- United States

- /

- Beverage

- /

- NasdaqCM:CELH

Celsius Holdings (NasdaqCM:CELH) Reports Q4 2024 Earnings With US$332 Million Sales Decline

Reviewed by Simply Wall St

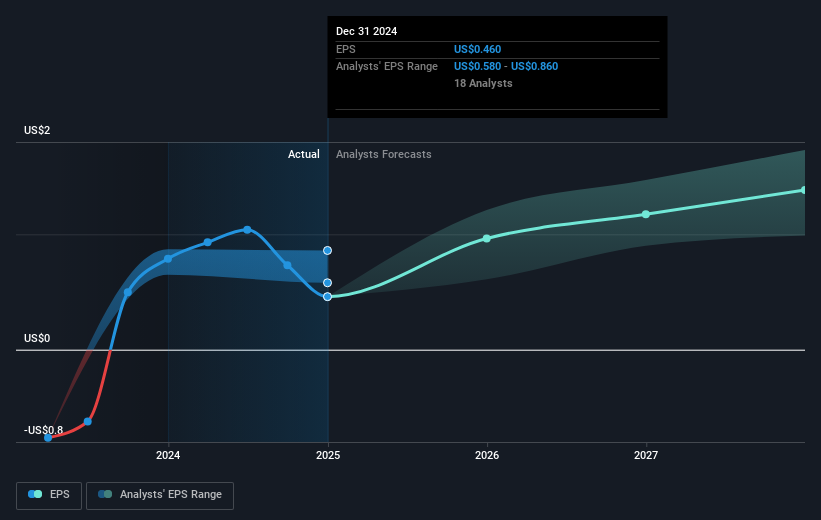

Celsius Holdings (NasdaqCM:CELH) recently reported its Q4 2024 earnings, revealing a downturn with a sales decline to USD 332 million and a net loss of USD 19 million. This financial report issued on February 20, 2025, highlighted a challenging period for the company following a strong previous year, subsequently aligning with a modest 0.35% share price decline over the past month. The broader market also mirrored challenges, with major indices like the Nasdaq Composite and S&P 500 experiencing losses amid economic uncertainties and concerns surrounding potential tariffs. Despite a temporary uptick in stocks toward the end of February due to cooling inflation data, the tech-heavy Nasdaq faced its worst monthly performance since April 2024, dropping 4% amid investor caution. The market drop of 1.4% in the same time frame may have exacerbated the challenges faced by the company, reflecting a tumultuous period in both corporate and wider market performance.

Dig deeper into the specifics of Celsius Holdings here with our thorough analysis report.

Over the past five years, Celsius Holdings' total shareholder return reached a very large increase, showcasing impressive growth despite encountering several challenges. The launch of the CELSIUS HYDRATION line in early 2024 marked a significant growth step by catering to sugar-free hydration needs, potentially appealing to the health-conscious consumer base. Also, the company's expansion into international markets like Canada, France, and Australia with PepsiCo played a critical role in increasing exposure and revenue streams.

Despite these positive strides, Celsius experienced hurdles, such as a downturn in Q4 2024 with sales at US$332.2 million and a net loss of US$18.88 million, alongside a class-action lawsuit filed in November 2024. The company's substantial insider selling over recent months and volatile share price also point to turbulence. Notably, over the past year, CELH underperformed both the US market and the beverage industry, which returned 15.3% and 0.7%, respectively.

- Unlock the insights behind Celsius Holdings' valuation and discover its true investment potential

- Analyze the downside risks for Celsius Holdings and understand their potential impact—click to learn more.

- Hold shares in Celsius Holdings? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, markets, distributes, and sells functional energy drinks and liquid supplements in the United States, Australia, New Zealand, Canadian, European, Middle Eastern, Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives