- United States

- /

- Energy Services

- /

- NYSE:XPRO

Expro Group Holdings N.V.'s (NYSE:XPRO) Price Is Out Of Tune With Revenues

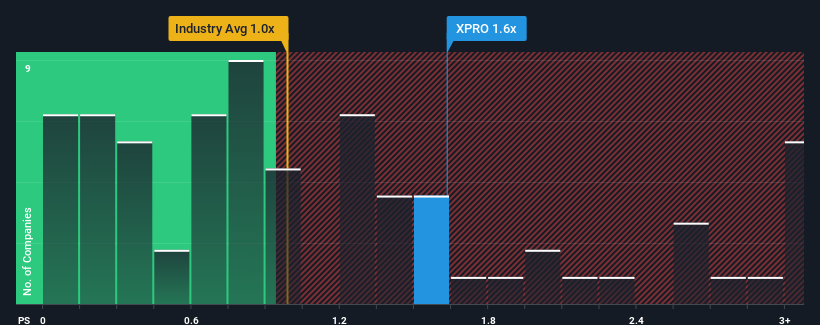

When close to half the companies in the Energy Services industry in the United States have price-to-sales ratios (or "P/S") below 1x, you may consider Expro Group Holdings N.V. (NYSE:XPRO) as a stock to potentially avoid with its 1.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Expro Group Holdings

What Does Expro Group Holdings' P/S Mean For Shareholders?

There hasn't been much to differentiate Expro Group Holdings' and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Expro Group Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Expro Group Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Expro Group Holdings would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The latest three year period has also seen an excellent 149% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 7.6% per year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 7.2% each year, which is not materially different.

With this information, we find it interesting that Expro Group Holdings is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Expro Group Holdings' P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Expro Group Holdings currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Expro Group Holdings that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Expro Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:XPRO

Expro Group Holdings

Provides energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives