- United States

- /

- Energy Services

- /

- NYSE:WTTR

Assessing Select Water Solutions (WTTR) Valuation as Dual Listing and Business Model Shift Draw Investor Focus

Reviewed by Kshitija Bhandaru

Investors are paying close attention to Select Water Solutions (WTTR) after Texas Capital Securities kicked off coverage, highlighting the company’s shift toward a steadier infrastructure-focused business model and its new dual listing on NYSE Texas.

See our latest analysis for Select Water Solutions.

The company’s announcement of a dual listing and upcoming quarterly earnings release has put the spotlight back on its shares, which have seen a recent uptick despite a tough year. Even after a sharp 26.6% year-to-date share price decline, Select Water Solutions enjoyed a 12.1% gain over the past month and still boasts an impressive 218% total shareholder return over five years. This suggests long-term momentum is very much alive.

If news of Select Water Solutions’ ongoing transformation has you considering what else is out there, this is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With the share price still well below analyst targets and long-term returns looking strong, the key question is whether Select Water Solutions is trading at a bargain now or if the market has already factored in its future growth trajectory.

Most Popular Narrative: 30.3% Undervalued

With Select Water Solutions closing at $10.10, the most widely followed narrative places its fair value much higher at $14.50. This signals a sizable gap between market price and analyst expectations, sparking growing investor interest in the company's evolving business model.

The company has secured a substantial and growing backlog of long-term, acreage-dedicated water infrastructure contracts in the Northern Delaware Basin, providing high predictability on revenue and cash flows over multiple years. There is further upside as undedicated and ROFR acreage is converted, positioning Select to achieve significant Water Infrastructure revenue growth above a $400 million annual exit run rate in 2026. This is likely to support sustainable top-line growth and improved earnings visibility.

Curious how one major basin contract could reset the value? The heart of this bull case is future profit expansion, stable revenues and a multiple that rivals fast-growing industries. Wondering what hidden metrics analysts are betting on? Dig into the narrative to uncover the financial forces behind this projected upside.

Result: Fair Value of $14.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as heavy reliance on oil and gas clients and the potential for project cost overruns could quickly challenge this optimistic forecast.

Find out about the key risks to this Select Water Solutions narrative.

Another View: What Do Market Multiples Say?

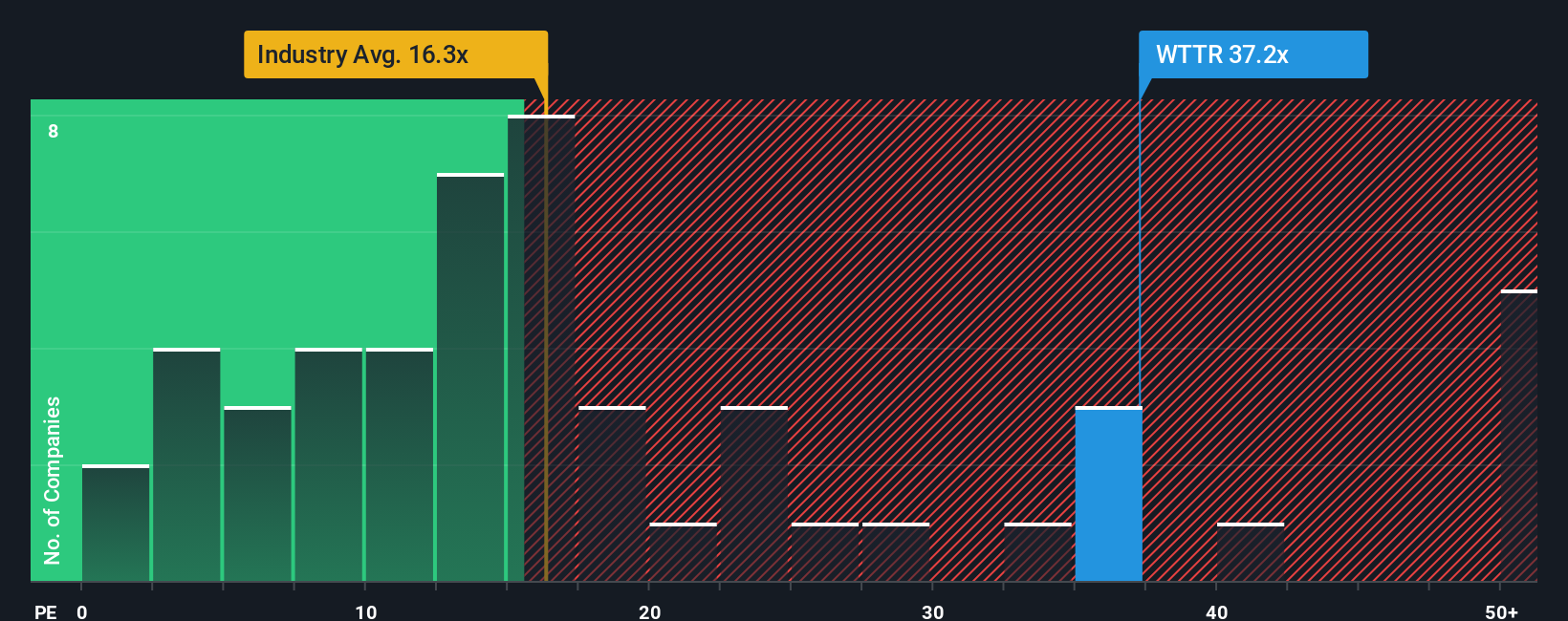

Looking from a different angle, Select Water Solutions is trading at a price-to-earnings ratio of 31.9 times, which is more than double the US Energy Services industry average of just 14 times and notably higher than its peer group at 3.8 times. The market's fair ratio, based on regression analysis, is 19.5 times. This sizable premium suggests investor optimism for future growth but also adds risk if the company cannot deliver as expected. Is the market simply betting on transformation, or are expectations running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Select Water Solutions Narrative

If you see things differently or want to dive into the numbers yourself, it takes just a few minutes to craft your own perspective. Do it your way

A great starting point for your Select Water Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means staying ahead of the obvious trends. Don’t let opportunity pass you by when prized stocks are just a step away from your radar.

- Accelerate your portfolio growth by checking out these 893 undervalued stocks based on cash flows companies currently trading at a significant discount to their true potential.

- Maximize your earning power and seek steady income through these 18 dividend stocks with yields > 3% offering yields above 3% for reliable, long-term rewards.

- Catalyze your returns by targeting innovation and future disruption with these 25 AI penny stocks poised to benefit from breakthroughs in artificial intelligence across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTTR

Select Water Solutions

Provides water management and chemical solutions to the energy industry in the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives