- United States

- /

- Oil and Gas

- /

- NYSE:WMB

Do Williams Companies' (NYSE:WMB) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Williams Companies (NYSE:WMB). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Williams Companies

How Fast Is Williams Companies Growing Its Earnings Per Share?

In the last three years Williams Companies' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Williams Companies' EPS shot up from US$1.64 to US$2.30; a result that's bound to keep shareholders happy. That's a commendable gain of 40%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Williams Companies' EBIT margins have actually improved by 15.5 percentage points in the last year, to reach 41%, but, on the flip side, revenue was down 10%. While not disastrous, these figures could be better.

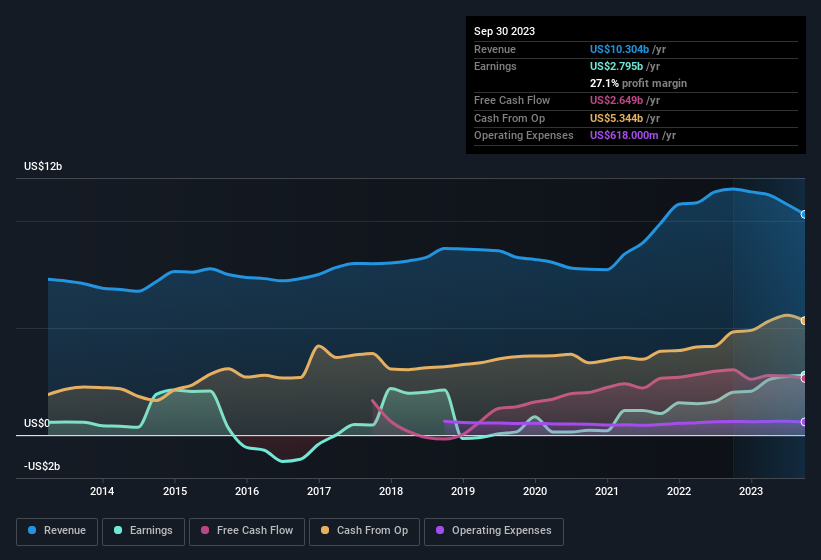

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Williams Companies' future EPS 100% free.

Are Williams Companies Insiders Aligned With All Shareholders?

Since Williams Companies has a market capitalisation of US$42b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Notably, they have an enviable stake in the company, worth US$171m. We note that this amounts to 0.4% of the company, which may be small owing to the sheer size of Williams Companies but it's still worth mentioning. This should still be a great incentive for management to maximise shareholder value.

Does Williams Companies Deserve A Spot On Your Watchlist?

For growth investors, Williams Companies' raw rate of earnings growth is a beacon in the night. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. We should say that we've discovered 2 warning signs for Williams Companies that you should be aware of before investing here.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives