- United States

- /

- Beverage

- /

- NasdaqCM:CELH

Celsius Holdings (CELH): Evaluating Valuation Following Flavor Success and Strong Analyst Buzz

Reviewed by Kshitija Bhandaru

If you’ve had Celsius Holdings (CELH) on your watchlist, recent headlines might have caught your eye. The company has made a splash with successful new flavors, even clinching the number one spot for ready-to-drink energy brands on Amazon during Prime Day. Combined with upbeat commentary from analysts and industry watchers, it is no surprise Celsius is sparking fresh debates about where the stock could go next.

This flavor-fueled excitement is unfolding against a background of shifting share prices. Celsius rocketed to 52-week highs at the end of August, only to see a pullback in September. Even so, the stock remains up an impressive 94% for the year and nearly 57% over the past 12 months. This suggests that momentum, while recently challenged, is far from extinguished. In addition, the market is still digesting news of the Alani Nu acquisition and the broader competitive moves from rivals like Monster Beverage and Coca-Cola. These developments could have implications for Celsius’s valuation story.

So after a year of strong gains and a recent dip, should investors see the current setup as a compelling entry point for Celsius, or has the market already priced in these wins and future growth?

Most Popular Narrative: 22.5% Undervalued

According to the most widely followed narrative, Celsius Holdings appears to be significantly undervalued relative to its long-term growth prospects, with analysts maintaining a high degree of conviction in future performance drivers.

Expansion of distribution and increased activation through leading partners (PepsiCo in North America, Suntory internationally) is accelerating store count, new market entries, and international growth (27% YoY). This provides exposure to broader health and wellness trends globally and underpins expectations for long-term revenue expansion.

Want to see what’s fueling this bold price target? Behind the valuation is not just healthy projected growth, but an aggressive set of assumptions that could reshape the entire market’s view of Celsius. Intrigued by the specific financial forecasts and the unique profit dynamics that drive this rerating? The full narrative reveals the real math behind the story, with numbers that could surprise even the most experienced investors.

Result: Fair Value of $66.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising input costs and heightened competition could weigh on margins and challenge Celsius’s ability to sustain its impressive growth trajectory.

Find out about the key risks to this Celsius Holdings narrative.Another View: What Does the Market Multiple Say?

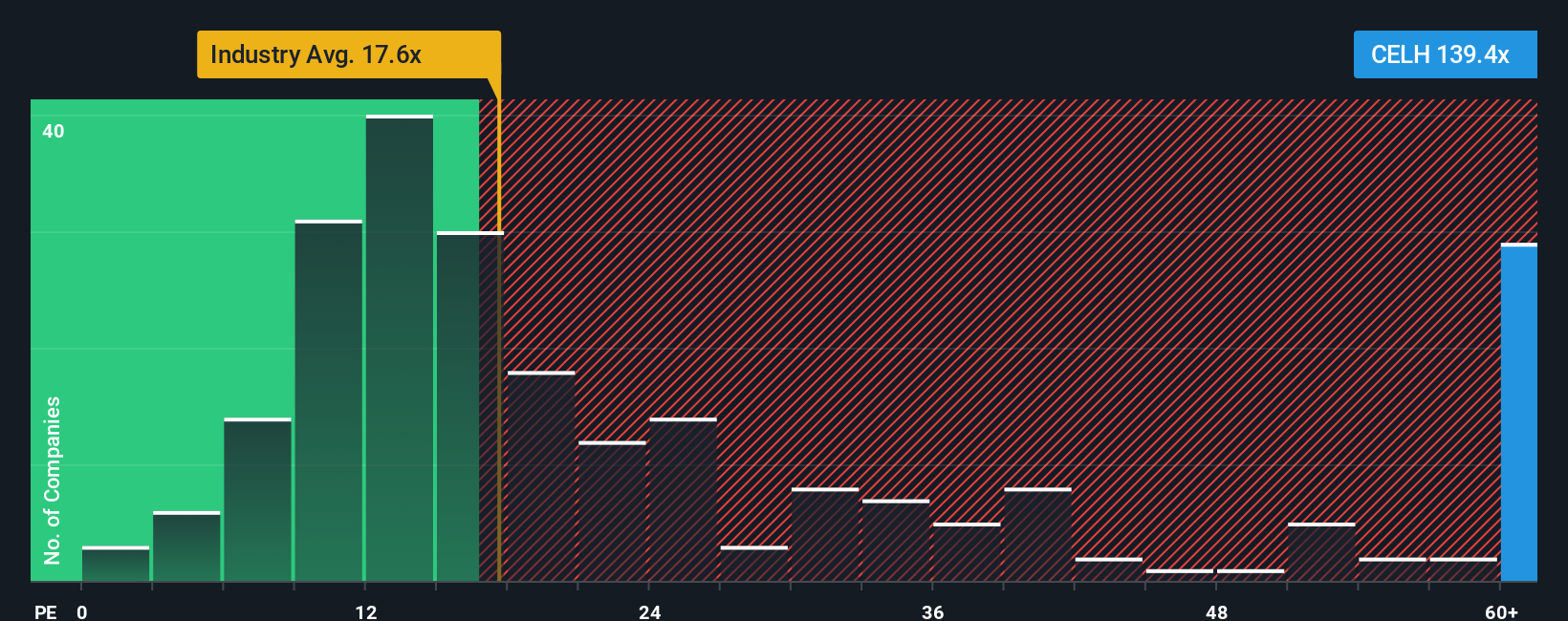

Taking a look through the lens of the most common valuation multiple used by investors, Celsius appears far pricier than the industry average. Does this challenge the growth optimism behind the first valuation, or is a premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Celsius Holdings Narrative

If you see the story differently or want to dive deeper into the data yourself, you can build your own outlook in just a few minutes with your own assumptions. Do it your way.

A great starting point for your Celsius Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next smart move could be just a click away. Don’t let opportunity pass by. The Simply Wall Street Screener is your shortcut to finding standout stocks with serious potential.

- Uncover potentially overlooked gems by checking out penny stocks with strong financials using the penny stocks with strong financials.

- Target tomorrow’s breakthroughs in innovation by browsing companies at the forefront of artificial intelligence with AI penny stocks.

- Supercharge your portfolio with equities showing exceptional value compared to their true worth. Start with the undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, manufactures, markets, sells, and distributes functional energy drinks in the United States, North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives