- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Rising Energy Prices - Exxon Mobil (NYSE:XOM) Leads Our List of Stocks as Oil Prices Climb

3 Key Takeaways

- Sanctions imposed on Russia’s Oil & Gas industry has led to a tightening of supply, causing prices to rise.

- US Oil & Gas companies are well positioned to take advantage of the supply shortfall, increasing exports to Europe.

- Investments in clean energy solutions may provide opportunities as the world looks to cut back its reliance on fossil fuels.

The fallout of the war and the sanctions have wreaked havoc on global markets with major indices like the S&P 500 declining 15% since the beginning of February. Consumers have also been feeling the pressure on their wallets as supply chain stresses have caused the cost of necessities and energy to climb.

Black Gold

The EU is proposing completely curtailing their reliance on Russian crude oil within the next six months. The US and UK are also following suit, as they begin to phase out all Russian oil imports by the end of 2022 in what can only be described as a radical disruption in the global energy landscape. But disruption can lead to opportunity for the countries able to fill the gap left by eliminating the second largest exporter of oil and natural gas from the market.

The US has agreed to ship an additional 15 billion cubic meters of liquified natural gas (LNG) to Europe by the end of this year and has already increased exports in crude oil and petroleum exports some 40% since February.

.png)

Sky high energy prices have meant that companies directly involved in the production and refinement of oil and natural gas products have enjoyed an appreciable increase in margins for the quarter. Our analysis has shown that these companies will provide plenty of opportunities for investors:

Exxon Mobil

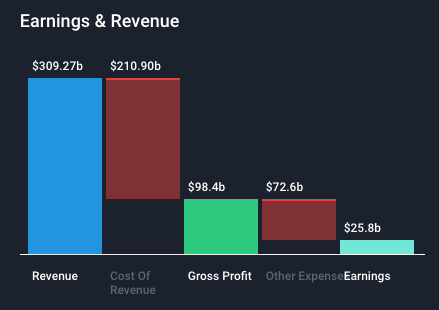

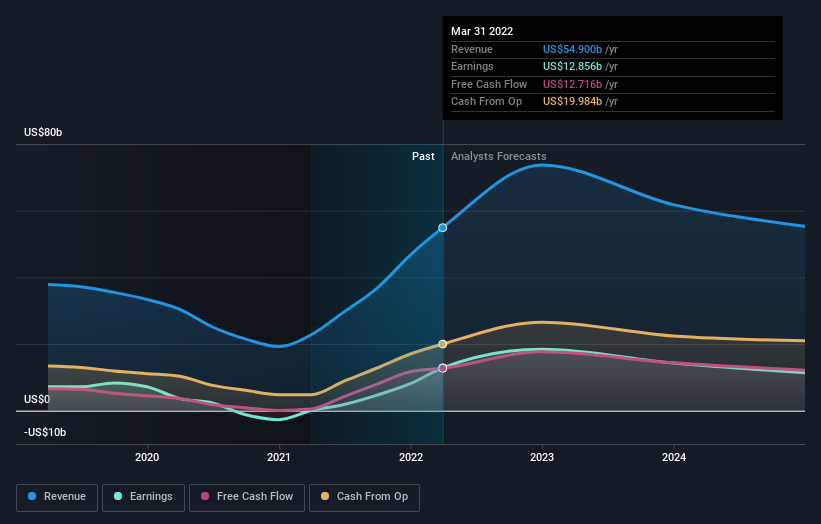

Exxon Mobil (NYSE:XOM) is one of the largest publicly traded energy and petrochemical companies in the world. During the first quarter of 2022, Exxon Mobil bore the fruit of rising energy prices and saw crude, natural gas and refining margins strengthen. While Q1 earnings were down compared to Q4 of 2021, there was an appreciable increase in earnings to US$5.5B. Compared to US$2.7B in the same quarter of the previous year this is a great result for the company, even in spite of an unfavorable charge of US$3.4B due to their exit from the Russian Sahkalin-1 project. Looking forward to the remainder of 2022, further supply uncertainty in the natural gas sector will encourage price increases and a recovery in transportation demand post-COVID will keep crude oil and petroleum margins high.

For those who are interested in Exxon’s prospects will find be eager to know the following:

- Three additional discoveries have been made offshore Guyana , increasing the recoverable resource estimate for the Stabroek Block to nearly 11 billion oil-equivalent barrels. This follows two previous discoveries earlier this year, bringing the total to five in 2022.

- Improvements in the realized prices were able to offset weather related impacts in Canada. Poor weather in Q1 2022 contributed to a drop in production volumes from 3.82M barrels of oil equivalent (BOE) to 3.68M BOE but higher oil prices actually lead to growth in earnings in their upstream sector.

Our analysis of Exxon Mobil has also revealed that insiders have been selling shares. To find out more about this and other risks we have uncovered, you can head to our Exxon Mobil company report.

ConocoPhillips

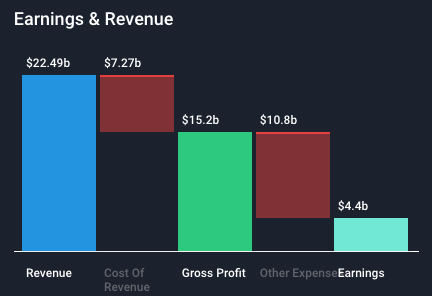

ConocoPhillips (NYSE:COP) is another major player in the petroleum industry, with major projects in the US, Australia, Norway and Canada. ConocoPhillips has been a major beneficiary of the rising energy prices, with the company’s total average realized price hitting US$76.99 per BOE, 70% higher than the $45.36 per BOE realized in the first quarter of 2021. The healthy increase in oil price has had a flow on effect to the financials, increasing quarterly adjusted earnings over 40% to US$4.29B from the last quarter in 2021. High performance across their liquid portfolio has delivered record production numbers of 1.75M BOE per day and should this performance continue, they look set to push this further to 1.76M BOE per day for the full year of 2022. On balance of these factors, the near term looks positive for the company as tightening supply should keep prices favorable.

Investors will be pleased to see that ConocoPhillip’s strong operational and financial performances are supported with the following announcements:

- ConocoPhillips acquired an additional 10% interest in Australian Pacific LNG from Origin Energy (ASX:ORG) for US$1.65B. This brings ConocoPhillips’ interest to 47.5%, from which they’re expecting to receive US$1.8B in dividend distributions for 2022.

- The company was granted an extension on their production licenses in Norway’s Greater Ekofisk area. The extension now provides them with the license to produce in the area until 2048. Plans for development and operation in the area are still being finalized, however this should provide a welcome bit of security for the future.

The future looks fairly bright for the company, yet analyst consensus is forecasting future earnings to fall. Our analysis on ConocoPhillips’ future growth prospects is available for free on our website .

EOG Resources

EOG Resources (NYSE:EOG) is another oil and gas company that is reaping the benefits of rising oil prices. A focus on low-cost operation has led to a windfall of impressive margins over the first quarter of 2022. Reliance on US exported oil will help them capture the premium pricing on the international market relative to the domestic. Despite a fall in statutory earnings, EOG resources recorded strong performance in their underlying crude oil operations as a result of consistent production volumes and a significantly higher oil price benchmark.

Our look into EOG Resources has yielded the following opportunities that set the company apart from its peers:

- EOG Resources has managed to deviate from the rest of the industry and keep CAPEX budget unchanged in the face of industry cost inflation. Technical improvements and increased drilling efficiency have aided in cost reduction.

- EOG’s investment in Information Technology is hoping to deliver sustainable competitive advantage over its peers. With over 140+ proprietary applications in use, EOG is targeting a data driven approach that will assist with decision-making, accountability and transparency across the company and help deliver the lowest cost outcomes.

It’s always important to consider the financial health of companies to gain a full picture of a company’s merits. Check out our EOG Resources Financial Health analysis on our website to see why we’ve scored EOG Resources 5/6 for financial health.

If investing in fossil fuels and other existing energy sources isn't on your radar, you might be more interested in the company's pioneering in the renewable energy space

A Cleaner Future

Tightening oil supply brought about by the sanctions placed against Russia begs the question: where do we see the future of energy? While the US and Saudi Arabia can meet some of the demand in oil and natural gas, the recent events that have transpired highlight the desperate need for energy alternatives so that global supply chains aren’t so heavily impacted by the geopolitical relations of oil producing countries. A brief look into the above companies will yield a common theme in their Environmental, social and corporate governance (ESG) discussions: the importance of sustainability. Investors and shareholders are more conscious of the environmental impacts these companies are having and investment capital will inevitably look towards greener initiatives.

We still have a fair way to go before we completely phase out fossil fuel reliance but early investments by businesses are required right now to facilitate the transition in the future. For those of you who are proponents of ethical investment, our analysis has highlighted some opportunity in these clean energy players:

NextEra Energy

NextEra Energy (NYSE:NEE) , through its subsidiary NextEra Energy Resources LLC and its entities, is the largest generator of renewable energy in the world. The company boasts a significant generation portfolio with clean energy assets valued at over US$62B, helping to generate 28 gigawatts (GW) of clean energy for customers across Florida - enough to power 21M homes at full capacity. NextEra Energy is poised to maintain its dominance in the renewable market as 14GW of wind and solar capacity come to fruition. Investment capital flowing into the clean energy sector will find it hard to look beyond the company as considerable scale advantages allow NextEra Energy to expand and operate their portfolio at a cost advantage.

Our analysis of NextEra Energy has shown that earnings are forecast to grow at 17.31% per year, to find out more on how NextEra Energy is expected to stack up to its competitors, head to our Future Growth Analysis on our company report .

Clearway Energy

Clearway Energy (NYSE:CWEN) , through its subsidiaries, is a key operator in the United States’ renewable energy sector. Clearway Energy has a generation portfolio of approximately 7.5GW, consisting of 5GW in wind and solar generation and close to 2.5GW in natural gas generation facilities, providing clean energy to commercial customers across the country. The recent sale of Clearway’s Thermal generation business for a total consideration of US$1.9B has created a foundation for future growth, with capital being reinvested to accelerate their renewable generation pipeline. Investors will be encouraged to see that the company’s renewable segment’s operations have grown 31% in the last year to 3,319 MWh, which management has attributed to investment in portfolio growth.

Clearway Energy has outperformed both industry and market over the past year Future earnings forecasts available for free on our website .

Clean Harbors

Clean Harbors (NYSE: CLH) is an essential operator in the oil industry, providing waste management, emergency spill response, industrial cleaning and maintenance and recycling services to a variety of Furtune 500 companies. As domestic oil production and refinery volumes rose, so too did Clean Harbors' earnings, climbing a scarcely believable 108% to US$45.3M when compared to the corresponding period last year. Although, the real excitement for Clean Harbor comes from the recent introduction of their KLEEN+ brand of base oils .

Operating through their subsidiary Safety-Kleen, the company has been able to develop a base oil product that achieves a 78% reduction in greenhouse gas emissions compared to base oil made via traditional methods. Safety-Kleen's 're-refining' process takes feedstock that has already undergone a process of refinement and removes further impurities. The resulting base oil contains molecular bonds that are stronger, providing their product with greater lubricating properties and greater resistance to head than traditional base oils.

Our look into Clean Harbors has shown the company is trading at a 35% discount to our assessment of fair value. Head to our valuation summary for Clean Harbors to see how the company stacks up to its peers.

The Bottom Line

Uncertainty surrounding global oil supply has caused oil prices to rise. A buoyant oil price improves margins for large oil producers and American companies are well positioned to crank up their exports and take advantage of pricing premiums on the international market. Investors looking for opportunities aren't restricted to pure oil plays, thanks to sky-high energy prices shifting the spotlight to greeener alternatives in energy production.

If greener alternatives interest you, you may want to check out our comapny report on Avantium (OTCPK:AVTX.F). Avantium is a Dutch chemical technology company that is exploring sustainable altenatives to petrochemicals.

Most plastics we use and dispose of on a daily basis are derived from crude oil. The environmental concerns alone are enough to prompt further research into alternatives, but given the rising cost of crude oil, potential rises in the cost of plastic production will also be a concern. Avantium's two lead products are FDCA and plantMEG™ . Together, they enable the production of the novel plastic PEF which is 100% plant-based, recyclable and degradable. Could this be where the future heads given our finite supply of crude oil?

We are looking for feedback on this article. Let us know what you think by completing this quick survey .

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States and internationally.

Excellent balance sheet established dividend payer.