- United States

- /

- Oil and Gas

- /

- NYSEAM:UEC

Uranium Energy (UEC): How Does Its Valuation Stack Up After Recent Share Gains?

Reviewed by Simply Wall St

Price-to-Book of 4.7x: Is it justified?

Based on the price-to-book (P/B) ratio, Uranium Energy appears expensive relative to both its direct peers and the broader US oil and gas industry. The company is trading at 4.7 times its book value, whereas the average peer trades at 3 times and the industry average is even lower at 1.3 times.

The price-to-book ratio is a commonly used metric for valuing companies in resource and capital-intensive sectors. It compares a company's market price to its net asset value, providing a sense of whether investors are paying a premium or discount for the underlying assets of the business.

In this case, the elevated P/B ratio suggests investors have high expectations for Uranium Energy’s future earnings or asset growth relative to its industry peers. However, with the company currently unprofitable and forecast to remain so in the near term, the high multiple may be difficult to justify unless there is a significant improvement in operational results.

Result: Fair Value of $9.39 (OVERVALUED)

See our latest analysis for Uranium Energy.However, continued losses and a stretched valuation could pressure shares if operational improvements or industry tailwinds do not materialize soon.

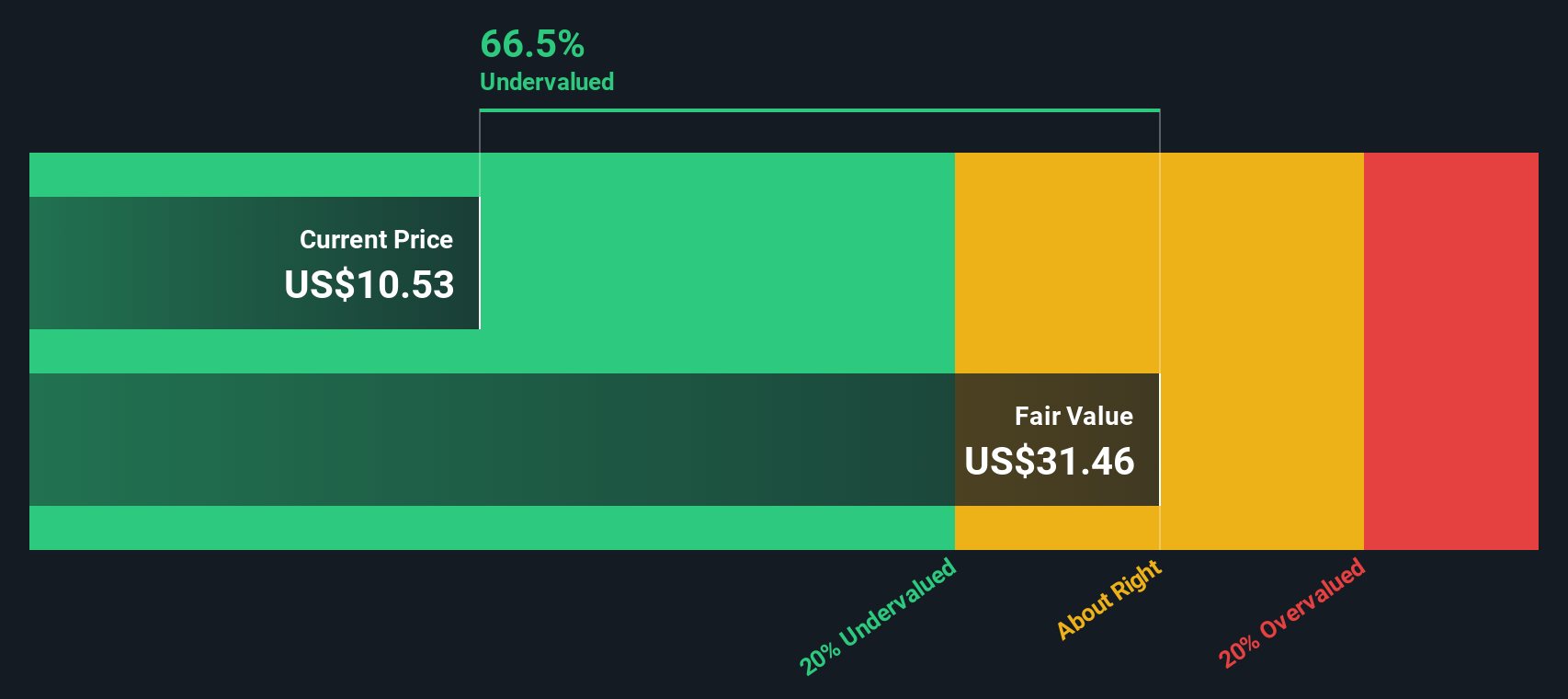

Find out about the key risks to this Uranium Energy narrative.Another View: What Does the DCF Say?

Looking from a different angle, our DCF model paints a sharply contrasting picture. While the market may expect a premium based on assets, DCF analysis suggests the stock could actually be undervalued. Which outlook deserves more weight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Uranium Energy Narrative

If you see the data differently or think you've spotted something others might have missed, it's easy to craft your own analysis to reflect your perspective. do it your way.

A great starting point for your Uranium Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Why settle for just one angle? Open yourself to a broader world of smart investment ideas. The Simply Wall Street Screener highlights companies that are thriving across exciting fields. Take action now and gain an edge with these handpicked opportunities before you miss out:

- Capitalize on strong income streams by uncovering high-yield picks with dividend stocks with yields > 3% which deliver steady returns above 3%.

- Supercharge your portfolio with innovative healthcare trends by targeting standout prospects in healthcare AI stocks at the forefront of AI-powered medicine.

- Boost your search for the next undervalued winner by tapping into undervalued stocks based on cash flows that offer compelling cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UEC

Uranium Energy

Engages in exploration, pre-extraction, extraction, and processing of uranium and titanium concentrates properties in the United States, Canada, and the Republic of Paraguay.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives