- United States

- /

- Oil and Gas

- /

- NYSEAM:UEC

Is Uranium Energy Still Fairly Priced After Shares Surge 10.9% This Week?

Reviewed by Bailey Pemberton

So, you are staring at Uranium Energy’s ticker, wondering whether to jump in or cash out after this remarkable run. The numbers are tough to ignore: in just the past week, the stock surged 10.9%. Zoom out further and it gets even more dramatic, with a 1-year gain of 106.6% and a jaw-dropping 1376.8% return over five years. These climbs are attracting both longtime optimists and fresh faces chasing momentum, especially as market buzz continues around nuclear energy’s comeback and shifts in global energy policy.

Recent shifts in uranium prices, growing interest in nuclear as a low-emission solution, and geopolitical supply chain jitters have all played their role in sending investor confidence sky-high. Those strong, steady returns in 2024, already up 92.3% year-to-date, signal optimism but also suggest changing risk appetites among market participants. Everyone wants to know if this is just another leg up or if things are getting overheated.

But here is the catch: when we look at the company’s valuation score, Uranium Energy comes in at 0 out of 6. In other words, according to our checks, the company does not pass any of the standard undervaluation tests right now.

So, before you make your next move, let’s walk through the different valuation approaches investors use. Stick around, because after the usual numbers, I will reveal a smarter way to put the whole valuation puzzle together.

Uranium Energy scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Uranium Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is really worth by projecting its future cash flows and then discounting them back to today’s value. This approach is popular among investors because it tries to look past market excitement and focuses on the company’s actual ability to generate cash.

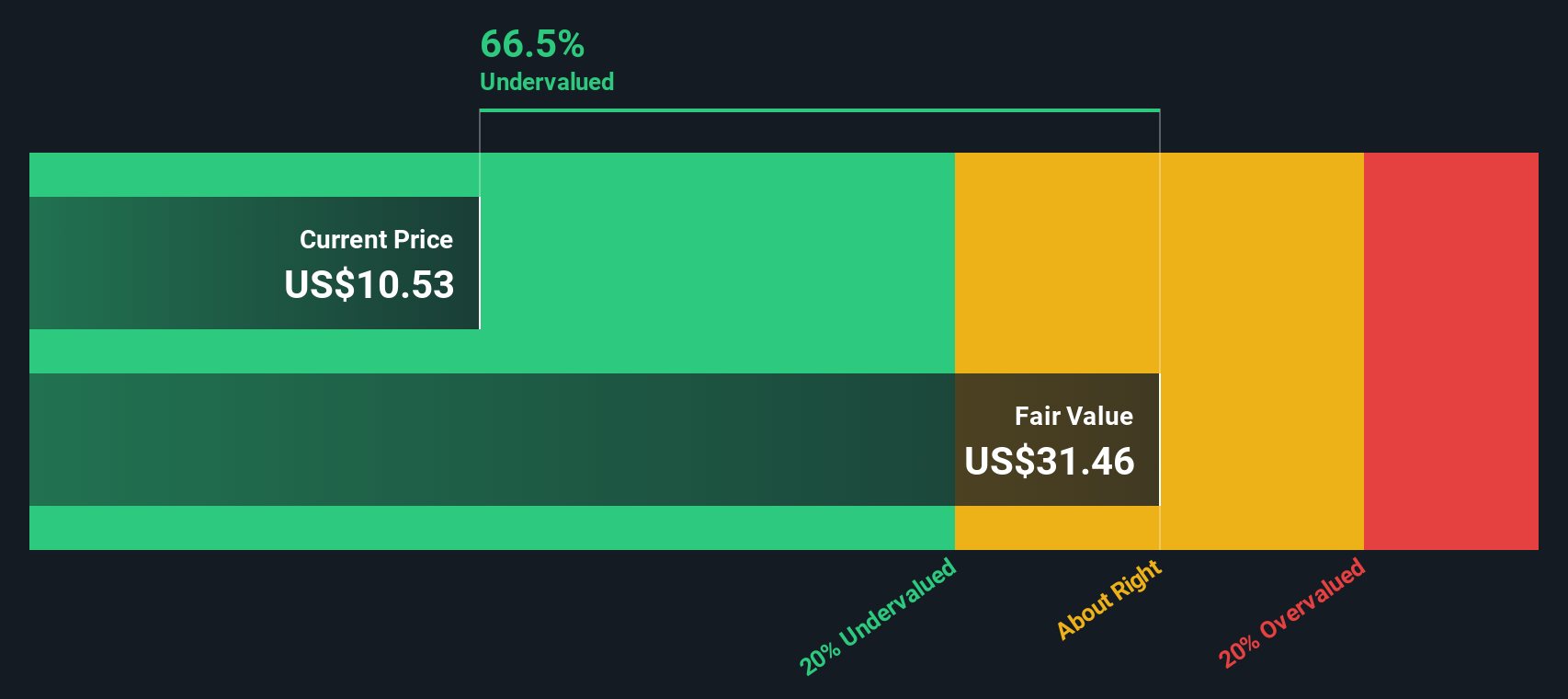

For Uranium Energy, the current Free Cash Flow stands at -$67.3 million (based on the latest twelve months). Analysts expect the company to exit negative territory in coming years, with projections climbing to $86.7 million by 2028. Fast forward to 2035, and projections, albeit increasingly speculative, push annual Free Cash Flow to nearly $375.3 million. Remember, estimates for the next 4-5 years are based on analyst views, but beyond that, they are extrapolations and should be taken with extra caution.

After crunching the numbers, the DCF model pegs Uranium Energy’s “fair value” at $14.22 per share. Currently, the stock trades about 3.0% above this estimate, suggesting it is just a notch over what the cash flows justify.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Uranium Energy's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Uranium Energy Price vs Book Value (P/B)

The Price-to-Book (P/B) ratio is a common valuation tool for companies in industries like energy and mining, where asset values play a crucial role. It compares a company’s market value to its net assets, making it especially relevant when profits fluctuate or earnings are negative, as is the case with Uranium Energy right now.

Growth expectations and perceived risks often impact what investors consider a “fair” P/B multiple. Companies poised for rapid expansion, or those with unique assets or technologies, typically command higher ratios, while greater risks and uncertainties push it lower. Essentially, the market is weighing potential future upside against today’s tangible asset base and industry norms.

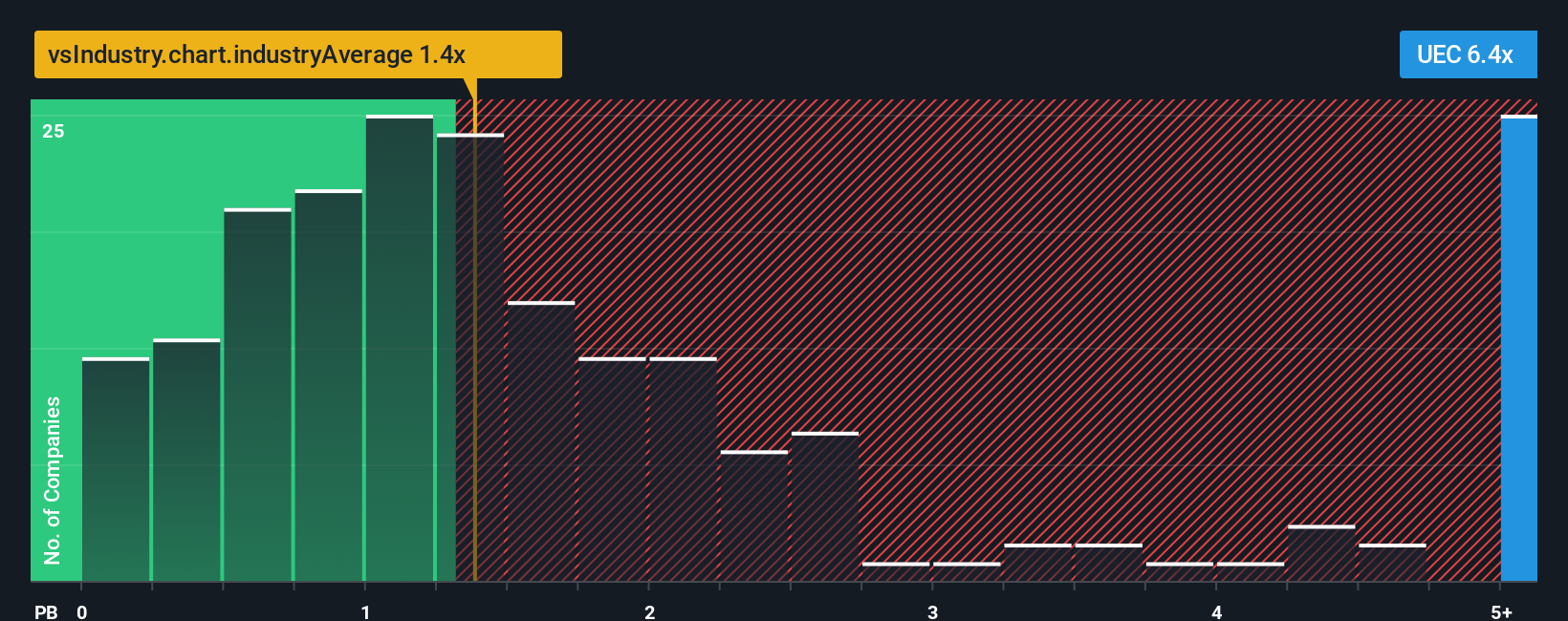

Uranium Energy currently trades at a P/B ratio of 6.9x. That is well above the Oil and Gas industry average of 1.4x, and also higher than its peer group average of 5.6x. While these comparisons are helpful, they do not paint the whole picture, as peers and industries can have widely varying prospects and risks.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Unlike blunt industry or peer comparisons, the Fair Ratio factors in Uranium Energy’s specific earnings growth outlook, risk profile, profit margins, and market cap. By tailoring the multiple to the company’s unique characteristics, it offers a more meaningful benchmark for valuation.

Comparing Uranium Energy’s actual P/B ratio to its Fair Ratio, the difference is so slim that it suggests the company is priced about right at today’s levels. Investors might take comfort knowing that, at this stage, neither strong undervaluation nor obvious excess is present.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Uranium Energy Narrative

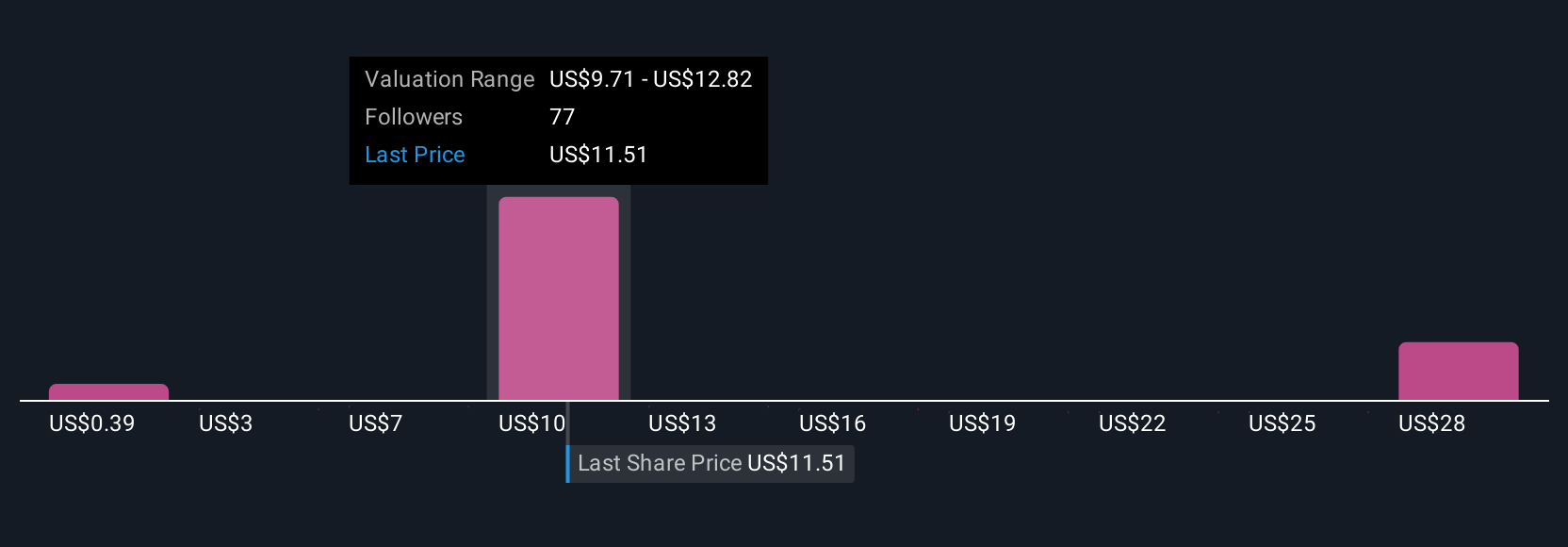

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Simply put, a Narrative captures your story and perspective about a company, beyond just the raw numbers. It connects your expectations about Uranium Energy’s future revenue, profit margins, and fair value to a clear financial forecast, bridging the gap between what you believe will happen and what the numbers say.

On Simply Wall St’s platform, Narratives are a simple and powerful tool available on the Community page, where millions of investors share and compare their views. By building a Narrative, you can compare your own estimate of Uranium Energy’s Fair Value with the current market Price, helping you make more confident decisions about when to buy, hold, or sell.

Narratives are updated automatically as new data or company announcements emerge, so your view always reflects the latest developments. For example, one investor's Narrative might see Uranium Energy as undervalued with a fair value of $24 per share, while another might believe it is overvalued at $8. This demonstrates just how flexible and insightful this approach can be.

Do you think there's more to the story for Uranium Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UEC

Uranium Energy

Engages in exploration, pre-extraction, extraction, and processing of uranium and titanium concentrates properties in the United States, Canada, and the Republic of Paraguay.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives