- United States

- /

- Oil and Gas

- /

- NYSE:WKC

World Kinect Insiders Sell US$592k Of Stock, Possibly Signalling Caution

The fact that multiple World Kinect Corporation (NYSE:WKC) insiders offloaded a considerable amount of shares over the past year could have raised some eyebrows amongst investors. Knowing whether insiders are buying is usually more helpful when evaluating insider transactions, as insider selling can have various explanations. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

The Last 12 Months Of Insider Transactions At World Kinect

Over the last year, we can see that the biggest insider sale was by the Independent Director, Richard Kassar, for US$522k worth of shares, at about US$26.10 per share. That means that an insider was selling shares at slightly below the current price (US$26.92). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. It is worth noting that this sale was only 26% of Richard Kassar's holding.

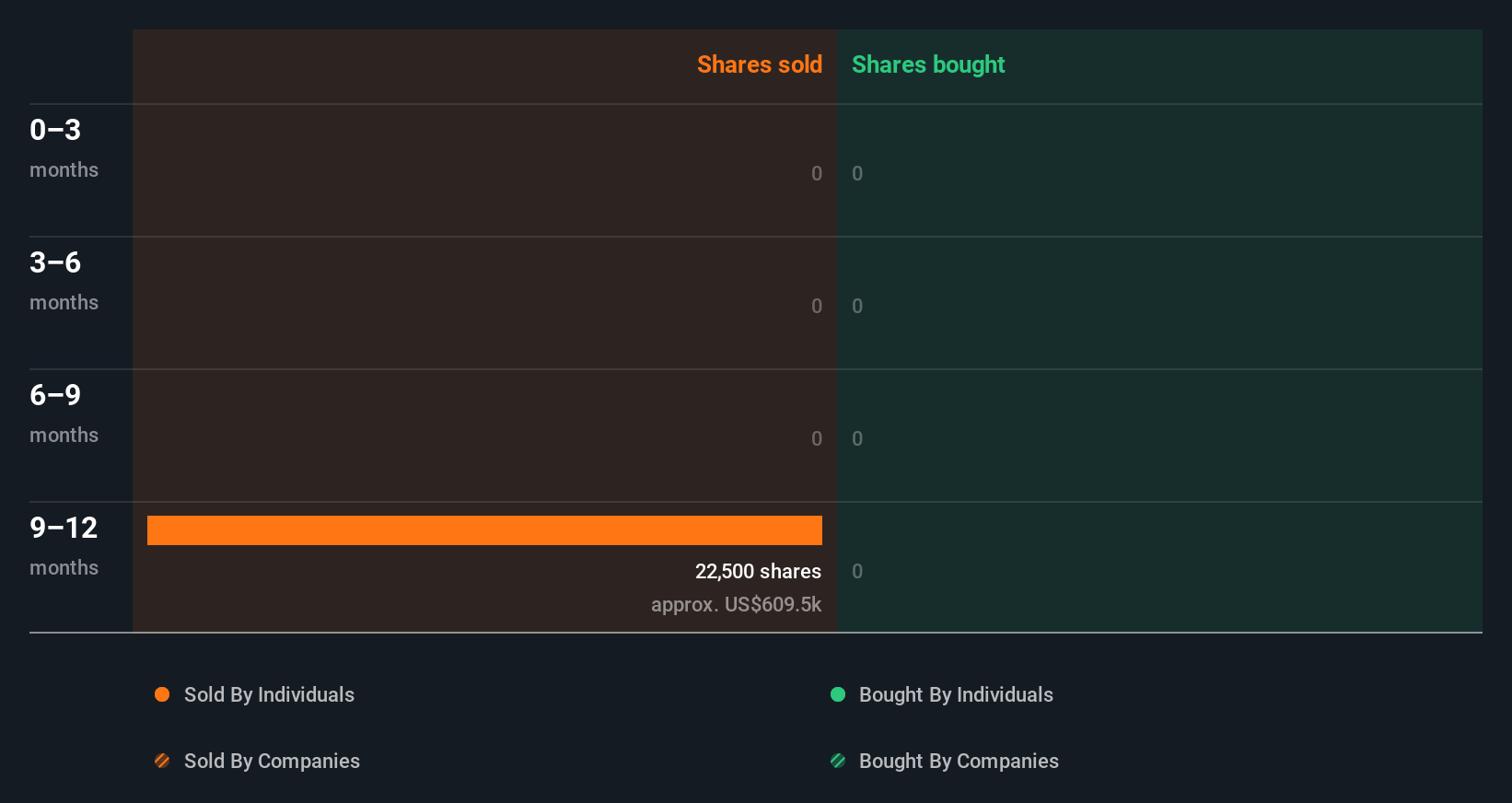

In the last year World Kinect insiders didn't buy any company stock. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

See our latest analysis for World Kinect

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Does World Kinect Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. World Kinect insiders own about US$49m worth of shares. That equates to 3.4% of the company. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

What Might The Insider Transactions At World Kinect Tell Us?

It doesn't really mean much that no insider has traded World Kinect shares in the last quarter. We don't take much encouragement from the transactions by World Kinect insiders. But it's good to see that insiders own shares in the company. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. You'd be interested to know, that we found 1 warning sign for World Kinect and we suggest you have a look.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if World Kinect might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WKC

World Kinect

Operates as an energy management company in the United States, the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)