- United States

- /

- Energy Services

- /

- NYSE:XPRO

Does Expro Group Holdings (XPRO) Have a Sustainable Edge in Offshore Efficiency After Its RCIS Debut?

Reviewed by Sasha Jovanovic

- Expro announced it has successfully completed the first full deployment of its Remote Clamp Installation System (RCIS), an automated technology that enables remote installation of control line clamps for smart well completions in the North Sea with BP and subsequent commercial use by another operator.

- The RCIS sharply improved installation efficiency, cut manual interventions and rig floor exposure, and delivered a completely hands-free upper completion with zero non-productive time or damage, signaling a material operational advance in offshore well services.

- We'll explore how this technology-led efficiency gain could influence Expro's investment narrative and forward operational outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Expro Group Holdings Investment Narrative Recap

To be an Expro shareholder, you typically need to believe that advancements in digital and automation technologies will drive efficiency, operational safety, and sustained service demand in global offshore energy markets. The recently completed deployment of Expro’s Remote Clamp Installation System (RCIS) is a clear demonstration of innovation, but it does not meaningfully address the most pressing risk: Expro’s exposure to fluctuating offshore project approvals by major clients, which could continue to weigh on near-term revenue momentum.

The August 2025 announcement of Expro achieving the world record deployment of the Blackhawk Gen III Wireless Top Drive Cement Head stands out as a parallel advance in offshore well construction, reinforcing the importance of technology-led efficiency gains as potential catalysts for future growth, but only if new project activity remains robust.

In contrast, investors should be aware that even the strongest technology improvements may not fully offset the risk if customer spending...

Read the full narrative on Expro Group Holdings (it's free!)

Expro Group Holdings' narrative projects $1.7 billion revenue and $83.2 million earnings by 2028. This requires a 0.3% annual revenue decline and an earnings increase of $11.9 million from the current $71.3 million level.

Uncover how Expro Group Holdings' forecasts yield a $12.80 fair value, in line with its current price.

Exploring Other Perspectives

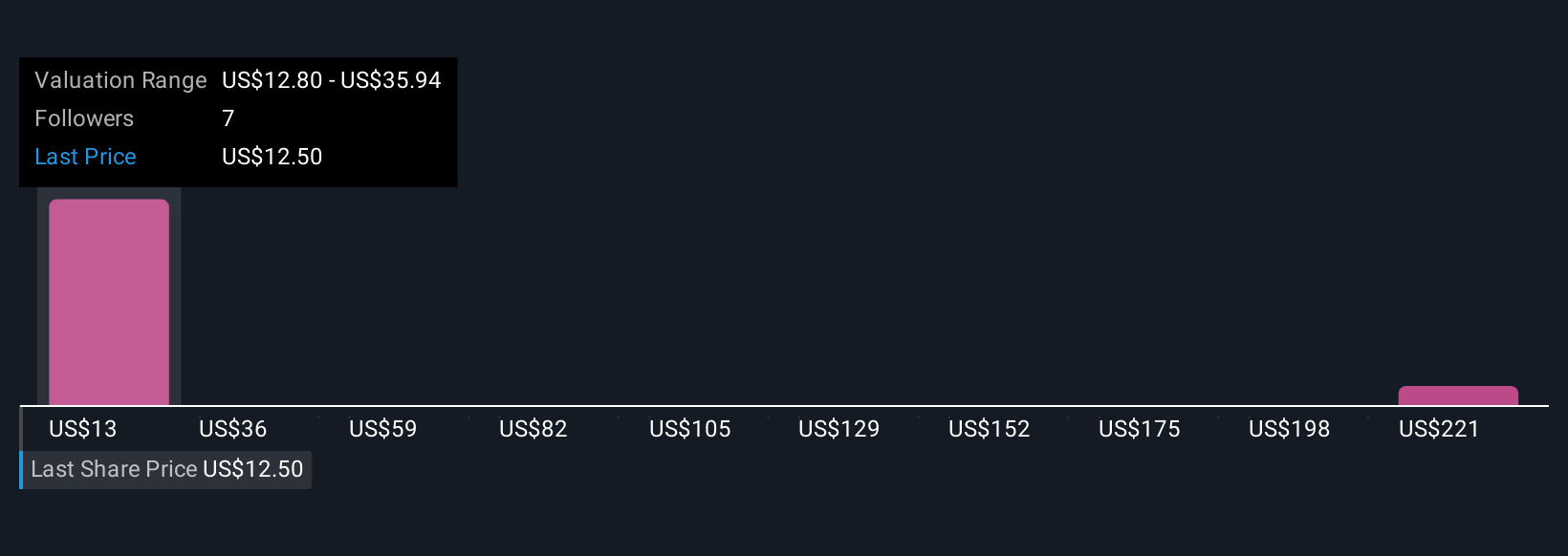

Simply Wall St Community members’ fair value estimates for Expro span US$12.80 to US$244.23, based on three distinct analyses. Such diverse views sit alongside analysts’ comments that technology rollouts bring operational upside but cannot remove exposure to volatile offshore project cycles, inviting you to explore several alternative viewpoints.

Explore 3 other fair value estimates on Expro Group Holdings - why the stock might be worth just $12.80!

Build Your Own Expro Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expro Group Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Expro Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expro Group Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expro Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPRO

Expro Group Holdings

Provides energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives