- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Exxon Mobil (NYSE:XOM) Negotiates €400 Million Sale of French Stake

Reviewed by Simply Wall St

Exxon Mobil (NYSE:XOM) recently entered exclusive talks to sell its 82.89% stake in its French subsidiary, Esso S.A.F., to North Atlantic France SAS for about €400 million. This proposed divestiture aligns with strategic shifts amid regulatory pressures in Europe. Over the past week, Exxon's stock experienced a 1.5% decline. This move in its stock price came amid a mixed market backdrop where strong performance from tech stocks like Nvidia lifted the Nasdaq and tech-focused sectors, while broader market fluctuations, influenced by shifts in trade policy and tariffs, created a varying investment climate.

Buy, Hold or Sell Exxon Mobil? View our complete analysis and fair value estimate and you decide.

The news regarding Exxon Mobil's decision to explore selling its stake in Esso S.A.F. for approximately €400 million may influence its strategic narrative, underlining a focus on adapting to regulatory challenges in Europe. This divestiture aligns with Exxon Mobil's broader cost reduction and portfolio optimization efforts, potentially affecting revenue and earnings forecasts by streamlining operations and reinforcing capital allocation towards high-growth opportunities.

Over the past five years, Exxon Mobil has provided investors with a total return of approximately 160.25%, a significant appreciation that places recent short-term share price fluctuations into a larger context. Although the stock declined by 1.5% recently amid mixed market conditions, this longer-term performance underscores a stronger growth trajectory for shareholders.

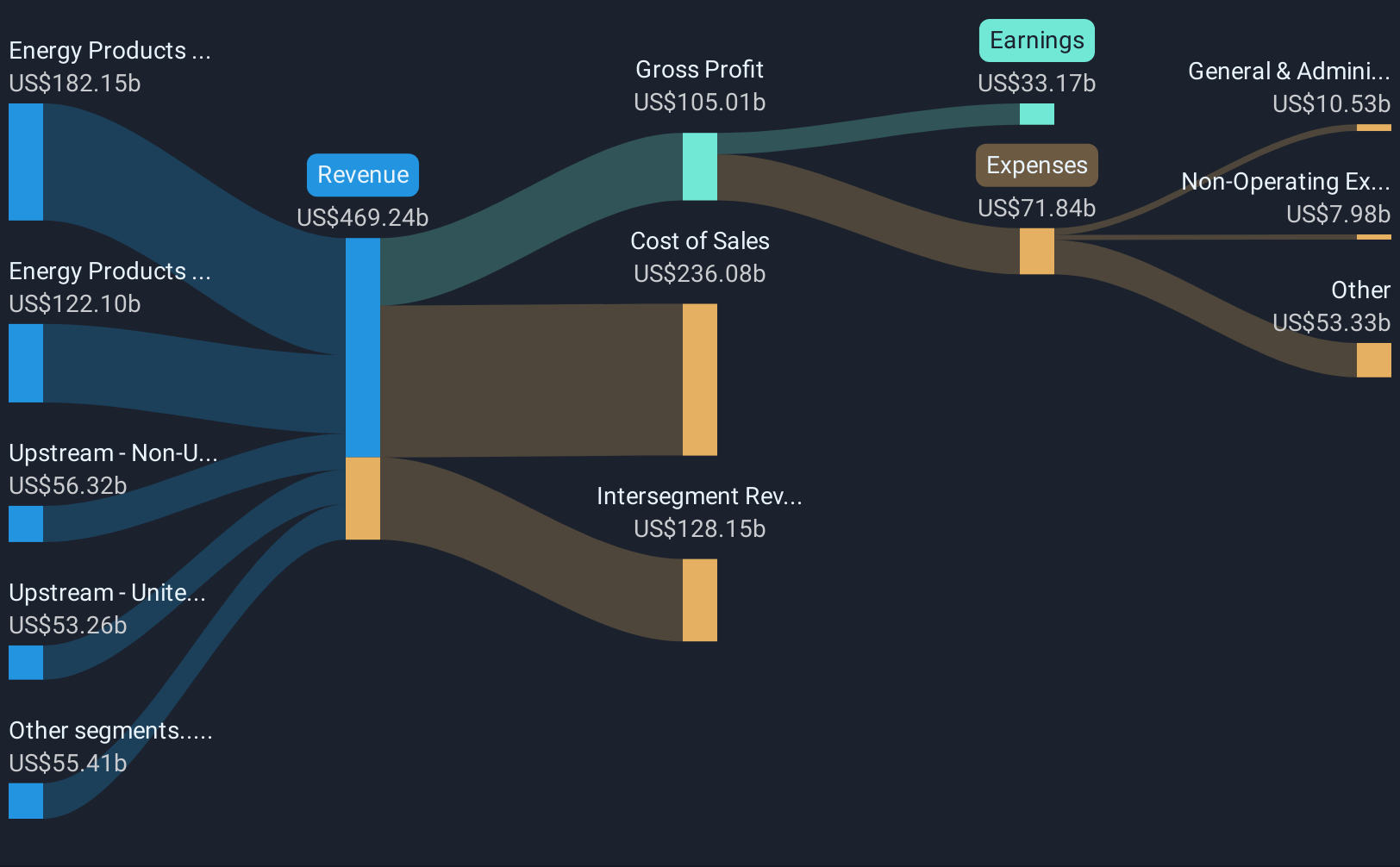

In comparison to broader industry and market metrics, Exxon Mobil underperformed the US Oil and Gas industry's and US Market's performance over the past year. While the company's revenue is projected to decrease annually by 0.7% over the next 3 years, earnings are anticipated to grow, reaching US$42.1 billion, with an expected increase in profit margins from 9.7% to 12.1% over the same period.

The current stock price of US$104.71 is a 15.4% discount compared to the consensus analyst price target of US$123.74. This context suggests investors remain cautious yet optimistic about future growth potential, as Exxon Mobil aligns its strategic initiatives and investments with emerging market dynamics and growth opportunities globally.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Canada, the United Kingdom, Singapore, France, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives