- United States

- /

- Diversified Financial

- /

- NYSE:GHLD

California BanCorp And 2 More High Growth Companies Insiders Favor

Reviewed by Simply Wall St

As the U.S. stock market grapples with the impact of newly imposed tariffs and economic uncertainty, investors are closely watching sectors that might offer resilience amid volatility. In such an environment, companies with strong insider ownership can be appealing, as they often signal confidence from those most familiar with the business's prospects and operations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.1% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Kingstone Companies (NasdaqCM:KINS) | 17.7% | 24.2% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

Here we highlight a subset of our preferred stocks from the screener.

California BanCorp (NasdaqCM:BCAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: California BanCorp operates as the bank holding company for California Bank of Commerce, N.A., with a market cap of $515.93 million.

Operations: The company generates revenue primarily through its Commercial Banking segment, amounting to $106.05 million.

Insider Ownership: 17.3%

Earnings Growth Forecast: 67.3% p.a.

California BanCorp shows promising growth potential with revenue forecasted to grow 27.3% annually, outpacing the US market. Earnings are expected to increase significantly at 67.3% per year, despite recent profit margin declines due to large one-off items impacting results. Fourth-quarter net income surged to US$16.77 million from US$4.41 million a year ago, although full-year net income decreased compared to the previous year. The stock trades slightly below its estimated fair value without substantial insider trading activity recently noted.

- Take a closer look at California BanCorp's potential here in our earnings growth report.

- The analysis detailed in our California BanCorp valuation report hints at an inflated share price compared to its estimated value.

Campbell's (NasdaqGS:CPB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Campbell's Company, along with its subsidiaries, manufactures and markets food and beverage products both in the United States and internationally, with a market cap of approximately $11.94 billion.

Operations: Campbell's revenue is derived from two main segments: Snacks, contributing $4.33 billion, and Meals & Beverages, accounting for $5.56 billion.

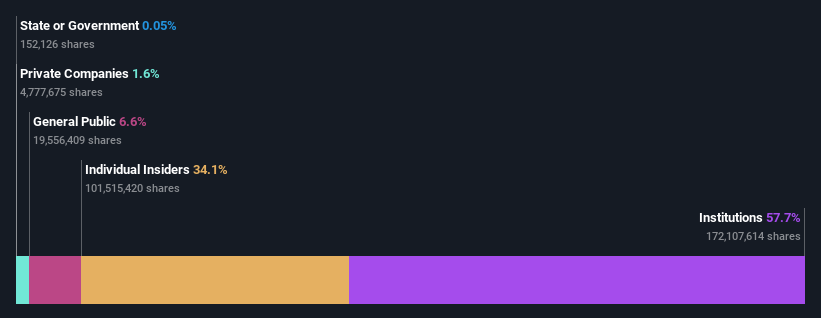

Insider Ownership: 34.1%

Earnings Growth Forecast: 21.3% p.a.

Campbell's earnings are forecast to grow significantly at 21.3% annually, surpassing the US market average, though revenue growth lags at 1.9%. Recent insider activity shows more shares bought than sold, albeit not in substantial volumes. The company maintains a reliable dividend yield of 3.78%, but profit margins have decreased from last year. Campbell's stock trades well below its estimated fair value, and recent leadership changes could impact future performance positively given Risa Cretella’s extensive industry experience.

- Delve into the full analysis future growth report here for a deeper understanding of Campbell's.

- The valuation report we've compiled suggests that Campbell's current price could be quite moderate.

Guild Holdings (NYSE:GHLD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guild Holdings Company originates, sells, and services residential mortgage loans in the United States with a market cap of approximately $773.57 million.

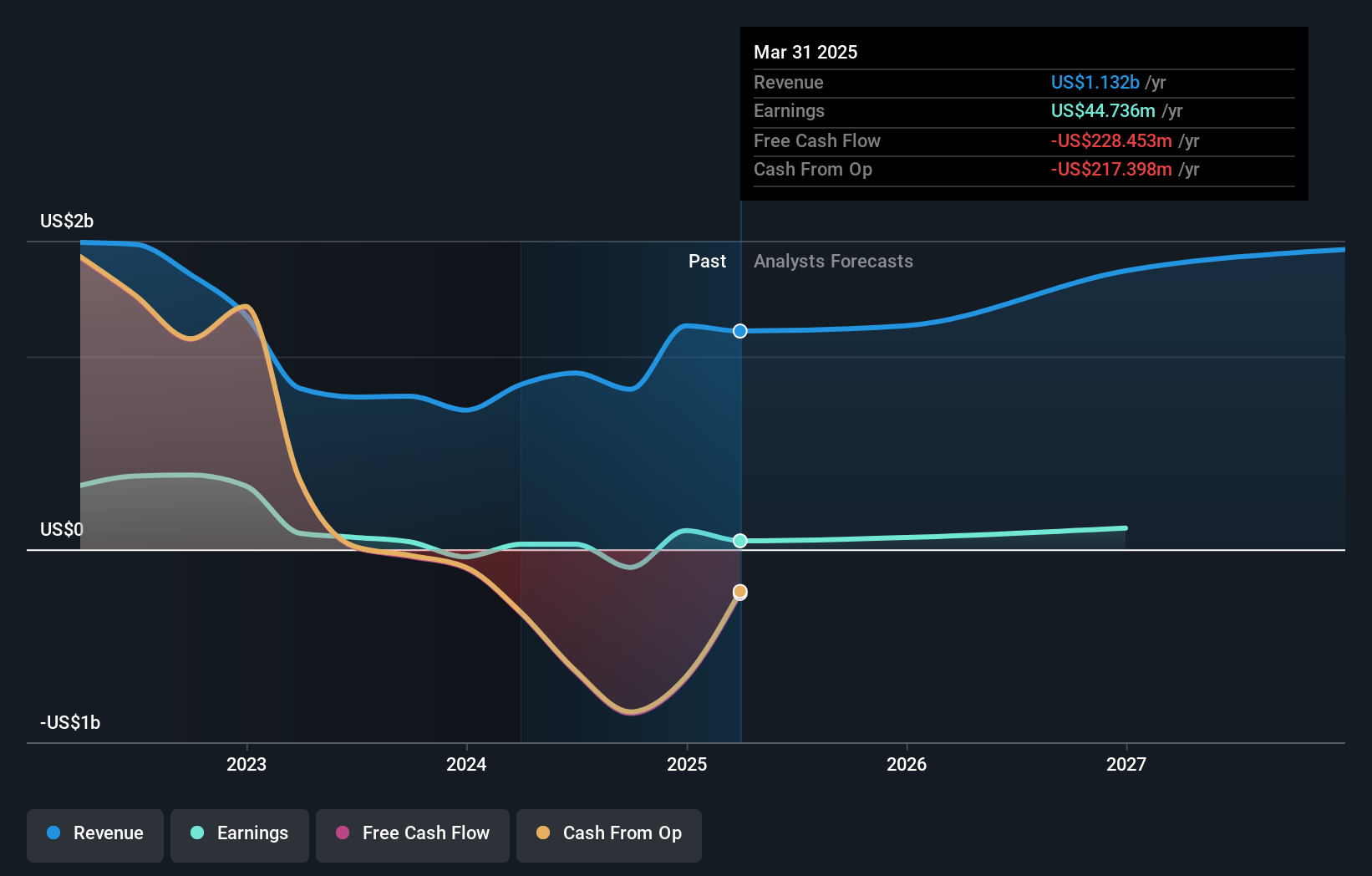

Operations: The company's revenue segments include $684.44 million from origination and $16.82 million from servicing residential mortgage loans in the United States.

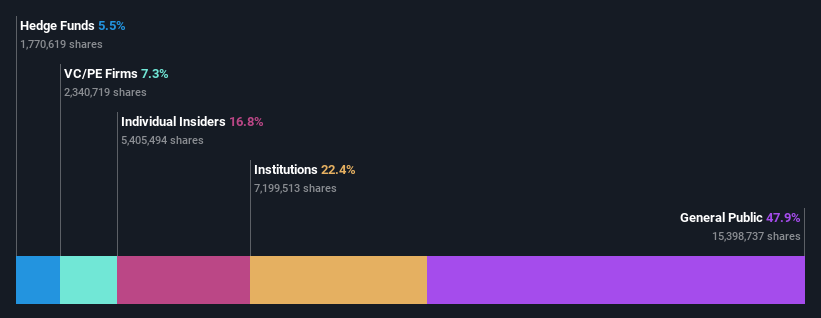

Insider Ownership: 11.4%

Earnings Growth Forecast: 118.5% p.a.

Guild Holdings' revenue is projected to grow at 22.2% annually, outpacing the US market average, with earnings expected to increase significantly by 118.52% per year. Despite trading at a 36.5% discount to its estimated fair value and being well-valued relative to peers, insider buying hasn't been substantial recently. The company has filed shelf registrations totaling over $1 billion in January 2025, indicating potential capital raising activities amid its growth trajectory challenges with debt coverage through operating cash flow.

- Click to explore a detailed breakdown of our findings in Guild Holdings' earnings growth report.

- Upon reviewing our latest valuation report, Guild Holdings' share price might be too pessimistic.

Key Takeaways

- Get an in-depth perspective on all 201 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHLD

Guild Holdings

Through its subsidiary, originates, sells, and services residential mortgage loans in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives