- United States

- /

- Beverage

- /

- NasdaqGS:COKE

Coca-Cola Consolidated (COKE): Valuation Check After Securing $1.35 Billion in New Term Loan Facilities

Reviewed by Simply Wall St

Coca-Cola Consolidated (COKE) just lined up $1.35 billion in new senior unsecured term loans with Wells Fargo and others, refinancing a short term bridge facility and opening fresh room for shareholder friendly uses.

See our latest analysis for Coca-Cola Consolidated.

The financing news lands after a powerful run, with the latest $162.97 share price coming off a 90 day share price return of 37.49 percent and a five year total shareholder return of 545.35 percent, suggesting momentum remains firmly on Coca Cola Consolidated’s side.

If this kind of financial firepower has you thinking about what else could surprise to the upside, now is a good time to explore fast growing stocks with high insider ownership.

Yet with returns this strong and fresh debt capacity to deploy, the key question now is simple: are investors still underestimating Coca Cola Consolidated, or is the market already pricing in years of future growth?

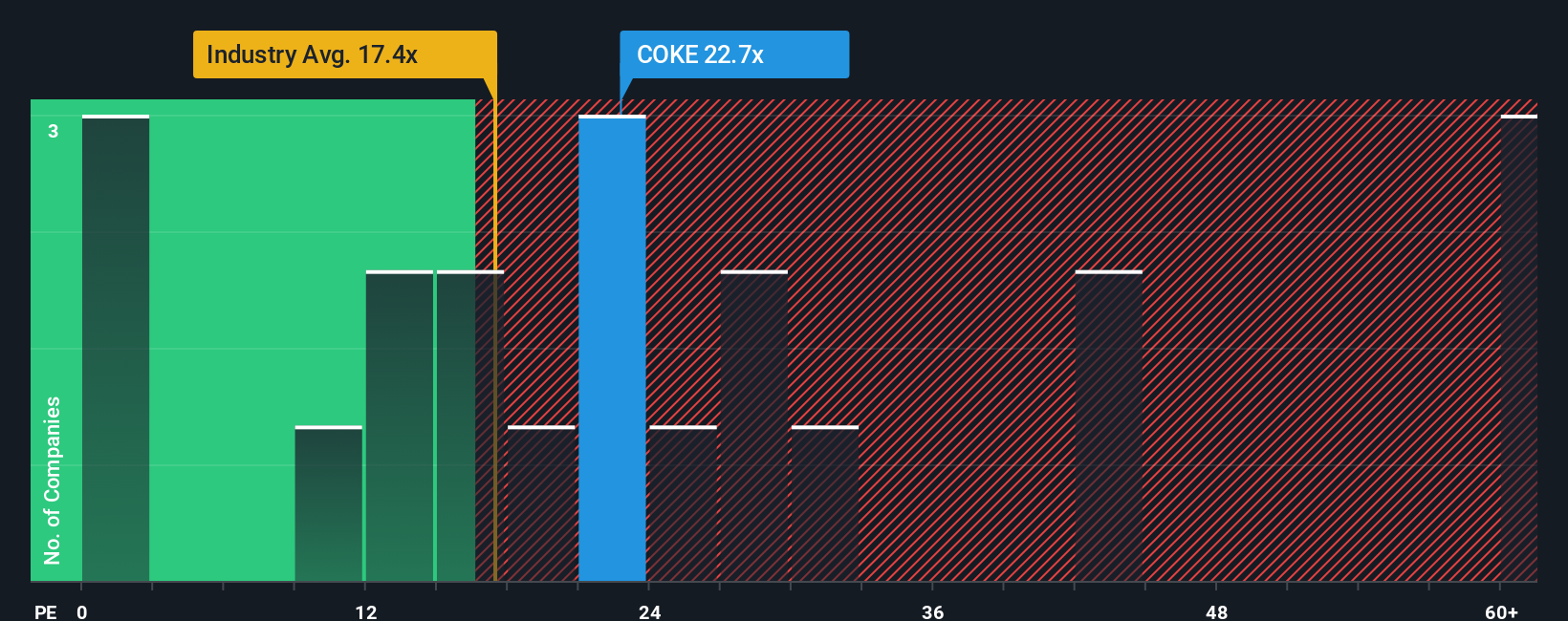

Price to earnings of 22.7x: Is it justified?

Coca-Cola Consolidated is trading below our SWS DCF model fair value estimate of $171.48 per share, versus a last close of $162.97, implying modest undervaluation.

Our DCF model estimates fair value by projecting the company’s future cash flows and discounting them back to today, capturing both growth and risk in a single figure. For a mature, cash generative bottler with a long operating history, this kind of cash flow based lens helps cut through short term price moves and focus on the earnings power that can service and eventually reduce debt.

Alongside that cash flow view, the stock changes hands at a price to earnings ratio of 22.7 times. This is a key benchmark for what the market is willing to pay for each dollar of current earnings. For a company that has grown earnings 15.6 percent over the past year and 26.5 percent annually over five years, this points to investors placing a premium on the durability of profits and management’s ability to keep compounding results.

Compared with the global beverage industry’s average price to earnings ratio of 17.4 times, Coca-Cola Consolidated trades at a clear premium, underlining how strongly its performance is being rewarded. However, against a peer set average of 24.8 times, its multiple looks more restrained. This suggests the market is giving credit for its growth and quality while still leaving a little valuation headroom relative to close comparables.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to earnings of 22.7x (ABOUT RIGHT)

However, rising interest costs on new debt and any slowdown in consumer beverage demand could quickly challenge today’s premium valuation and growth expectations.

Find out about the key risks to this Coca-Cola Consolidated narrative.

Another angle on value

Looking at simple earnings multiples, Coca-Cola Consolidated trades at 22.7 times earnings versus 17.4 times for the global beverage sector, but slightly below close peers at 24.8 times. That leaves the stock sitting between a quality premium and a potential overpay, raising the question of how much more upside the market will reward.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coca-Cola Consolidated for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coca-Cola Consolidated Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Coca-Cola Consolidated.

Ready for your next investing move?

Before this opportunity slips by, use the Simply Wall Street Screener to uncover fresh, data backed ideas that could shape the next stage of your portfolio.

- Capture potential mispricings early by targeting these 915 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has overlooked.

- Position yourself for structural healthcare shifts by backing these 30 healthcare AI stocks at the intersection of medicine, data, and automation.

- Tap into digital asset momentum by reviewing these 80 cryptocurrency and blockchain stocks exposed to blockchain infrastructure and real world adoption themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COKE

Coca-Cola Consolidated

Manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)