- United States

- /

- Beverage

- /

- NasdaqGS:COKE

A Fresh Look at Coca-Cola Consolidated (COKE) Valuation After Latest Dividend and Stock Split

Reviewed by Kshitija Bhandaru

Coca-Cola Consolidated (COKE) has just declared its regular fourth-quarter dividend of $0.25 per share, building on a major dividend hike and stock split earlier this year. Investors are also watching planned executive changes, which reinforce the leadership’s commitment to stability and growth.

See our latest analysis for Coca-Cola Consolidated.

After an energetic few months capped by the recent dividend and stock split, Coca-Cola Consolidated has been regaining momentum. While the last 12 months brought a slight dip in total shareholder return, the stock has delivered an impressive 198% total return over three years and more than 400% over five years. This highlights its resilience and long-term growth story.

If you’re inspired by COKE’s track record and want to see what else is out there, discover fast growing stocks with high insider ownership.

But with shares up sharply in recent years, is Coca-Cola Consolidated trading at an attractive price today? Or has the market already factored in all of its future growth potential?

Price-to-Earnings of 18.5x: Is it justified?

Coca-Cola Consolidated trades at a price-to-earnings (P/E) ratio of 18.5x, noticeably below the peer average of 54.6x. At Friday’s close of $124.48, the stock looks undervalued by this key metric when compared to similar companies. This suggests the market has not fully priced in its recent profit strength.

The price-to-earnings multiple reflects how much investors are willing to pay today for $1 of the company’s earnings. For consumer beverage companies like COKE, the P/E ratio often captures market sentiment around long-term brand power, growth potential, and earnings consistency.

With a P/E of 18.5x, investors seem to be applying a moderate valuation to COKE’s earnings even after several years of robust profit growth. The peer group’s average multiple of 54.6x is much higher, which indicates that COKE could see a significant re-rating if market expectations catch up to its performance trajectory.

By contrast, COKE is slightly more expensive than the global beverage industry average, which sits at 17.6x. This difference is modest and could reflect a premium placed on its recent earnings momentum and strategic moves. If upside potential materializes, the market could revise its benchmark for companies in this category.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 18.5x (UNDERVALUED)

However, investors should watch for slowing revenue growth or unexpected margin pressures. These factors could challenge the company's current valuation and growth trajectory.

Find out about the key risks to this Coca-Cola Consolidated narrative.

Another View: What Does the SWS DCF Model Indicate?

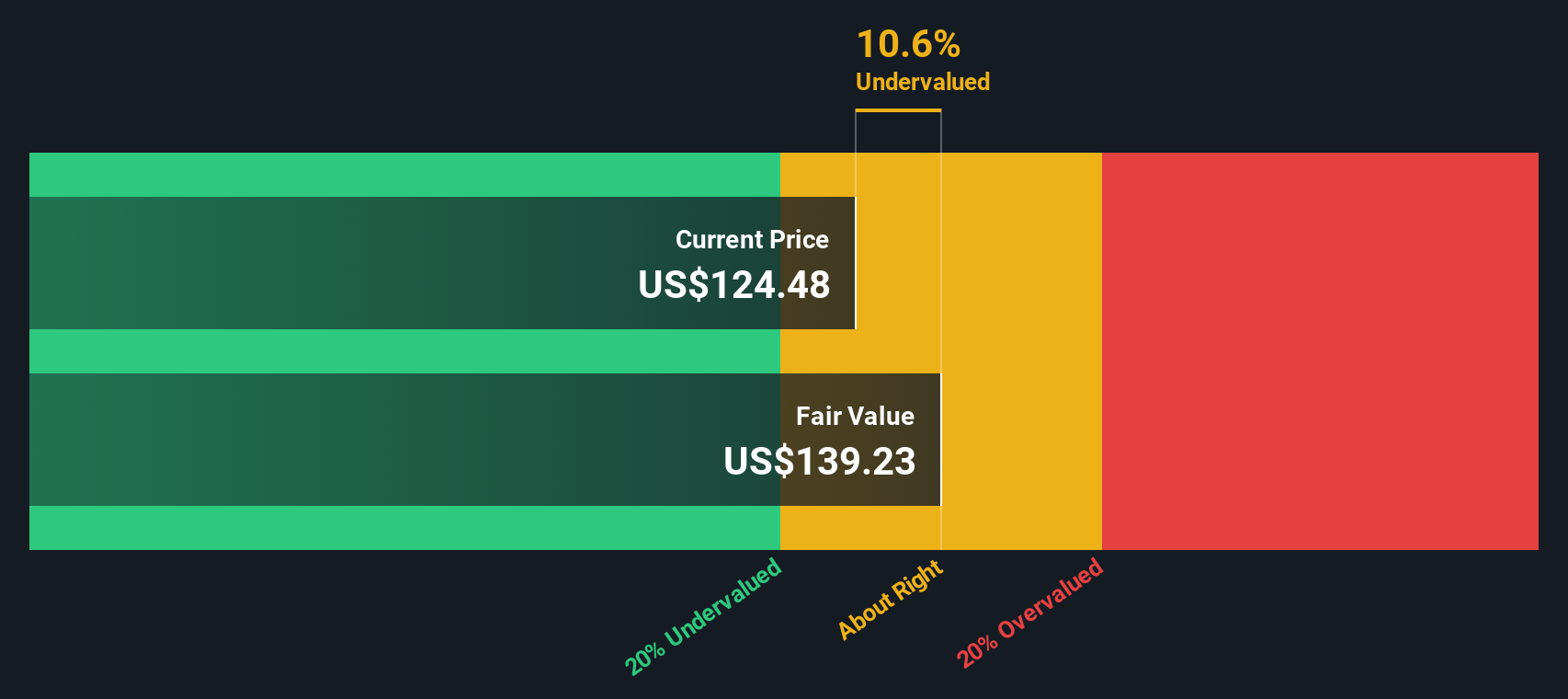

Taking a different approach, our DCF model estimates Coca-Cola Consolidated's fair value at $139.23, which is around 11% above its current market price of $124.48. This method points to the stock being undervalued. Does this signal more upside, or does it reflect uncertainty that investors see in the outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coca-Cola Consolidated for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coca-Cola Consolidated Narrative

If you see the story differently or want to dig deeper on your own terms, you can easily craft your own analysis in just a few minutes and put your perspective to the test. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Coca-Cola Consolidated.

Looking for more investment ideas?

Smart investors seize opportunities before they’re obvious to everyone else. Make your next move with targeted ideas built by the Simply Wall Street Screener. Don’t let the best opportunities pass you by.

- Boost your portfolio's income by targeting companies with generous yields using these 19 dividend stocks with yields > 3%, and enjoy steady potential returns above 3%.

- Tap into innovative forces transforming global healthcare with the latest breakthroughs by checking out these 33 healthcare AI stocks.

- Catch tomorrow’s crypto and blockchain trendsetters early by searching for leaders through these 79 cryptocurrency and blockchain stocks before the crowd does.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COKE

Coca-Cola Consolidated

Manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives