- United States

- /

- Oil and Gas

- /

- NYSE:WKC

World Kinect (NYSE:WKC) Seeks Growth Through Acquisitions and Renewable Energy Amid Market Challenges

Reviewed by Simply Wall St

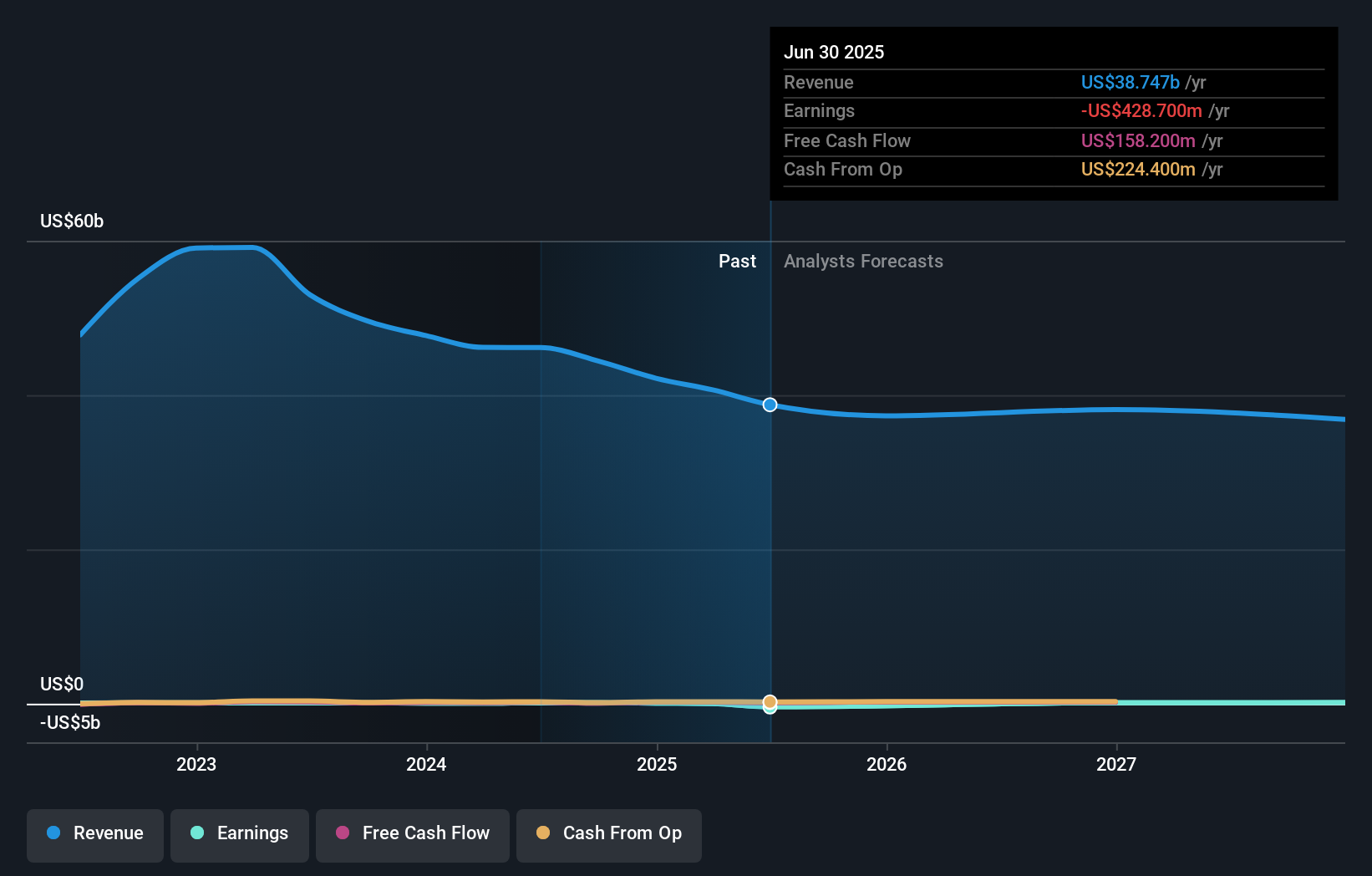

World Kinect (NYSE:WKC) has recently showcased impressive financial health, with a 23.8% growth in earnings over the past year, driven by strong performances in its aviation and marine segments. The latest development includes a strategic tuck-in acquisition in business aviation, aimed at expanding its U.S. network and customer base, signifying potential growth avenues. This report will explore key areas such as competitive advantages, vulnerabilities, growth opportunities, and the impact of market volatility on World Kinect's strategic positioning.

Dive into the specifics of World Kinect here with our thorough analysis report.

Competitive Advantages That Elevate World Kinect

World Kinect has demonstrated strong financial health, with earnings growing by 23.8% over the past year, showcasing strong recent performance. The aviation segment, in particular, has experienced double-digit growth in operating margins, driven by high demand in both passenger and air cargo sectors. This reflects the effectiveness of their diversified platform. Additionally, the marine business has shown an 8% year-over-year increase in gross profit, with operating margins improving by 450 basis points. This highlights the scalability and efficiency of their operations. Furthermore, the company pays a reliable dividend of 2.33%, which has been stable and increased over the past decade, indicating a commitment to shareholder returns. Notably, WKC is trading at 60.1% below its estimated fair value of $73.24, suggesting it may be undervalued compared to its peers and the industry.

Vulnerabilities Impacting World Kinect

World Kinect faces several challenges. Earnings are forecast to decline by an average of 0.7% per year over the next three years, which could impact investor confidence. The land segment continues to struggle, with a 16% year-over-year decline in gross profit due to unfavorable market conditions in North America and Brazil. Additionally, the company's Return on Equity stands at a low 6.5%, and revenue growth is projected at 3.1% per year, lagging behind the market average of 8.9%. These factors, combined with large one-off gains that may not reflect sustainable performance, highlight areas of concern.

Growth Avenues Awaiting World Kinect

Opportunities for growth are evident, particularly through strategic acquisitions. The company recently closed a small tuck-in acquisition in business aviation, enhancing its core offerings in the United States. This move is expected to expand their network and customer base, driving future growth. Furthermore, there is significant potential in scaling the North American land business, which is a larger market than marine and aviation combined. World Kinect is also well-positioned in the renewable energy space, particularly with Sustainable Aviation Fuel (SAF), as the aviation industry seeks decarbonization solutions.

Market Volatility Affecting World Kinect's Position

World Kinect faces threats from market volatility and economic conditions, as reduced volatility and lower bunker fuel prices can impact their marine and aviation segments. Regulatory pressures and competition in SAF and other low-carbon solutions pose additional challenges as the energy industry shifts towards renewables. Interest rate fluctuations also present a risk, as changes could affect financial performance and the cost of capital. These external factors highlight the need for strategic agility to maintain and enhance their market position.

Explore the current health of World Kinect and how it reflects on its financial stability and growth potential.

Conclusion

World Kinect's strong financial performance, particularly in the aviation and marine segments, underscores its operational efficiency and commitment to shareholder returns, as evidenced by its stable dividend. However, challenges in the land segment and modest revenue growth projections could dampen investor confidence. Strategic acquisitions and potential growth in renewable energy and North American land markets present promising opportunities for expansion. Notably, the company's current trading price, significantly below its estimated fair value, suggests that there is potential for capital appreciation as it navigates market volatility and positions itself for future growth.

Where To Now?

- Shareholder in World Kinect? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```If you're looking to trade World Kinect, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if World Kinect might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WKC

World Kinect

Operates as an energy management company in the United States, the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives