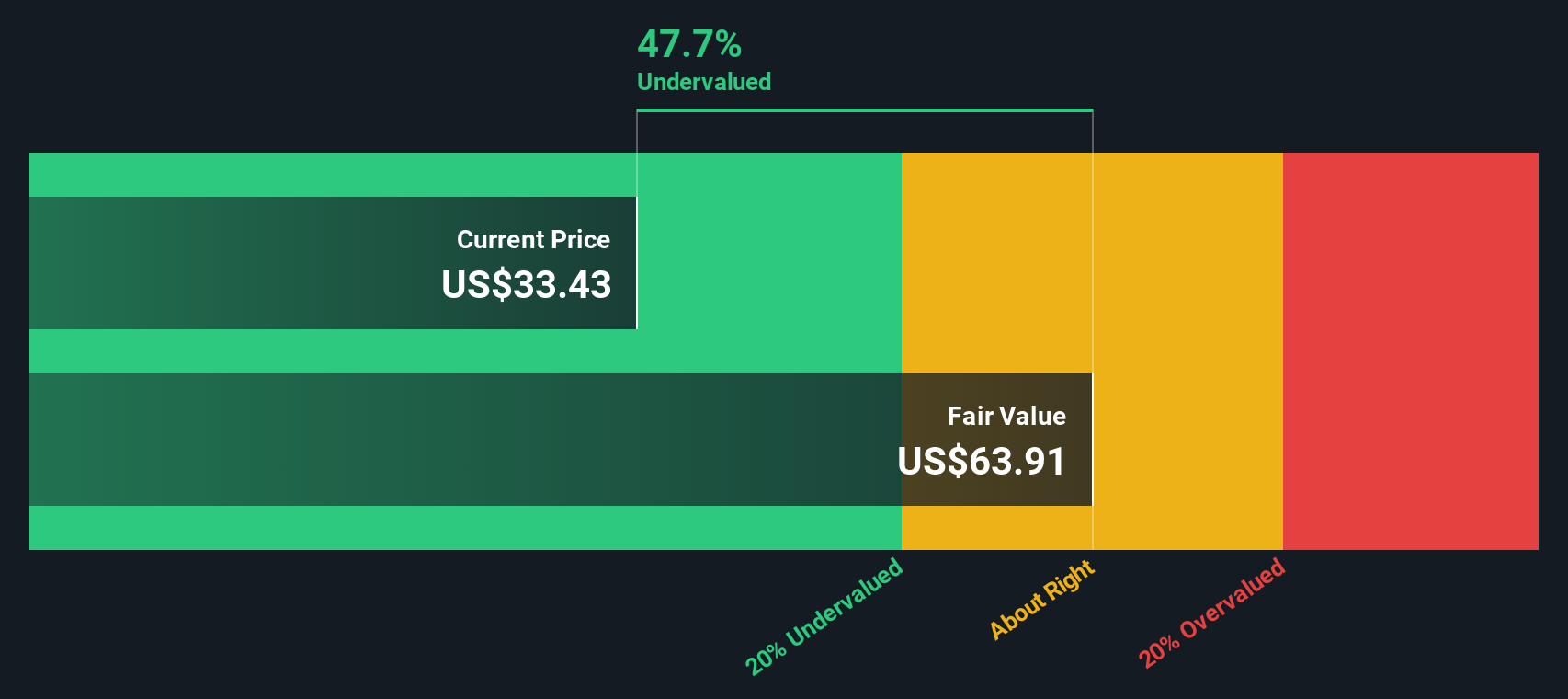

After crunching the numbers, the model estimates Campbell's intrinsic value at $63.91 per share. Compared to the recent closing price of $29.89, this implies the stock is trading at a 53.2% discount to its fair value. In other words, if the DCF assumptions hold, Campbell's may be deeply undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Campbell's is undervalued by 53.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Campbell's Price vs Earnings

The Price-to-Earnings (PE) ratio is a standard valuation metric for profitable companies like Campbell's, as it directly compares share price to the earnings each share generates. This makes it a widely used indicator for assessing whether a company's stock is reasonably valued relative to its profit-making capacity.

Typically, what counts as a “normal” or “fair” PE ratio depends on expectations for a company’s future earnings growth and the risks it faces. Fast-growing or lower-risk companies generally command higher PE ratios, while slower-growing or riskier businesses tend to trade at lower multiples.

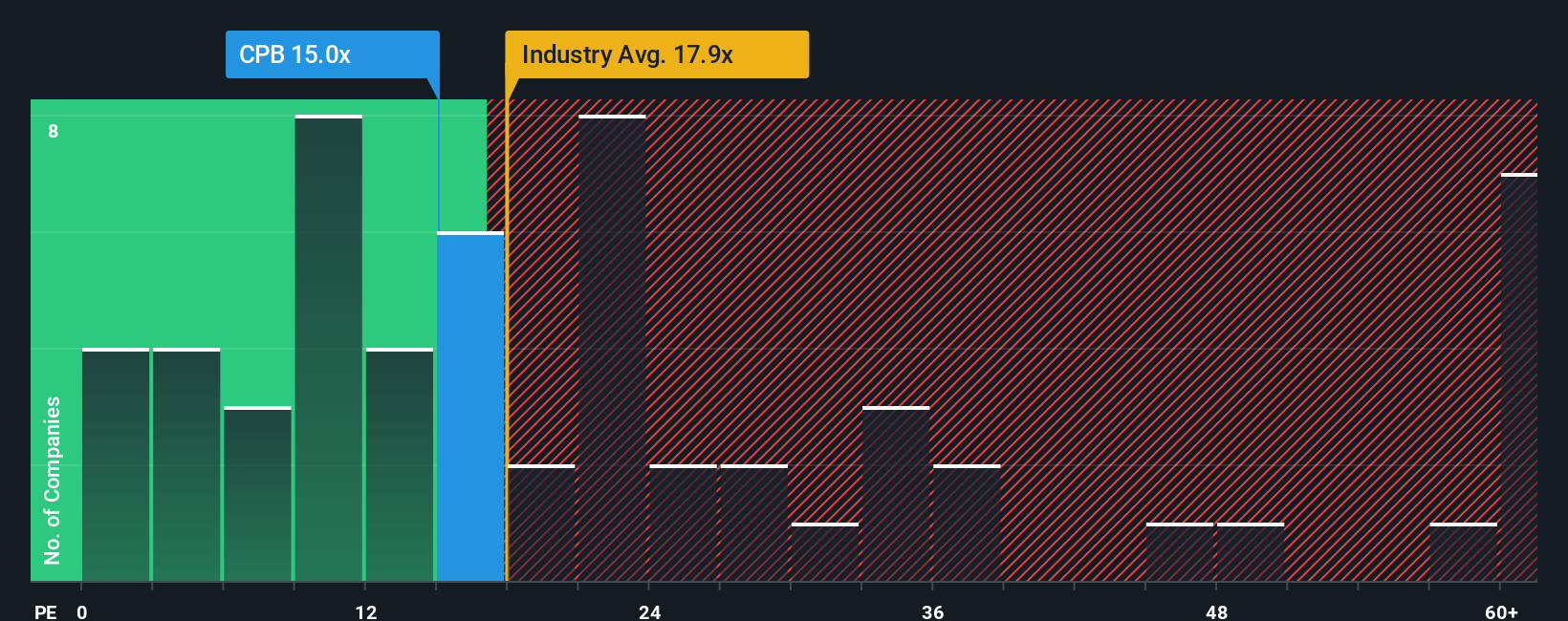

Currently, Campbell's PE ratio stands at 14.8x. That is right in line with its peer group, which averages 14.7x, and trailing the broader food industry average of 17.9x. However, looking beyond simple averages, Simply Wall St's proprietary Fair Ratio estimates the fair PE value for Campbell's at 20.0x. This Fair Ratio is especially insightful because it adjusts for not only earnings growth, but also the company’s margins, risk factors, industry dynamics, and market capitalization. This approach offers a more comprehensive and tailored benchmark than peer or industry comparisons alone.

With Campbell's trading at a 14.8x PE, well below its calculated Fair Ratio of 20.0x, the stock appears undervalued based on this benchmark.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Campbell's Narrative

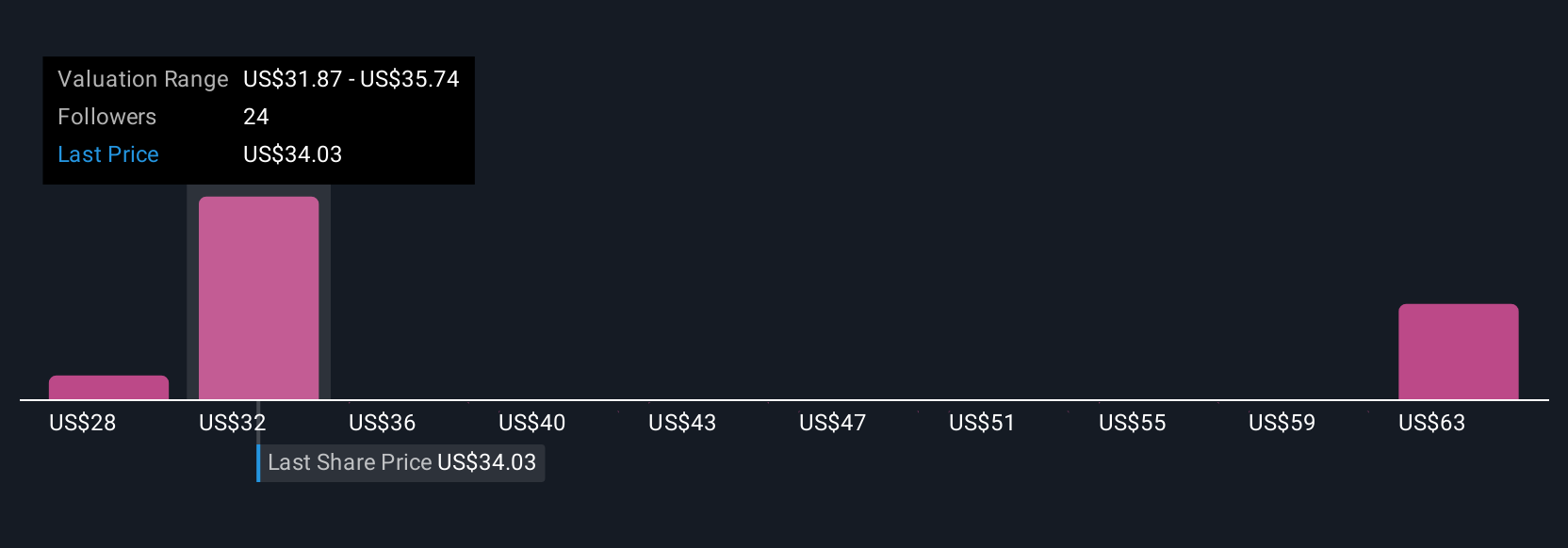

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personalized story about a company, the “why” behind your numbers, where you connect your perspective (such as assumptions about future revenue, margins, and fair value) with Campbell's actual performance and outlook. Narratives bridge the gap between a company’s story, a financial forecast, and an estimated fair value, making your investment decisions more meaningful and actionable.

With Narratives, you do not need to be a professional analyst. Simply Wall St’s platform, used by millions, lets you easily create and compare Narratives on the Community page. Investors use them to decide when to buy or sell by seeing how their calculated Fair Value stacks up against Campbell's current share price. Plus, these Narratives update automatically when new news or earnings come in, ensuring your thinking stays fresh and aligned with the latest data.

For Campbell's, one investor might see long-term upside and set a Narrative fair value near $62 based on resilience and innovation, while another sees risks dominating and estimates fair value closer to $29. This allows you to immediately understand the range of viewpoints driving price targets.

Do you think there's more to the story for Campbell's? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives