- United States

- /

- Chemicals

- /

- OTCPK:GLGI

Discover 3 US Penny Stocks With Market Caps Over $20M

Reviewed by Simply Wall St

As U.S. markets navigate the challenges of soaring yields and persistent inflation, investors are increasingly exploring diverse opportunities beyond traditional blue-chip stocks. Penny stocks, often representing smaller or newer companies, may carry a vintage label but remain a relevant investment area due to their potential for growth at lower price points. This article explores three penny stocks that stand out for their financial resilience and compelling opportunities in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.870625 | $6.51M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $131.87M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.26 | $9.2M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $89.48M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.44 | $46.86M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.71 | $48.23M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.46 | $25.54M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8876 | $80.72M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.61 | $388.67M | ★★★★☆☆ |

Click here to see the full list of 717 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

UTStarcom Holdings (NasdaqGS:UTSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: UTStarcom Holdings Corp. is a telecom infrastructure provider that develops technology for bandwidth from cloud-based services, mobile, streaming, and other applications across China, India, Japan, and internationally with a market cap of $25.57 million.

Operations: UTStarcom Holdings does not report specific revenue segments.

Market Cap: $25.57M

UTStarcom Holdings, with a market cap of US$25.57 million, recently secured a significant contract with China Telecom Research Institute for manufacturing disaggregated router hardware. Despite being unprofitable, the company has reduced its losses by 13.8% annually over five years and maintains a stable financial position with short-term assets of US$65.7 million exceeding liabilities. The experienced management team and lack of debt further bolster its stability in the volatile penny stock market. With sufficient cash runway for over three years, UTStarcom is positioned to leverage its technological developments in key international markets.

- Take a closer look at UTStarcom Holdings' potential here in our financial health report.

- Review our historical performance report to gain insights into UTStarcom Holdings' track record.

Greystone Logistics (OTCPK:GLGI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Greystone Logistics, Inc., with a market cap of $29.69 million, operates in the United States through its subsidiaries by manufacturing and marketing plastic pallets and pelletized recycled plastic resins.

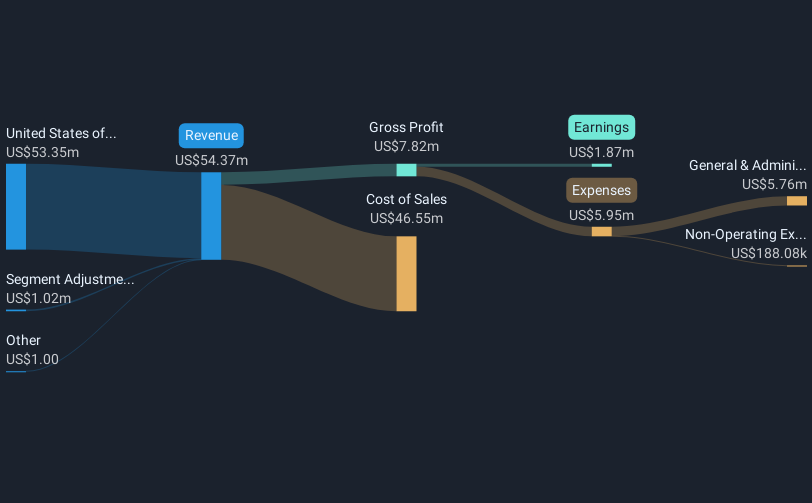

Operations: The company's revenue is primarily generated from its Plastic Pallets segment, which accounts for $54.37 million.

Market Cap: $29.69M

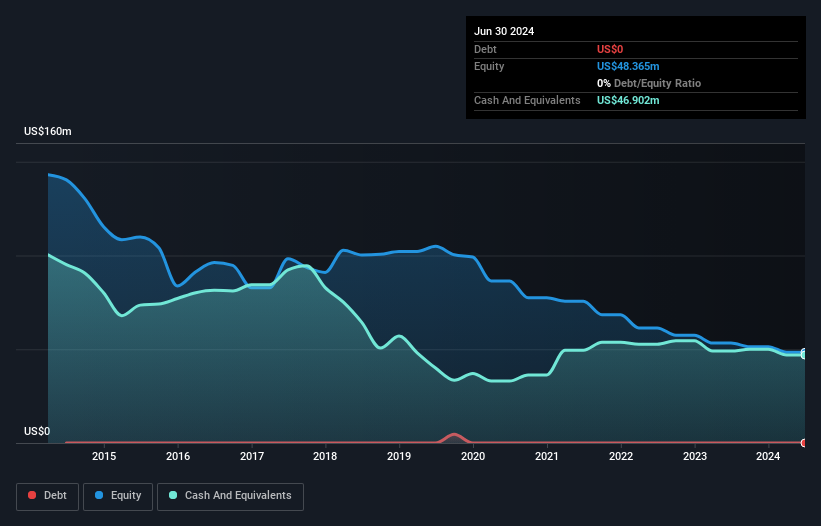

Greystone Logistics, with a market cap of US$29.69 million, is actively seeking small acquisitions to drive growth. The company reported a net loss for Q2 2025 with sales decreasing to US$12.14 million from the previous year. Despite this setback, Greystone's debt management has improved significantly over five years, reducing its debt-to-equity ratio from a very large value to 51.5%. Its operating cash flow covers 79.1% of its debt, and short-term assets exceed liabilities by US$7 million. However, interest payments are not well covered by EBIT and profit margins have decreased compared to last year.

- Unlock comprehensive insights into our analysis of Greystone Logistics stock in this financial health report.

- Evaluate Greystone Logistics' historical performance by accessing our past performance report.

Hugoton Royalty Trust (OTCPK:HGTX.U)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hugoton Royalty Trust operates as an express trust in the United States with a market cap of $21.71 million.

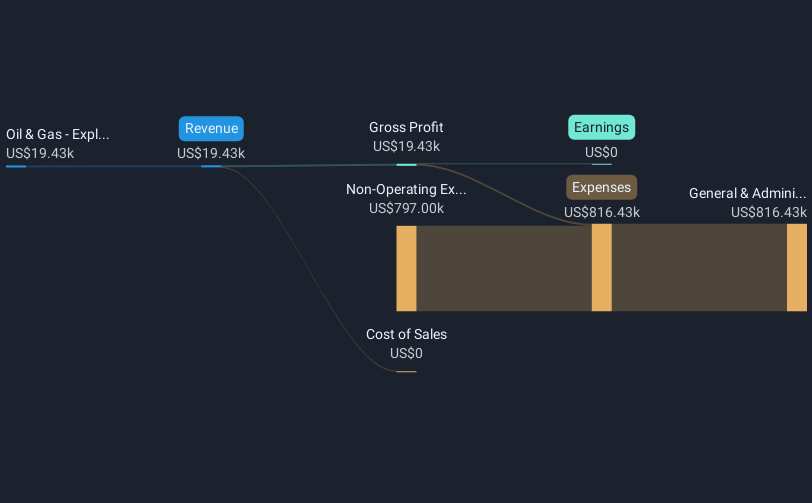

Operations: The trust generates revenue from its Oil & Gas - Exploration & Production segment, amounting to $0.02 million.

Market Cap: $21.71M

Hugoton Royalty Trust, with a market cap of US$21.71 million, operates without debt and has managed to reduce its losses by 50.3% annually over the past five years despite being pre-revenue with minimal income of US$19K. The trust's short-term assets match its liabilities at US$341.5K, indicating stable financial management in the absence of long-term liabilities or shareholder dilution. Recent earnings reports show declining revenue for Q3 2024 at US$4,710 compared to previous periods, reflecting challenges in revenue generation within the Oil & Gas sector amidst broader industry declines.

- Click here and access our complete financial health analysis report to understand the dynamics of Hugoton Royalty Trust.

- Understand Hugoton Royalty Trust's track record by examining our performance history report.

Seize The Opportunity

- Click here to access our complete index of 717 US Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:GLGI

Greystone Logistics

Through its subsidiaries, manufactures and markets plastic pallets and pelletized recycled plastic resins in the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives