Less than 2 years after trading at unprecedented prices, crude oil is running on the other side of the boat – reaching the highs unseen since 2008. Unsurprisingly, both events had an external catalyst. The first one in 2020 killed the demand, while the ongoing one restricted the supply.

Yet, as the geopolitical crisis has no end in sight, multi-national oil producers like Exxon Mobil Corporation (NYSE: XOM) must reassess the situation.

Check out our latest analysis for Exxon Mobil

Commodities on the Run

The following chart depicts what happens when everyone runs to the other side of the boat within 22 months.

Yet, although scary, we have to note that global energy stocks trade around the top of the long term range – like in 2008 and 2014.

At this point, short-term projections are futile, but futures can tell us something about the medium-term. Looking at the quotes, March 2025 futures are trading around US$77/barrel. This is still way above Exxon's breakeven costs, as the company expected to fund investments, cover the dividend and preserve the balance sheet at prices between US$45-50 per barrel by 2025.

An Overview of the Most Recent Returns

Looking back a year ago, Exxon rallied over 38%, but zooming out the long-term picture is less optimistic as the stock is only 6.4% higher than it was 3 years ago.

We note that the most recent dividend payment is higher than the payment a year ago, which may have assisted the share price. It could be that the company is reaching maturity, and dividend investors are buying for the yield, pushing the price up in the process. We must add that the revenue growth of 55% year on year would have helped paint a pretty picture.

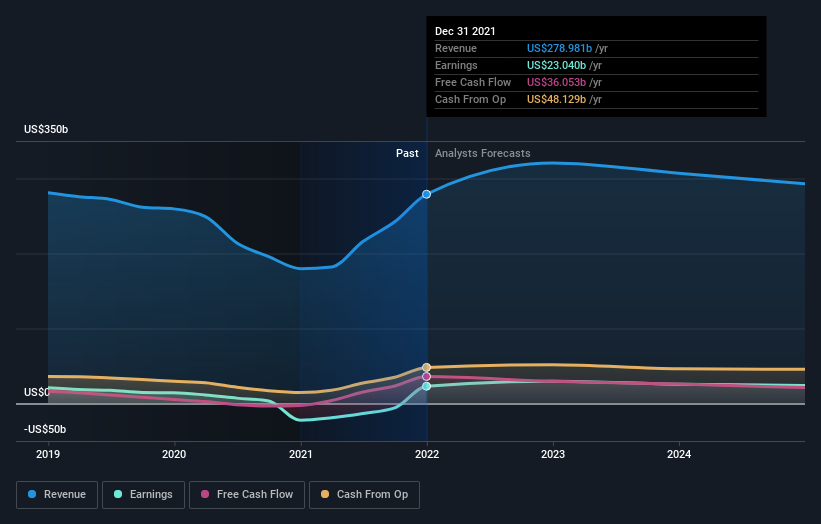

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Exxon Mobil.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return.

We note that for Exxon Mobil, the TSR over the last 1 year was 46%, which is better than the share price return mentioned above. This is in line with expectations, as Exxon has relied on its dividend for decades.

High Returns Can Absorb Geopolitical Losses

While Exxon had a nice run last year, we have to notice it still trades at a reasonable P/E ratio of 15.5, which is below the broad market's average.

It is not all smooth sailing in the face of geopolitical issues, but it is good to know that Exxon's downside risk is in the ballpark of 1-2%. CFO Kathryn Mikelis provided this estimate just days ago. Mrs.Mikelis did not provide details on Exxon's US$4.1b worth of assets in Russia. However, given the current oil price and record-shattering revenues in the last quarter, we expect that the company will be able to absorb any write-downs at these prices.

To understand Exxon Mobil better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Exxon Mobil (including 1, which is a bit unpleasant).

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States and internationally.

Excellent balance sheet established dividend payer.